BB&T 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

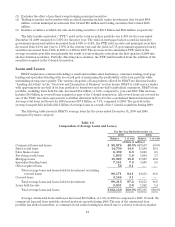

areas and industries in which BB&T conducts business. The methodology used to determine an estimate for the

reserve for unfunded lending commitments is inherently similar to the methodology used in calculating the

allowance for loans and leases adjusted for factors specific to binding commitments, including the probability of

funding and exposure at the time of funding. A detailed discussion of the methodology used in determining the

allowance for loan and lease losses and the reserve for unfunded lending commitments is included in the

“Overview and Description of Business—Allowance for Loan and Lease Losses and Reserve for Unfunded

Lending Commitments.”

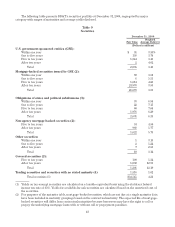

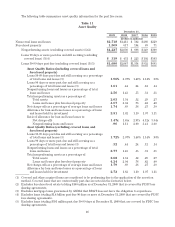

Fair Value of Financial Instruments

A significant portion of BB&T’s assets and certain liabilities are financial instruments carried at fair value.

This includes securities available for sale, trading securities, derivatives, certain loans held for sale, residential

mortgage servicing rights, certain short-term borrowings and venture capital investments. At December 31,

2009, the percentage of total assets and total liabilities measured at fair value was 23.6% and less than 1%,

respectively. The vast majority of assets and liabilities carried at fair value are based on either quoted market

prices or market prices for similar instruments. At December 31, 2009, 5.4% of assets measured at fair value were

based on significant unobservable inputs. This is approximately 1% of BB&T’s total assets. See Note 18 “Fair

Value Disclosures” in the “Notes to Consolidated Financial Statements” herein for additional disclosures

regarding the fair value of financial instruments.

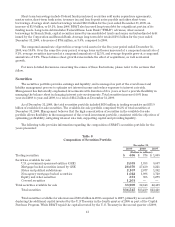

Securities

The fair values for available-for-sale and trading securities are generally based upon quoted market prices or

observable market prices for similar instruments. These values take into account recent market activity as well

as other market observable data such as interest rate, spread and prepayment information. When market

observable data is not available, which generally occurs due to the lack of liquidity for certain securities, the

valuation of the security is subjective and may involve substantial judgment. As of December 31, 2009, BB&T had

approximately $1.0 billion of available-for-sale and trading securities, which is less than 1% of total assets, valued

using unobservable inputs. This total includes $668 million of non-agency mortgage backed securities that are

covered by a loss sharing agreement with the FDIC and $219 million of auction-rate securities. BB&T conducts

periodic reviews to identify and evaluate each available-for-sale security that has an unrealized loss for other-

than-temporary impairment. An unrealized loss exists when the current fair value of an individual security is less

than its amortized cost basis. The primary factors BB&T considers in determining whether an impairment is

other-than-temporary are the financial condition and near–term prospects of the issuer, including any specific

events which may influence the operations of the issuer and BB&T’s intent to sell and whether it is more likely

than not that the Company will be required to sell these debt securities before the anticipated recovery of the

amortized cost basis.

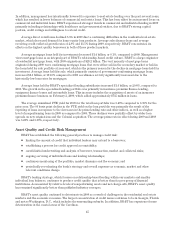

Mortgage Servicing Rights

BB&T has a significant mortgage loan servicing portfolio and related mortgage servicing rights (“MSRs”).

BB&T has two classes of MSRs for which it separately manages the economic risk: residential and commercial.

Residential MSRs are carried at fair value with changes in fair value recorded as a component of mortgage

banking income each period. BB&T uses various derivative instruments to mitigate the income statement effect

of changes in fair value, due to changes in valuation inputs and assumptions, of its residential MSRs. MSRs do not

trade in an active, open market with readily observable prices. While sales of MSRs do occur, the precise terms

and conditions typically are not readily available. Accordingly, BB&T estimates the fair value of residential

MSRs using an option adjusted spread (“OAS”) valuation model to project MSR cash flows over multiple interest

rate scenarios, which are then discounted at risk-adjusted rates. The OAS model considers portfolio

characteristics, contractually specified servicing fees, prepayment assumptions, delinquency rates, late charges,

other ancillary revenue, costs to service and other economic factors. BB&T reassesses and periodically adjusts

the underlying inputs and assumptions in the OAS model to reflect market conditions and assumptions that a

market participant would consider in valuing the MSR asset. When available, fair value estimates and

assumptions are compared to observable market data and to recent market activity and actual portfolio

experience. Due to the nature of the valuation inputs, MSRs are classified within Level 3 of the valuation

hierarchy. The value of MSRs is significantly affected by mortgage interest rates available in the marketplace,

which influence mortgage loan prepayment speeds. In general, during periods of declining interest rates, the

38