BB&T 2008 Annual Report Download - page 64

Download and view the complete annual report

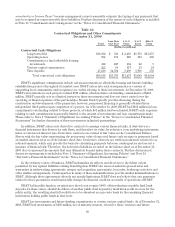

Please find page 64 of the 2008 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.other things, allows 20% of deductions, imputes interest income and deems the remaining transactions to be

terminated as of December 31, 2008. As a result of this settlement, BB&T recognized pre-tax interest income of

$93 million, or $60 million after-tax, which is reflected as a reduction in tax expense. As a result of changes in the

timing of tax payments, FSP FAS 13-2 required a recalculation of each transaction that resulted in a $67 million

charge to interest income and a corresponding $24 million tax benefit.

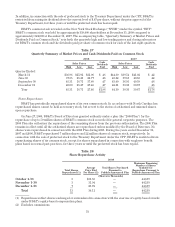

Market Risk Management

The effective management of market risk is essential to achieving BB&T’s strategic financial objectives. As a

financial institution, BB&T’s most significant market risk exposure is interest rate risk; however, market risk

also includes product liquidity risk, price risk and volatility risk. The primary objective of interest rate risk

management is to minimize any adverse effect that changes in interest rates may have on net interest income.

This is accomplished through active management of asset and liability portfolios with a focus on the strategic

pricing of asset and liability accounts and management of appropriate maturity mixes of assets and liabilities. The

goal of these activities is the development of appropriate maturity and repricing opportunities in BB&T’s

portfolios of assets and liabilities that will produce consistent net interest income during periods of changing

interest rates. BB&T’s Market Risk and Liquidity Committee monitors loan, investment and liability portfolios to

ensure comprehensive management of interest rate risk. These portfolios are analyzed for proper fixed-rate and

variable-rate mixes under various interest rate scenarios.

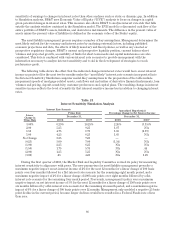

The asset/liability management process is designed to achieve relatively stable net interest margins and

assure liquidity by coordinating the volumes, maturities or repricing opportunities of earning assets, deposits and

borrowed funds. It is the responsibility of the Market Risk and Liquidity Committee to determine and achieve

the most appropriate volume and mix of earning assets and interest-bearing liabilities, as well as to ensure an

adequate level of liquidity and capital, within the context of corporate performance goals. The Market Risk and

Liquidity Committee also sets policy guidelines and establishes long-term strategies with respect to interest rate

risk exposure and liquidity. The Market Risk and Liquidity Committee meets regularly to review BB&T’s

interest rate risk and liquidity positions in relation to present and prospective market and business conditions,

and adopts funding and balance sheet management strategies that are intended to ensure that the potential

impact on earnings and liquidity as a result of fluctuations in interest rates is within acceptable standards.

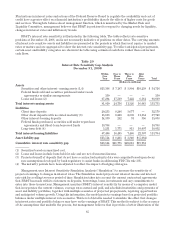

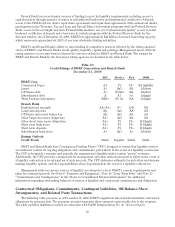

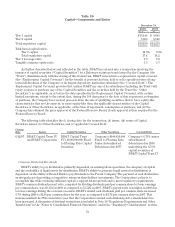

BB&T utilizes a variety of financial instruments to manage various financial risks. These instruments,

commonly referred to as derivatives, primarily consist of interest-rate swaps, swaptions, caps, floors, collars,

financial forward and futures contracts, when-issued securities and options written and purchased. A derivative

is a financial instrument that derives its cash flows, and therefore its value, by reference to an underlying

instrument, index or referenced interest rate. BB&T uses derivatives primarily to manage risk related to

securities, business loans, Federal funds purchased, long-term debt, mortgage servicing rights, mortgage banking

operations and certificates of deposit. BB&T also uses derivatives to facilitate transactions on behalf of its clients.

BB&T’s derivatives produced a benefit to net interest income of $101 million during 2008 and resulted in a

decrease in net interest income of $19 million and $8 million in 2007 and 2006, respectively. The increase in

benefits to net interest income from 2007 to 2008 can primarily be attributed to decreases in rates that affected

the benefits received on BB&T’s interest rate swaps on its medium and long-term debt.

Derivative contracts are written in amounts referred to as notional amounts. Notional amounts only provide

the basis for calculating payments between counterparties and do not represent amounts to be exchanged

between parties, and are not a measure of financial risk. On December 31, 2008, BB&T had derivative financial

instruments outstanding with notional amounts totaling $74.2 billion. The estimated net fair value of open

contracts was $626 million at December 31, 2008.

See Note 19 “Derivative Financial Instruments” in the “Notes to Consolidated Financial Statements” herein

for additional disclosures.

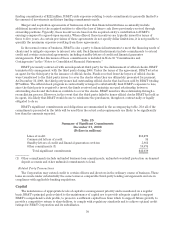

Impact of Inflation and Changing Interest Rates

The majority of BB&T’s assets and liabilities are monetary in nature and, therefore, differ greatly from most

commercial and industrial companies that have significant investments in fixed assets or inventories.

64