BB&T 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

broader responsibilities, which are discussed in the “Market Risk Management” section in “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” herein.

Investment strategies are established by the MRLC based on the interest rate environment, balance sheet

mix, actual and anticipated loan demand, funding opportunities and the overall interest rate sensitivity of the

Corporation. In general, the investment portfolio is managed in a manner appropriate to the attainment of the

following goals: (i) to provide a sufficient margin of liquid assets to meet unanticipated deposit and loan

fluctuations and overall funds management objectives; (ii) to provide eligible securities to secure public funds,

trust deposits as prescribed by law and other borrowings; and (iii) to earn the maximum return on funds invested

that is commensurate with meeting the requirements of (i) and (ii).

Funding Activities

Deposits are the primary source of funds for lending and investing activities, and their cost is the largest

category of interest expense. Scheduled payments, as well as prepayments, and maturities from portfolios of

loans and investment securities also provide a stable source of funds. Federal Home Loan Bank (“FHLB”)

advances, other secured borrowings, Federal funds purchased and other short-term borrowed funds, as well as

longer-term debt issued through the capital markets, all provide supplemental liquidity sources. BB&T’s funding

activities are monitored and governed through BB&T’s overall asset/liability management process, which is

further discussed in the “Market Risk Management” section in “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” herein. BB&T conducts its funding activities in compliance with

all applicable laws and regulations. Following is a brief description of the various sources of funds used by BB&T.

For further discussion relating to outstanding balances and balance fluctuations, refer to the “Deposits and Other

Borrowings” section in “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” herein.

Deposits

Deposits are attracted principally from clients within BB&T’s branch network through the offering of a

broad selection of deposit instruments to individuals and businesses, including noninterest-bearing checking

accounts, interest-bearing checking accounts, savings accounts, money rate savings accounts, investor deposit

accounts, certificates of deposit and individual retirement accounts. Deposit account terms vary with respect to

the minimum balance required, the time period the funds must remain on deposit and service charge schedules.

Interest rates paid on specific deposit types are determined based on (i) the interest rates offered by competitors,

(ii) the anticipated amount and timing of funding needs, (iii) the availability and cost of alternative sources of

funding, and (iv) the anticipated future economic conditions and interest rates. Client deposits are attractive

sources of funding because of their stability and relative cost. Deposits are regarded as an important part of the

overall client relationship and provide opportunities to cross-sell other BB&T services. In addition, BB&T

gathers a portion of its deposit base through wholesale funding products, which include negotiable certificates of

deposit and Eurodollar deposits through the use of a Cayman branch facility. At December 31, 2008, these

sources of deposits represented approximately 15% of BB&T’s total deposits.

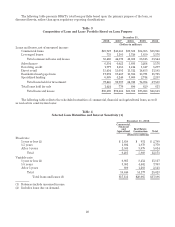

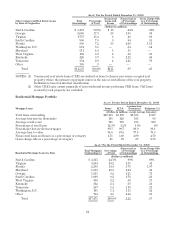

The following table provides information regarding the scheduled maturities of time deposits that are

$100,000 and greater at December 31, 2008:

Table 7

Scheduled Maturities of Time Deposits $100,000 and Greater

December 31, 2008

(Dollars in millions)

Maturity Schedule

Three months or less $ 4,992

Over three through six months 2,486

Over six through twelve months 4,366

Over twelve months 4,429

Total $16,273

26