BB&T 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital

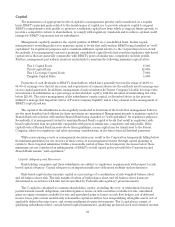

The maintenance of appropriate levels of capital is a management priority and is monitored on a regular

basis. BB&T’s principal goals related to the maintenance of capital are to provide adequate capital to support

BB&T’s comprehensive risk profile, to preserve a sufficient capital base from which to support future growth, to

provide a competitive return to shareholders, to comply with regulatory standards and to achieve optimal credit

ratings for BB&T Corporation and its subsidiaries.

Management regularly monitors the capital position of BB&T on a consolidated basis. In this regard,

management’s overriding policy is to maintain capital at levels that will result in BB&T being classified as “well-

capitalized” for regulatory purposes and to maintain sufficient capital relative to the Corporation’s level of risk.

Secondarily, it is management’s intent to maintain consolidated capital levels that result in regulatory risk-based

capital ratios that are generally comparable with BB&T’s peers of similar size, complexity and risk profile.

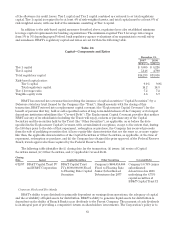

Further, management particularly monitors and intends to maintain the following minimum capital ratios:

Tier 1 Capital Ratio 8.50%

Total Capital Ratio 12.00%

Tier 1 Leverage Capital Ratio 7.00%

Tangible Capital Ratio 5.50%

Payments of cash dividends to BB&T’s shareholders, which have generally been in the range of 40.0% to

60.0% of earnings over the last six years, and repurchases of common shares are the methods used to manage any

excess capital generated. In addition, management closely monitors the Parent Company’s double leverage ratio

(investments in subsidiaries as a percentage of shareholders’ equity) with the intention of maintaining the ratio

below 125.0%. The active management of the subsidiaries’ equity capital, as described above, is the process

utilized to manage this important driver of Parent Company liquidity and is a key element in the management of

BB&T’s capital position.

The capital of the subsidiaries is also regularly monitored to determine if the levels that management believes

are the most beneficial and efficient for their operations are maintained. Management intends to maintain capital at

Branch Bank at levels that will result in Branch Bank being classified as “well-capitalized” for regulatory purposes.

Secondarily, it is management’s intent to maintain Branch Bank’s capital at levels that result in regulatory risk-

based capital ratios that are generally comparable with peers of similar size, complexity and risk profile. If the

capital levels of Branch Bank increase above these guidelines, excess capital may be transferred to the Parent

Company, subject to regulatory and other operating considerations, in the form of special dividend payments.

While nonrecurring events or management decisions may result in the Corporation temporarily falling below

its minimum guidelines for one or more of these ratios, it is management’s intent through capital planning to

return to these targeted minimums within a reasonable period of time. Such temporary decreases below these

minimums are not considered an infringement of BB&T’s overall capital policy provided the Corporation and

Branch Bank remain “well-capitalized.”

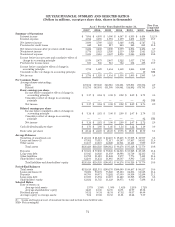

Capital Adequacy and Resources

Bank holding companies and their subsidiaries are subject to regulatory requirements with respect to risk-

based capital adequacy. Capital adequacy is an important indicator of financial stability and performance.

Risk-based capital ratios measure capital as a percentage of a combination of risk-weighted balance sheet

and off-balance sheet risk. The risk-weighted values of both balance sheet and off-balance sheet items are

determined in accordance with risk factors specified by Federal bank regulatory pronouncements.

Tier 1 capital is calculated as common shareholders’ equity, excluding the over- or underfunded status of

postretirement benefit obligations, unrealized gains or losses on debt securities available for sale, unrealized

gains on equity securities available for sale and unrealized gains or losses on cash flow hedges, net of deferred

income taxes; plus certain mandatorily redeemable capital securities, less nonqualifying intangible assets, net of

applicable deferred income taxes, and certain nonfinancial equity investments. Tier 2 capital may consist of

qualifying subordinated debt, certain hybrid capital instruments, qualifying preferred stock and a limited amount

62