Humana 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158

|

|

Humana Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

100

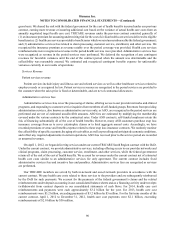

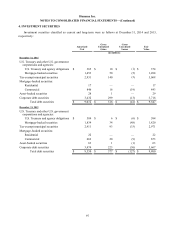

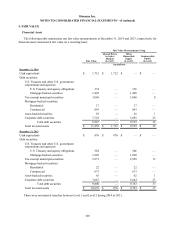

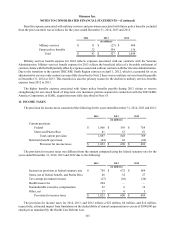

5. FAIR VALUE

Financial Assets

The following table summarizes our fair value measurements at December 31, 2014 and 2013, respectively, for

financial assets measured at fair value on a recurring basis:

Fair Value Measurements Using

Fair Value

Quoted Prices

in Active

Markets

(Level 1)

Other

Observable

Inputs

(Level 2)

Unobservable

Inputs

(Level 3)

(in millions)

December 31, 2014

Cash equivalents $ 1,712 $ 1,712 $ — $ —

Debt securities:

U.S. Treasury and other U.S. government

corporations and agencies:

U.S. Treasury and agency obligations 374 — 374 —

Mortgage-backed securities 1,498 — 1,498 —

Tax-exempt municipal securities 3,068 — 3,060 8

Mortgage-backed securities:

Residential 17 — 17 —

Commercial 843 — 843 —

Asset-backed securities 29 — 28 1

Corporate debt securities 3,718 — 3,695 23

Total debt securities 9,547 — 9,515 32

Total invested assets $ 11,259 $ 1,712 $ 9,515 $ 32

December 31, 2013

Cash equivalents $ 876 $ 876 $ — $ —

Debt securities:

U.S. Treasury and other U.S. government

corporations and agencies:

U.S. Treasury and agency obligations 584 — 584 —

Mortgage-backed securities 1,820 — 1,820 —

Tax-exempt municipal securities 2,971 — 2,958 13

Mortgage-backed securities:

Residential 22 — 22 —

Commercial 673 — 673 —

Asset-backed securities 63 — 62 1

Corporate debt securities 3,667 — 3,644 23

Total debt securities 9,800 — 9,763 37

Total invested assets $ 10,676 $ 876 $ 9,763 $ 37

There were no material transfers between Level 1 and Level 2 during 2014 or 2013.