Coca Cola 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Coca Cola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

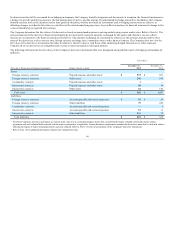

dollar, resulting in a charge of $226 million recorded in the line item other income (loss) — net in our consolidated statement of income.

In December 2014, due to the continued lack of liquidity and increasing economic uncertainty, the Company reevaluated the rate that should be used to

remeasure the monetary assets and liabilities of our Venezuelan subsidiary. As of December 31, 2014, we determined that the SICAD 2 rate of 50 bolivars per

U.S. dollar was the most appropriate legally available rate and remeasured the net monetary assets of our Venezuelan subsidiary, resulting in a charge of $146

million recorded in the line item other income (loss) — net in our consolidated statement of income.

In February 2015, the Venezuelan government merged SICAD 1 and SICAD 2 into a single mechanism called SICAD and introduced a new open market

exchange rate system, SIMADI. As a result, management determined that the SIMADI rate was the most appropriate legally available rate and remeasured the

net monetary assets of our Venezuelan subsidiary, resulting in a charge of $27 million recorded in the line item other income (loss) — net in our consolidated

statement of income.

In addition to the foreign currency exchange exposure related to our Venezuelan subsidiary's net monetary assets, we also sell concentrate to our bottling

partner in Venezuela from outside the country. These sales are denominated in U.S. dollars. During the years ended December 31, 2015 and December 31,

2014, as a result of the continued lack of liquidity and our revised assessment of the U.S. dollar value we expect to realize upon the conversion of Venezuelan

bolivars into U.S. dollars by our bottling partner to pay our concentrate sales receivables, we recorded write-downs of $56 million and $296 million,

respectively, recorded in the line item other operating charges in our consolidated statements of income.

We also have certain U.S. dollar denominated intangible assets associated with products sold in Venezuela. As a result of the Company's revised expectations

regarding the convertibility of the local currency, we recognized impairment charges of $55 million and $18 million, respectively, during the years ended

December 31, 2015 and December 31, 2014. These charges were recorded in the line item other operating charges in our consolidated statements of income.

During the year ended December 31, 2015, the Company continued to use the SIMADI rate to remeasure the net monetary assets of our Venezuelan

subsidiary. As of December 31, 2015, the combined value of the net monetary assets of our Venezuelan subsidiary, the receivables from our bottling partner

in Venezuela and the intangible assets associated with products sold in Venezuela was $100 million. Included in this combined value is $15 million of cash

and cash equivalents. Despite the additional currency conversion mechanisms, the Company's ability to pay dividends from Venezuela is still restricted due

to the low volume of U.S. dollars available for conversion.

In February 2016, the Venezuelan government devalued its currency and changed its official and most preferential exchange rate, which will continue to be

used for purchases of certain essential goods, to 10 bolivars per U.S. dollar from 6.3. The Venezuelan government announced it will reduce its three-tier

system of exchange rates to two tiers by eliminating the SICAD rate. Additionally, the government announced that the SIMADI rate will be allowed to float

freely beginning at a rate of 203 bolivars per U.S. dollar. As a result, the Company expects to continue to record losses on foreign currency exchange, may

incur additional write-downs of receivables or impairment charges and will continue to record our proportionate share of any charges recorded by our equity

method investee that has operations in Venezuela.

Recently Issued Accounting Guidance

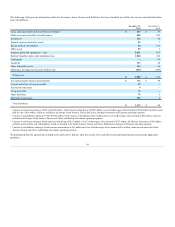

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with

Customers, which will replace most existing revenue recognition guidance in U.S. GAAP and is intended to improve and converge with international

standards the financial reporting requirements for revenue from contracts with customers. The core principle of ASU 2014-09 is that an entity should

recognize revenue for the transfer of goods or services equal to the amount that it expects to be entitled to receive for those goods or services. ASU 2014-09

also requires additional disclosures about the nature, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant

judgments and changes in judgments. ASU 2014-09 allows for both retrospective and prospective methods of adoption and will be effective for the Company

beginning January 1, 2018. The Company is currently evaluating the impact that the adoption of ASU 2014-09 will have on our consolidated financial

statements.

In February 2015, the FASB issued ASU 2015-02, Amendments to the Consolidation Analysis, which changes the guidance for evaluating whether to

consolidate certain legal entities. Specifically, the amendments modify the evaluation of whether limited partnerships and similar legal entities are VIEs or

voting interest entities. Additionally, the amendments eliminate the presumption that a general partner should consolidate a limited partnership and affect

the consolidation analysis of reporting entities that are involved with VIEs, particularly those that have fee arrangements and related party relationships. ASU

2015-02 will be effective for the Company beginning January 1, 2016. Companies have an option of using either a full retrospective or modified

retrospective adoption approach. The Company does not believe that the adoption of ASU 2015-02 will have a material impact on the Company's financial

position, results of operations or cash flows.

88