Philips 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group nancial statements 12.9

158 Annual Report 2015

The fair value of the performance shares is measured

based on Monte-Carlo simulation, which takes into

account dividend payments between the grant date

and the vesting date by including reinvested dividends,

the market conditions expected to impact relative Total

Shareholders’ Return performance in relation to

selected peers, and the following weighted-average

assumptions:

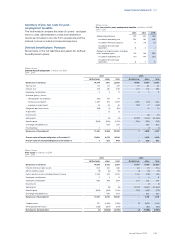

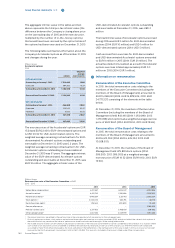

Philips Group

Assumptions used in Monte-Carlo simulation for valuation in %

2015

2015

EUR-denominated

Risk-free interest rate (0.11)%

Expected dividend yield 4.0%

Expected share price volatility 25%

USD-denominated

Risk-free interest rate (0.10)%

Expected dividend yield 4.0%

Expected share price volatility 27%

The assumptions were used for these calculations only

and do not necessarily represent an indication of

Management’s expectation of future developments for

other purposes. The Company has based its volatility

assumptions on historical experience measured over a

ten-year period.

The approach in calculating relative Total Shareholders

Return performance was determined to be based on

local currency instead of translating to the euro. This

clarication in the share-based compensation

arrangement did not result in accounting implications

for the grant of 2013 and 2014. For the grant of 2015 an

incremental fair value of EUR 6 million was recognized

in July and will be spread over the remaining vesting

period. The incremental fair value was measured using

the same assumptions used in the Monte-Carlo

simulation for the valuation of the 2015 grant, except for

the risk-free interest rate which was updated to (0.17)%.

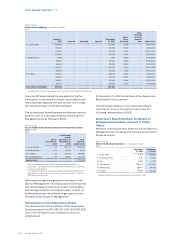

A summary of the status of the Company’s performance

share plans as of December 31, 2015 and changes

during the year are presented below:

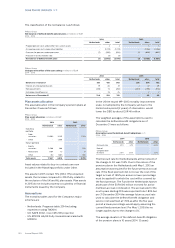

Philips Group

Performance share plans

2015

shares1)

weighted

average

grant-date

fair value

EUR-denominated

Outstanding at January 1, 2015 6,304,002 22.92

Granted 3,067,530 28.54

Forfeited 976,550 24.18

Outstanding at December 31, 2015 8,394,982 24.83

USD-denominated

Outstanding at January 1, 2015 4,200,900 30.44

Granted 1,985,066 30.19

Forfeited 411,266 30.48

Outstanding at December 31, 2015 5,774,700 30.35

1) Excludes dividend declared on outstanding shares between grant date

and vesting date that will be issued in shares (EUR-denominated:

566,851 shares and USD-denominated: 395,970 shares)

At December 31, 2015, a total of EUR 157 million of

unrecognized compensation costs relate to non-vested

performance shares. These costs are expected to be

recognized over a weighted-average period of 1.8

years.

Restricted shares

The fair value of restricted shares is equal to the share

price at grant date less the present value, using the risk-

free interest rate, of estimated future dividends which

will not be received up to the vesting date.

The Company issues restricted shares that, in general,

vest in equal annual installments over a three-year

period, starting one year after the date of grant. For

grants up to and including January 2013 the Company

granted 20% additional (premium) shares, provided the

grantee still holds the shares after three years from the

delivery date and the grantee is still with the Company

on the respective delivery dates.