BB&T 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

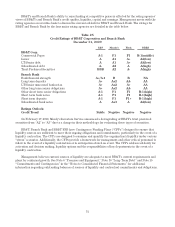

BB&T’s and Branch Bank’s ability to raise funding at competitive prices is affected by the rating agencies’

views of BB&T’s and Branch Bank’s credit quality, liquidity, capital and earnings. Management meets with the

rating agencies on a routine basis to discuss the current outlook for BB&T and Branch Bank. The ratings for

BB&T and Branch Bank by the four major rating agencies are detailed in the table below.

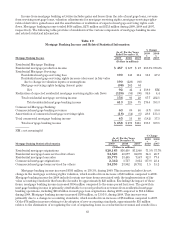

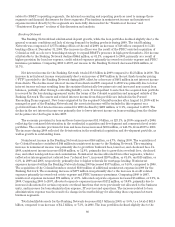

Table 25

Credit Ratings of BB&T Corporation and Branch Bank

December 31, 2009

S&P Moody’s Fitch DBRS

BB&T Corp.

Commercial Paper A-1 P1 F1 R-1(middle)

Issuer A A1 A+ AA(low)

LT/Senior debt A A1 A+ AA(low)

Subordinated debt A- A2 A A(high)

Trust Preferred Securities BBB A2 A- A(high)

Branch Bank

Bank financial strength A+/A-1 B B NA

Long term deposits A+ Aa2 AA- AA

LT/Senior unsecured bank notes A+ Aa2 A+ AA

Other long term senior obligations A+ Aa2 AA- AA

Other short term senior obligations A-1 P1 F1 R-1(high)

Short term bank notes A-1 P1 F1 R-1(high)

Short term deposits A-1 P1 F1+ R-1(high)

Subordinated bank notes A Aa3 A AA(low)

Ratings Outlook:

Credit Trend Stable Negative Negative Negative

On February 17, 2010, Moody’s Investors Service announced a downgrading of BB&T’s trust preferred

securities from “A2” to “A3” due to a change in their methodology for evaluating these types of securities.

BB&T, Branch Bank and BB&T FSB have Contingency Funding Plans (“CFPs”) designed to ensure that

liquidity sources are sufficient to meet their ongoing obligations and commitments, particularly in the event of a

liquidity contraction. The CFPs are designed to examine and quantify the organization’s liquidity under various

“stress” scenarios. Additionally, the CFPs provide a framework for management and other critical personnel to

follow in the event of a liquidity contraction or in anticipation of such an event. The CFPs address authority for

activation and decision making, liquidity options and the responsibilities of key departments in the event of a

liquidity contraction.

Management believes current sources of liquidity are adequate to meet BB&T’s current requirements and

plans for continued growth. See Note 6 “Premises and Equipment,” Note 10 “Long-Term Debt” and Note 15

“Commitments and Contingencies” in the “Notes to Consolidated Financial Statements” for additional

information regarding outstanding balances of sources of liquidity and contractual commitments and obligations.

73