General Motors 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 General Motors annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GENERAL MOTORS COMPANY AND SUBSIDIARIES

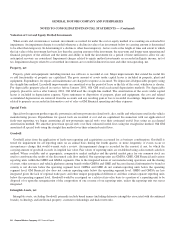

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Research and Development Expenditures

The following table summarizes research and development expenditures, which are expensed as incurred (dollars in millions):

Successor Predecessor

Year Ended

December 31, 2011

Year Ended

December 31, 2010

July 10, 2009

Through

December 31, 2009

January 1, 2009

Through

July 9, 2009

Research and development expense ................... $8,124 $6,962 $3,034 $3,017

Cash Equivalents

Cash equivalents are defined as short-term, highly-liquid investments with original maturities of 90 days or less.

Fair Value Measurements

A three-level valuation hierarchy, based upon observable and unobservable inputs, is used for fair value measurements. Observable

inputs reflect market data obtained from independent sources, while unobservable inputs reflect market assumptions based on the best

evidence available. These two types of inputs create the following fair value hierarchy:

• Level 1 — Quoted prices for identical instruments in active markets;

• Level 2 — Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in

markets that are not active; and model-derived valuations whose significant inputs are observable; and

• Level 3 — Instruments whose significant inputs are unobservable.

Financial instruments are transferred in and/or out of Level 1, 2 or 3 at the beginning of the accounting period in which there is a

change in the valuation inputs.

Marketable Securities

We classify marketable securities as available-for-sale or trading. Various factors, including turnover of holdings and investment

guidelines, are considered in determining the classification of securities. Available-for-sale securities are recorded at fair value with

unrealized gains and losses recorded, net of related income taxes, in Accumulated other comprehensive income until realized. Trading

securities are recorded at fair value with changes in fair value recorded in Interest income and other non-operating income, net. We

determine realized gains and losses for all securities using the specific identification method.

Securities are classified in Level 1 when quoted prices in an active market for identical securities are available. If quoted market

prices are not available, fair values of securities are determined using prices from a pricing service, pricing models, quoted prices of

securities with similar characteristics or discounted cash flow models and are generally classified in Level 2. These prices represent

non-binding quotes. U.S. government and agency securities, sovereign debt, certificates of deposit, and corporate debt securities are

classified as Level 2. Our pricing vendor utilizes industry-standard pricing models that consider various inputs, including benchmark

yields, reported trades, broker/dealer quotes, issuer spreads and benchmark securities as well as other relevant economic measures.

Securities are classified in Level 3 in certain cases where there are unobservable inputs to the valuation in the marketplace. Level 3

financial instruments typically include, in addition to the unobservable inputs, observable components that are validated to external

sources.

We measure fair value of our marketable securities using a market approach where identical or comparable prices are available, and

an income approach in other cases. We obtain the majority of the prices used in this valuation from a pricing service. We conduct an

General Motors Company 2011 Annual Report 83