RBS 2007 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2007 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RBS Group • Annual Report and Accounts 2007 187

Financial statements

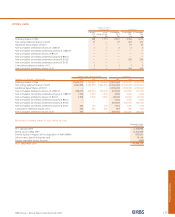

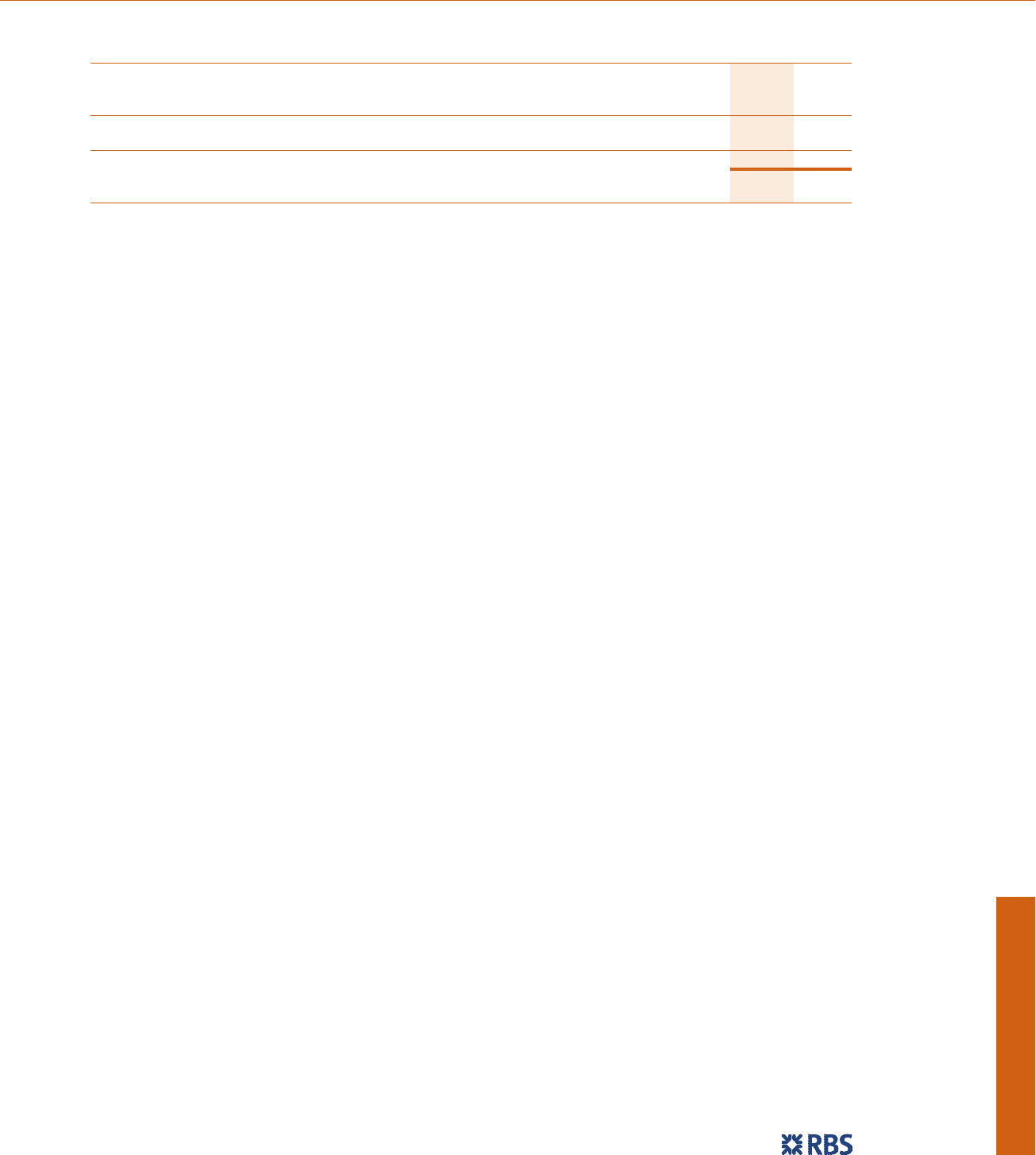

The table below sets out the Group’s loans that are classified as REIL and PPL:

2007 2006

REIL and PPL £m £m

Non-accrual loans (1) 10,362 6,232

Accrual loans past due 90 days (2) 369 105

Troubled debt restructurings (3) ——

Total REIL 10,731 6,337

PPL (4) 671 52

Total REIL and PPL 11,402 6,389

REIL and PPL as % of customer loans and advances – gross (5) 1.64% 1.57%

The sub-categories of REIL and PPL are calculated as described in notes 1 to 4 below.

Notes:

(1) All loans against which an impairment provision is held are reported in the non-accrual category.

(2) Loans where an impairment event has taken place but no impairment recognised. This category is used for fully collateralised non-revolving credit facilities.

(3) Troubled debt restructurings represent loans that have been restructured following the granting of a concession by the Group to the borrower.

(4) Loans for which an impairment event has occurred but no impairment provision is necessary. This category is used for fully collateralised advances and revolving credit facilities

where identification as 90 days overdue is not feasible.

(5) Gross of provisions and excluding reverse repurchase agreements.

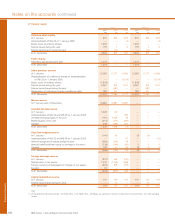

Impairment loss provision methodology

Provisions for impairment losses are assessed under three

categories as described below:

Individually assessed provisions are the provisions required

for individually significant impaired assets which are assessed

on a case by case basis, taking into account the financial

condition of the counterparty and any guarantor. This

incorporates an estimate of the discounted value of any

recoveries and realisation of security or collateral. The asset

continues to be assessed on an individual basis until it

is repaid in full, transferred to the performing portfolio or

written-off.

Collectively assessed provisions are provisions on impaired

credits below an agreed threshold which are assessed on

a portfolio basis, to reflect the homogeneous nature of the

assets, such as credit cards or personal loans. The provision is

determined from a quantitative review of the relevant portfolio,

taking account of the level of arrears, security and average

loss experience over the recovery period.

Latent loss provisions are provisions held against the

estimated impairment in the performing portfolio which have

yet to be identified as at the balance sheet date. To assess the

latent loss within the portfolios, the Group has developed

methodologies to estimate the time that an asset can remain

impaired within a performing portfolio before it is identified and

reported as such.

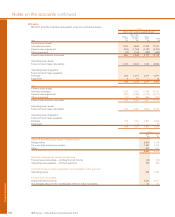

Provision analysis

The Group’s consumer portfolios, which consist of small value,

high volume credits, have highly efficient largely automated

processes for identifying problem credits and very short

timescales, typically three months, before resolution or

adoption of various recovery methods.

Corporate portfolios consist of higher value, low volume

credits, which tend to be structured to meet individual

customer requirements. Provisions are assessed on a case by

case basis by experienced specialists, with input from

professional valuers and accountants as appropriate. The

Group operates a provisions governance framework which

sets thresholds whereby suitable oversight and challenge

is undertaken. These opinions and levels of provision are

overseen by each division’s Provision Committee. Significant

cases are presented to, and challenged by, the Group Problem

Exposure Review Forum.

Early and active management of problem exposures ensures

that credit losses are minimised. Specialised units are used for

different customer types to ensure that the appropriate risk

mitigation is taken in a timely manner.

Portfolio provisions are reassessed regularly as part of the

Group’s ongoing monitoring process.