BB&T 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BB&T CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

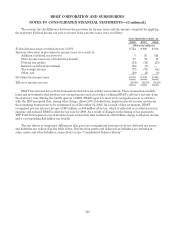

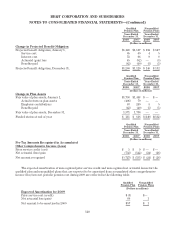

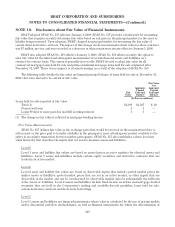

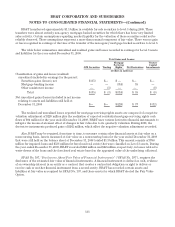

BB&T has made loan commitments to qualified special purpose entities as a nontransferor lender. As of

December 31, 2008, BB&T had loan commitments to these entities totaling $405 million. Of this amount, $290

million had been funded and was included in loans and leases on the Consolidated Balance Sheets.

Legal Proceedings

The nature of the business of BB&T’s banking and other subsidiaries ordinarily results in a certain amount of

litigation. The subsidiaries of BB&T are involved in various legal proceedings, all of which are considered

incidental to the normal conduct of business. Based on information currently available, advice of counsel, available

insurance coverage and established reserves, BB&T’s management believes that the liabilities, if any, arising

from these proceedings will not have a materially adverse effect on the consolidated financial position,

consolidated results of operations or consolidated cash flows of BB&T. However, in the event of unexpected

future developments, it is possible that the ultimate resolution of these matters, if unfavorable, may be material

to BB&T’s consolidated financial position, consolidated results of operations or consolidated cash flows.

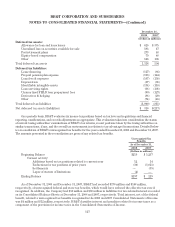

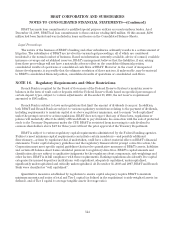

NOTE 16. Regulatory Requirements and Other Restrictions

Branch Bank is required by the Board of Governors of the Federal Reserve System to maintain reserve

balances in the form of vault cash or deposits with the Federal Reserve Bank based on specified percentages of

certain deposit types, subject to various adjustments. At December 31, 2008, the net reserve requirement

amounted to $381 million.

Branch Bank is subject to laws and regulations that limit the amount of dividends it can pay. In addition,

both BB&T and Branch Bank are subject to various regulatory restrictions relating to the payment of dividends,

including requirements to maintain capital at or above regulatory minimums, and to remain “well-capitalized”

under the prompt corrective action regulations. BB&T does not expect that any of these laws, regulations or

policies will materially affect the ability of Branch Bank to pay dividends. In connection with the sale of preferred

stock to the Treasury Department under the CPP, BB&T is restricted from increasing its cash dividend to

common shareholders above $.47 for three years without the prior approval of the Treasury Department.

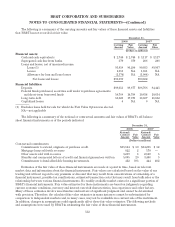

BB&T is subject to various regulatory capital requirements administered by the Federal banking agencies.

Failure to meet minimum capital requirements can initiate certain mandatory—and possibly additional

discretionary—actions by regulators that, if undertaken, could have a direct material effect on BB&T’s financial

statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the

Corporation must meet specific capital guidelines that involve quantitative measures of BB&T’s assets, liabilities

and certain off-balance-sheet items calculated pursuant to regulatory directives. BB&T’s capital amounts and

classification also are subject to qualitative judgments by the regulators about components, risk weightings and

other factors. BB&T is in full compliance with these requirements. Banking regulations also identify five capital

categories for insured depository institutions: well-capitalized, adequately capitalized, undercapitalized,

significantly undercapitalized and critically undercapitalized. At December 31, 2008 and 2007, BB&T and Branch

Bank were classified as “well capitalized”.

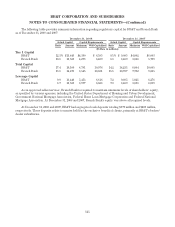

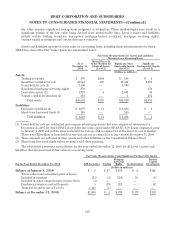

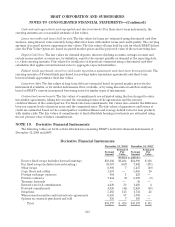

Quantitative measures established by regulation to ensure capital adequacy require BB&T to maintain

minimum amounts and ratios of total and Tier 1 capital (as defined in the regulations) to risk-weighted assets (as

defined), and of Tier 1 capital to average tangible assets (leverage ratio).

124