General Motors 2012 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2012 General Motors annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GENERAL MOTORS COMPANY AND SUBSIDIARIES

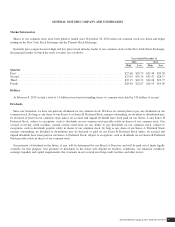

Market Information

Shares of our common stock have been publicly traded since November 18, 2010 when our common stock was listed and began

trading on the New York Stock Exchange and the Toronto Stock Exchange.

Quarterly price ranges based on high and low prices from intraday trades of our common stock on the New York Stock Exchange,

the principal market in which the stock is traded, are as follows:

Years Ended December 31,

2012 2011

High Low High Low

Quarter

First .......................................................................... $27.68 $20.75 $39.48 $30.20

Second ........................................................................ $27.03 $19.24 $33.47 $28.17

Third ......................................................................... $25.15 $18.72 $32.08 $19.77

Fourth ........................................................................ $28.90 $22.67 $26.55 $19.00

Holders

At February 8, 2013 we had a total of 1.4 billion issued and outstanding shares of common stock held by 319 holders of record.

Dividends

Since our formation, we have not paid any dividends on our common stock. We have no current plans to pay any dividends on our

common stock. So long as any share of our Series A or Series B Preferred Stock remains outstanding, no dividend or distribution may

be declared or paid on our common stock unless all accrued and unpaid dividends have been paid on our Series A and Series B

Preferred Stock, subject to exceptions, such as dividends on our common stock payable solely in shares of our common stock. Our

secured revolving credit facilities contain certain restrictions on our ability to pay dividends on our common stock, subject to

exceptions, such as dividends payable solely in shares of our common stock. So long as any share of our Series A Preferred Stock

remains outstanding, no dividend or distribution may be declared or paid on our Series B Preferred Stock unless all accrued and

unpaid dividends have been paid on our Series A Preferred Stock, subject to exceptions, such as dividends on our Series B Preferred

Stock payable solely in shares of our common stock.

Our payment of dividends in the future, if any, will be determined by our Board of Directors and will be paid out of funds legally

available for that purpose. Our payment of dividends in the future will depend on business conditions, our financial condition,

earnings, liquidity and capital requirements, the covenants in our secured revolving credit facilities and other factors.

General Motors Company 2012 ANNUAL REPORT 15