General Motors 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 General Motors annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GENERAL MOTORS COMPANY AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

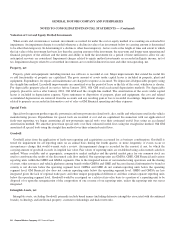

Revenue Recognition

Automotive

Automotive sales and revenue are primarily composed of revenue generated from the sale of vehicles. Vehicle sales are recorded

when title and risks and rewards of ownership have passed, which is generally when a vehicle is released to the carrier responsible for

transporting it to a dealer and when collectability is reasonably assured. Provisions for recurring dealer and customer sales and leasing

incentives, consisting of allowances and rebates, are recorded as reductions to Automotive sales and revenue at the time of vehicle

sales. All other incentives, allowances, and rebates related to vehicles previously sold are recorded as reductions to Automotive sales

and revenue when announced.

Vehicle sales to daily rental car companies with guaranteed repurchase obligations are accounted for as operating leases. Estimated

lease revenue is recorded ratably over the estimated term of the lease based on the difference between net sales proceeds and the

guaranteed repurchase amount. The difference between the cost of the vehicle and estimated residual value is depreciated on a

straight-line basis over the estimated term of the lease.

Payments received from banks for credit card programs in which there is a redemption liability are recorded on a straight-line basis

over the estimated period of time the customer will accumulate and redeem their rebate points. This time period is estimated to be 60

months for the majority of the credit card programs. The redemption liability anticipated to be paid to the dealer is estimated and

accrued at the time specific vehicles are sold to the dealer. The redemption cost is classified as a reduction of Automotive sales.

Automotive Financing — GM Financial

Finance income earned on receivables is recognized using the effective interest method. Fees and commissions (including incentive

payments) received and direct costs of originating loans are deferred and amortized over the term of the related finance receivables

using the effective interest method and are removed from the consolidated balance sheets when the related finance receivables are

sold, charged off or paid in full. Accrual of finance charge income is suspended on accounts that are more than 60 days delinquent,

accounts in bankruptcy, and accounts in repossession. Payments received on nonaccrual loans are first applied to any fees due, then to

any interest due and then any remaining amounts are recorded to principal. Interest accrual resumes once an account has received

payments bringing the delinquency to less than 60 days past due.

Income from operating lease assets, which includes lease origination fees, net of lease origination costs and incentives, is recorded

as operating lease revenue on a straight-line basis over the term of the lease agreement.

Advertising

The following table summarizes advertising expenditures, which are expensed as incurred (dollars in millions):

Successor Predecessor

Year Ended

December 31, 2011

Year Ended

December 31, 2010

July 10, 2009

Through

December 31, 2009

January 1, 2009

Through

July 9, 2009

Advertising expense ............................... $4,478 $4,259 $2,110 $1,471

82 General Motors Company 2011 Annual Report