General Motors 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 General Motors annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GENERAL MOTORS COMPANY AND SUBSIDIARIES

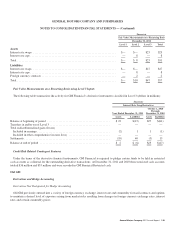

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Real estate investments include funds that invest in entities which are principally engaged in the ownership, acquisition,

development, financing, sale and/or management of income-producing real estate properties, both commercial and residential. These

funds typically seek long-term growth of capital and current income that is above average relative to public equity funds.

Significant Concentrations of Risk

The pension plans’ assets include certain private investment funds, private equity and debt securities, real estate investments and

derivative instruments. Investment managers may be unable to quickly sell or redeem some or all of these investments at an amount

close or equal to fair value in order to meet a plan’s liquidity requirements or to respond to specific events such as deterioration in the

creditworthiness of any particular issuer or counterparty.

Illiquid investments held by the plans are generally long-term investments that complement the long-term nature of pension

obligations and are not used to fund benefit payments when currently due. Plan management monitors liquidity risk on an ongoing

basis and has procedures in place that are designed to maintain flexibility in addressing plan-specific, broader industry and market

liquidity events.

Certain plan assets represent investments in group annuity contracts. We entered into group annuity contracts with various life

insurance companies to provide pension benefits to certain of our salaried workforce and backed these obligations by high quality

fixed income securities. We, as the plans’ sponsor, might be exposed to counterparty risk if any or all of the life insurance companies

fail to perform in accordance with the terms and conditions stipulated in the contracts, or any or all of the life insurance companies

become insolvent or experience other forms of financial distress. We and the plans might also be exposed to liquidity risk due to the

funding obligation that may arise under these contracts. The plans’ management monitors counterparty and liquidity risks on an

on-going basis and has procedures in place that are designed to monitor the financial performance of the life insurance companies that

are parties to these contracts and maintain flexibility in addressing contract-specific and broader market events.

The pension plans may invest in financial instruments denominated in foreign currencies and may be exposed to risks that the

foreign currency exchange rates might change in a manner that has an adverse effect on the value of the foreign currency denominated

assets or liabilities. Forward currency contracts are used to manage and mitigate foreign currency risk.

The pension plans may invest in fixed income securities for which any change in the relevant interest rates for particular securities

might result in an investment manager being unable to secure similar returns upon the maturity or the sale of securities. In addition,

changes to prevailing interest rates or changes in expectations of future interest rates might result in an increase or decrease in the fair

value of the securities held. Interest rate swaps and other financial derivative instruments may be used to manage interest rate risk.

Counterparty credit risk is the risk that a counterparty to a financial instrument will default on its commitment. Counterparty risk is

primarily related to over-the-counter derivative instruments used to manage risk exposures related to interest rates on long-term debt

securities and foreign currency exchange rate fluctuations. The risk of default can be influenced by various factors including macro-

economic conditions, market liquidity, fiscal and monetary policies and counterparty-specific characteristics and activities. Certain

agreements with counterparties employ set-off, collateral support arrangements and other risk mitigating procedures designed to

reduce the net exposure to credit risk in the event of counterparty default. Credit policies and processes are in place to manage

concentrations of counterparty risk by seeking to undertake transactions with large well-capitalized counterparties and by monitoring

the creditworthiness of these counterparties. The majority of our derivatives at December 31, 2011 were fully collateralized and

therefore, the related counterparty credit risk was significantly reduced.

Pension Funding Requirements

We are subject to a variety of U.S. federal rules and regulations, including the Employee Retirement Income Security Act of 1974,

as amended and the Pension Protection Act of 2006 (PPA), which govern the manner in which we fund and administer our pensions

for our retired employees and their spouses. The Pension Relief Act of 2010 provides us with options to amortize any shortfall

amortization base for U.S. qualified pension plans either (1) over seven years with amortization starting two years after the election of

this relief or (2) over 15 years.

General Motors Company 2011 Annual Report 143