BB&T 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170

|

|

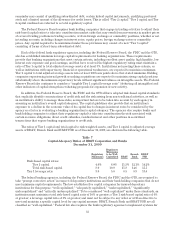

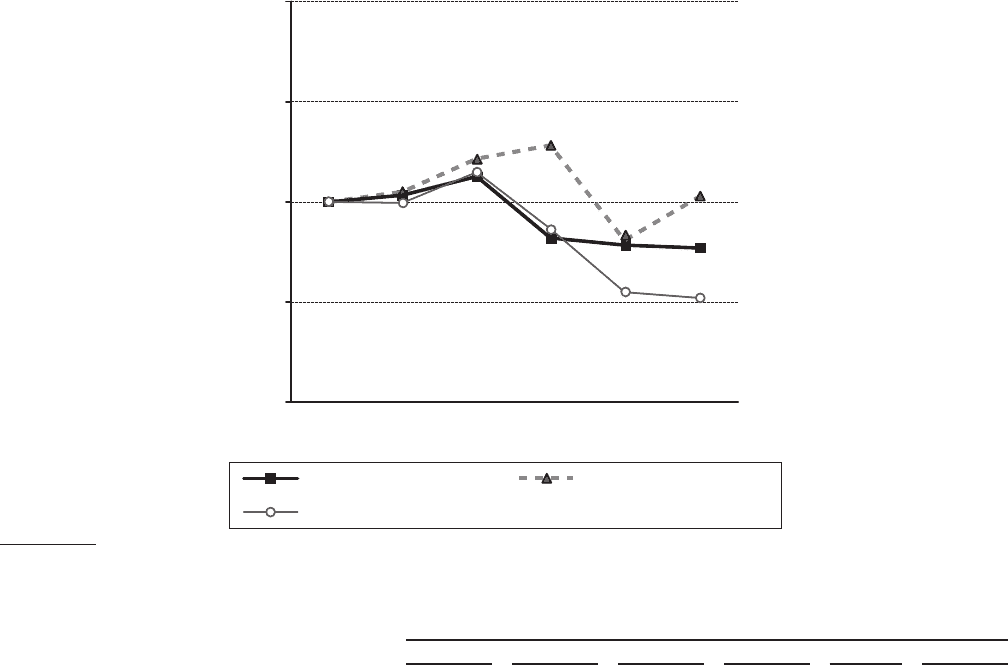

PERFORMANCE GRAPH

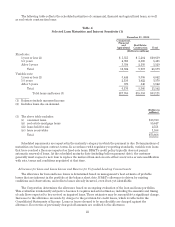

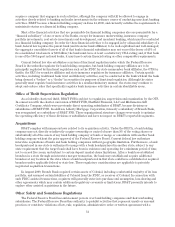

Set forth below is a graph comparing the total returns (assuming reinvestment of dividends) of BB&T

Common Stock, the S&P 500 Index, and an Industry Peer Group Index. The graph assumes $100 invested on

December 31, 2004 in BB&T Common Stock and in each of the indices. In 2009, the financial holding companies in

the Industry Peer Group Index (the “Peer Group”) were Capital One Financial Corporation, Comerica

Incorporated, Fifth-Third Bancorp, Huntington Bancshares, Incorporated, KeyCorp, M&T Bank Corporation,

Marshall & Ilsley Corporation, PNC Financial Services Group, Inc., Regions Financial Corporation, SunTrust

Banks, Inc., U.S. Bancorp and Zions Bancorporation. The Peer Group consists of bank holding companies with

assets between approximately $51 billion and $281 billion.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG BB&T CORPORATION, THE S&P 500 INDEX,

AND BB&T's PEER GROUP

0

50

100

150

200

12/04 12/05 12/06 12/08

12/09

12/07

DOLLARS

BB&T CORPORATION S&P 500

BB&T's PEER GROUP

* $ 100 invested on 12/31/04 in stock or index, including reinvestment of dividends. Fiscal year ending

December 31.

Cumulative Total Return

12/04 12/05 12/06 12/07 12/08 12/09

BB&T CORPORATION $100.00 $103.40 $112.63 $ 82.07 $78.53 $ 77.03

S&P 500 100.00 104.91 121.48 128.15 80.88 102.29

BB&T’s PEER GROUP 100.00 99.60 114.78 86.72 55.15 52.35

29