Coca Cola 2015 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2015 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

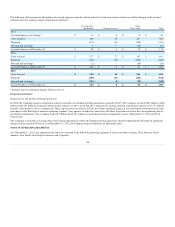

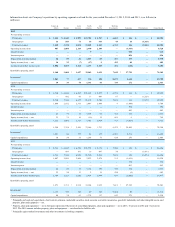

In 2015, the results of our operating segments were impacted by the following items:

• Operating income (loss) and income (loss) before income taxes were reduced by $16 million for Eurasia and Africa, $7 million for Latin America,

$384 million for North America, $2 million for Asia Pacific, $353 million for Bottling Investments and $246 million for Corporate due to the

Company's productivity and reinvestment program as well as other restructuring initiatives. Operating income (loss) and income (loss) before income

taxes were increased by $25 million for Europe due to the refinement of previously established accruals related to the Company's productivity and

reinvestment program. Refer to Note 18.

• Operating income (loss) and income (loss) before income taxes were reduced by $418 million for Corporate primarily due to an impairment charge

primarily related to the discontinuation of the energy products in the glacéau portfolio as a result of the Monster Transaction. Refer to Note 2 and

Note 17.

• Operating income (loss) and income (loss) before income taxes were reduced by $100 million for Corporate as a result of a cash contribution to The

Coca-Cola Foundation. Refer to Note 17.

• Income (loss) before income taxes was increased by $1,403 million for Corporate as a result of the Monster Transaction. Refer to Note 2 and Note 17.

• Income (loss) before income taxes was reduced by $1,006 million for North America due to the refranchising of certain territories in North America.

Refer to Note 2 and Note 17.

• Income (loss) before income taxes was reduced by $320 million for Corporate due to charges the Company recognized on the early extinguishment of

certain long-term debt. Refer to Note 10 and Note 17.

• Income (loss) before income taxes was reduced by $33 million for Latin America and $105 million for Corporate due to the remeasurement of the net

monetary assets of our local Venezuelan subsidiary into U.S. dollars using the SIMADI exchange rate, an impairment of a Venezuelan trademark, and a

write-down the Company recorded on receivables from our bottling partner in Venezuela. Refer to Note 1 and Note 17.

• Income (loss) before income taxes was reduced by $19 million for Corporate as a result of the remeasurement of our previously held equity interest in a

South African bottler to fair value upon our acquisition of the bottling operations. Refer to Note 2.

• Income (loss) before income taxes was reduced by $6 million for Corporate as a result of a Brazilian bottling entity's majority interest owners

exercising their option to acquire from us an additional equity interest at an exercise price less than that of our carrying value. Refer to Note 2 and

Note 17.

• Income (loss) before income taxes was increased by $3 million for Eurasia and Africa and reduced by $7 million for Europe and $83 million for

Bottling Investments due to the Company's proportionate share of unusual or infrequent items recorded by certain of our equity method investees.

Refer to Note 17.

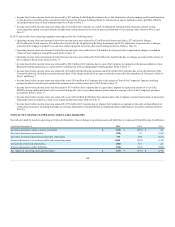

In 2014, the results of our operating segments were impacted by the following items:

• Operating income (loss) and income (loss) before income taxes were reduced by $26 million for Eurasia and Africa, $111 million for Europe,

$20 million for Latin America, $281 million for North America, $36 million for Asia Pacific, $211 million for Bottling Investments and $124 million

for Corporate due to charges related to the Company's productivity and reinvestment program as well as other restructuring initiatives. Refer to

Note 18.

• Operating income (loss) and income (loss) before income taxes were reduced by $42 million for Bottling Investments as a result of the restructuring

and transition of the Company's Russian juice operations to an existing joint venture with an unconsolidated bottling partner. Refer to Note 17.

• Income (loss) before income taxes was reduced by $2 million for Europe and $16 million for Bottling Investments due to the Company's proportionate

share of unusual or infrequent items recorded by certain of our equity method investees. Refer to Note 17.

• Income (loss) before income taxes was reduced by $799 million for North America due to the refranchising of certain territories. Refer to Note 2 and

Note 17.

• Income (loss) before income taxes was reduced by $275 million for Latin America and $411 million for Corporate due to the remeasurement of the net

monetary assets of our local Venezuelan subsidiary into U.S. dollars using the SICAD 2 exchange rate, an impairment of a Venezuelan trademark, and a

write-down the Company recorded on the concentrate sales receivables from our bottling partner in Venezuela. Refer to Note 1 and Note 17.

139