Electronic Arts 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 Electronic Arts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

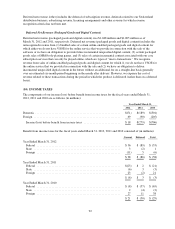

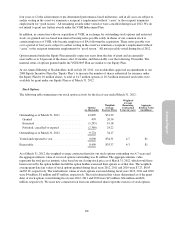

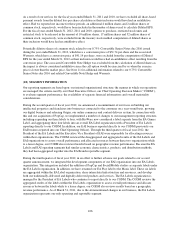

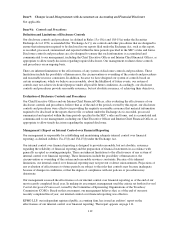

The following table summarizes outstanding and exercisable stock options as of March 31, 2012:

Options Outstanding Options Exercisable

Range of

Exercise Prices

Number

of Shares

(in thousands)

Weighted-

Average

Remaining

Contractual

Term (in years)

Weighted-

Average

Exercise

Prices

Potential

Dilution

Number

of Shares

(in thousands)

Weighted-

Average

Exercise

Prices

Potential

Dilution

$2.61-$19.99 2,676 6.66 $17.16 0.8% 2,211 $16.88 0.7%

20.00-39.99 3,227 4.65 24.95 1.1% 2,686 25.75 0.9%

40.00-59.99 3,157 3.65 51.15 1.0% 2,879 51.28 0.9%

60.00-65.93 714 2.04 64.67 0.2% 714 64.67 0.2%

$2.61-$65.93 9,774 4.69 34.17 3.1% 8,490 35.37 2.7%

Potential dilution is computed by dividing the options in the related range of exercise prices by 320 million

shares of common stock, which were issued and outstanding as of March 31, 2012.

Restricted Stock Rights

We grant restricted stock rights under our Equity Plan to employees worldwide (except in certain countries where

doing so is not feasible due to local legal requirements). Restricted stock units entitle holders to receive shares of

common stock at the end of a specified period of time. Upon vesting, the equivalent number of common shares is

typically issued net of required tax withholdings, if any. Restricted stock is issued and outstanding upon grant;

however, restricted stock award holders are restricted from selling the shares until they vest. Upon granting or

vesting of restricted stock, as the case may be, we will typically withhold shares to satisfy tax withholding

requirements. Restricted stock rights are subject to forfeiture and transfer restrictions. Vesting for restricted stock

rights is based on the holders’ continued employment with us. If the vesting conditions are not met, unvested

restricted stock rights will be forfeited. Generally, our restricted stock rights vest according to one of the

following vesting schedules:

• Three-year vesting with

1

⁄

3

cliff vesting at the end of each year;

• Four-year vesting with

1

⁄

4

cliff vesting at the end of each year;

• Three-year vesting with

1

⁄

4

cliff vesting at the end of each of the first and second years, and

1

⁄

2

cliff

vesting at the end of the third year;

• Five-year vesting with

1

⁄

9

,

2

⁄

9

,

3

⁄

9

,

2

⁄

9

and

1

⁄

9

of the shares cliff vesting respectively at the end of each of

the 1st,2

nd,3

rd,4

th, and 5th years;

• Two-year vesting with

1

⁄

2

cliff vesting at the end of each year;

• 35 month vesting with

1

⁄

3

cliff vesting after 11, 23 and 35 months or;

• One-year vesting with 100% cliff vesting at the end of one year.

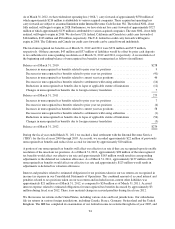

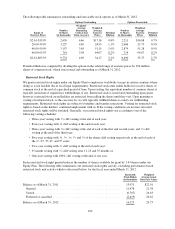

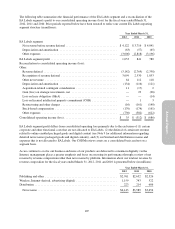

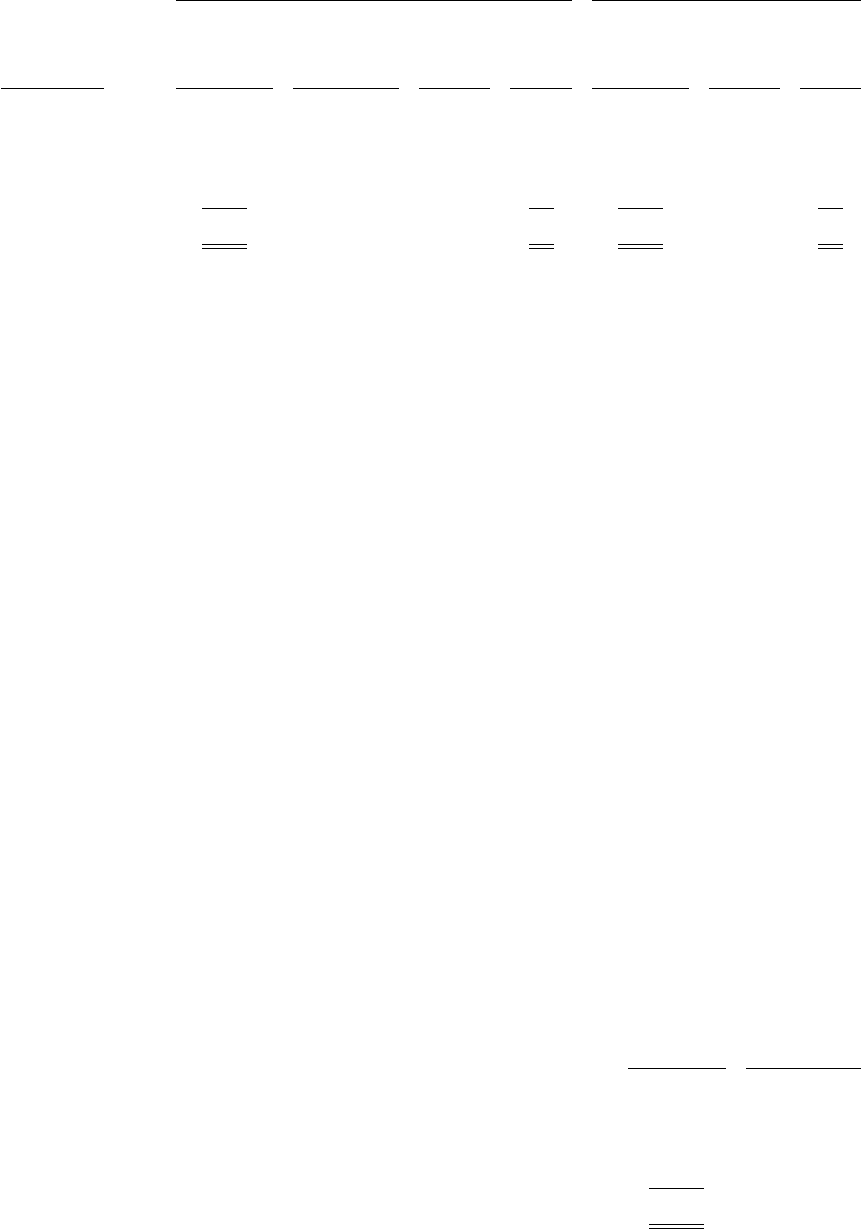

Each restricted stock right granted reduces the number of shares available for grant by 1.43 shares under our

Equity Plan. The following table summarizes our restricted stock rights activity, excluding performance-based

restricted stock unit activity which is discussed below, for the fiscal year ended March 31, 2012:

Restricted

Stock Rights

(in thousands)

Weighted-

Average Grant

Date Fair Values

Balance as of March 31, 2011 ......................................... 13,971 $22.01

Granted ......................................................... 11,478 21.38

Vested .......................................................... (6,707) 24.63

Forfeited or cancelled .............................................. (2,419) 20.42

Balance as of March 31, 2012 ......................................... 16,323 20.73

102