Humana 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Humana annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Humana Inc.

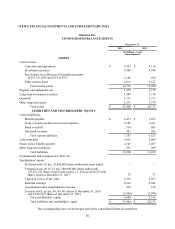

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

86

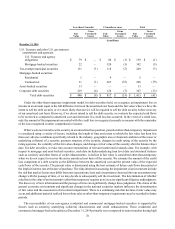

The Health Care Reform Law imposes an annual premium-based fee on health insurers for each calendar year

beginning on or after January 1, 2014 which is not deductible for tax purposes. We are required to estimate a liability

for the health insurer fee and record it in full once qualifying insurance coverage is provided in the applicable calendar

year in which the fee is payable with a corresponding deferred cost that is amortized ratably to expense over the same

calendar year. We record the liability for the health insurer fee in trade accounts payable and accrued expenses and

record the deferred cost in other current assets in our consolidated financial statements. We pay the health insurer fee

in September of each year. In September 2014, we paid the federal government $562 million for the annual health

insurance industry fee attributed to calendar year 2014, in accordance with the Health Care Reform Law.

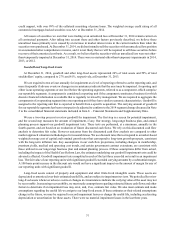

The Health Care Reform Law also establishes risk spreading premium stabilization programs effective January 1,

2014. The risk spreading programs are applicable to certain of our commercial medical insurance products. In the

aggregate, our commercial medical insurance products represented approximately 18% of our total premiums and

services revenue for the year ended December 31, 2014. These programs, commonly referred to as the 3Rs, include a

permanent risk adjustment program, a transitional reinsurance program, and a temporary risk corridors program designed

to more evenly spread the financial risk borne by issuers and to mitigate the risk that issuers would have mispriced

products. The transitional reinsurance and temporary risk corridors programs are for years 2014 through 2016, with

potential for additional reinsurance recoveries through 2018 to the extent funds are available. Policies issued prior to

March 23, 2010 are considered grandfathered policies and are exempt from the 3Rs. Certain states have allowed non-

grandfathered policies issued prior to January 1, 2014 to extend the date of required transition to policies compliant

with the Health Care Reform Law to as late as 2017. Accordingly, such policies are exempt from the 3Rs until they

transition to policies compliant with the Health Care Reform Law.

The permanent risk adjustment program adjusts the premiums that commercial individual and small group health

insurance issuers receive based on the demographic factors and health status of each member as derived from current

year medical diagnosis as reported throughout the year. This program transfers funds from lower risk plans to higher

risk plans within similar plans in the same state. The risk adjustment program is applicable to commercial individual

and small group health plans (except certain exempt and grandfathered plans as discussed above) operating both inside

and outside of the health insurance exchanges established under the Health Care Reform Law. Under the risk adjustment

program, a risk score is assigned to each covered member to determine an average risk score at the individual and small

group level by legal entity in a particular market in a state. Additionally, an average risk score is determined for the

entire subject population for each market in each state. Settlements are determined on a net basis by legal entity and

state. Each health insurance issuer’s average risk score is compared to the state’s average risk score. Plans with an

average risk score below the state average will pay into a pool and health insurance issuers with an average risk score

that is greater than the state average risk score will receive money from that pool. We generally rely on providers,

including certain network providers who are our employees, to appropriately document all medical data, including the

diagnosis codes submitted with claims, as the basis for our risk scores under the program. Our estimate of amounts

receivable and/or payable under the risk adjustment program is based on our estimate of both our own and the state

average risk scores. Assumptions used in these estimates include but are not limited to geographic considerations

including our historical experience in markets we have participated in over a long period of time, member demographics

(including age and gender for our members and other health insurance issuers), our pricing model, sales data for each

metal tier (different metal tiers yield different risk scores), the mix of previously underwritten membership as compared

to new members in plans compliant with the Health Care Reform Law, published third party studies, and other publicly

available data including regulatory plan filings. We expect to refine our estimates as new information becomes available,

including additional data released by the Department of Health and Human Services, or HHS, regarding estimates of

state average risk scores. Risk adjustment is subject to audit by HHS, however, there will be no payments associated

with these audits for 2014 or 2015, the first two years of the program.

The temporary risk corridor program applies to individual and small group Qualified Health Plans (or substantially

equivalent plans), or QHPs, as defined by HHS, operating both inside and outside of the exchanges. Accordingly, plans

subject to risk adjustment that are not QHPs, including our small group health plans, will not be subject to the risk

corridor program. The risk corridor provisions limit issuer gains and losses by comparing allowable medical costs to

a target amount, each defined/prescribed by HHS, and sharing the risk for allowable costs with the federal government.

Allowable medical costs are adjusted for risk adjustment settlements, transitional reinsurance recoveries, and cost

sharing reductions received from HHS. Variances from the target exceeding certain thresholds may result in HHS