RBS 2011 Annual Report Download - page 395

Download and view the complete annual report

Please find page 395 of the 2011 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RBS Group 2011 393

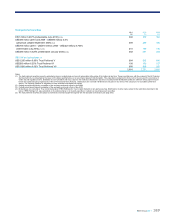

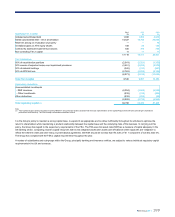

On a winding-up or liquidation of the company, the holders of the non-

cumulative preference shares will be entitled to receive, out of any

surplus assets available for distribution to the company's shareholders

(after payment of arrears of dividends on the cumulative preference

shares up to the date of repayment) pari passu with the cumulative

preference shares and all other shares of the company ranking pari

passu with the non-cumulative preference shares as regards participation

in the surplus assets of the company, a liquidation distribution per share

equal to the applicable redemption price detailed in the table above,

together with an amount equal to dividends for the then current dividend

period accrued to the date of payment, before any distribution or payment

may be made to holders of the ordinary shares as regards participation in

the surplus assets of the company.

Except as described above, the holders of the non-cumulative preference

shares have no right to participate in the surplus assets of the company.

Holders of the non-cumulative preference shares are not entitled to

receive notice of or attend general meetings of the company except if any

resolution is proposed for adoption by the shareholders of the company

to vary or abrogate any of the rights attaching to the non-cumulative

preference shares or proposing the winding-up or liquidation of the

company. In any such case, they are entitled to receive notice of and to

attend the general meeting of shareholders at which such resolution is to

be proposed and are entitled to speak and vote on such resolution (but

not on any other resolution). In addition, in the event that, prior to any

general meeting of shareholders, the company has failed to pay in full the

three most recent quarterly dividend payments due on the non-

cumulative dollar preference shares (other than Series U), the two most

recent semi-annual dividend payments due on the non-cumulative

convertible dollar preference shares and the most recent dividend

payments due on the non-cumulative euro preference shares, the non-

cumulative sterling preference shares, the Series U non-cumulative dollar

preference shares and the non-cumulative convertible sterling preference

shares, the holders shall be entitled to receive notice of, attend, speak

and vote at such meeting on all matters together with the holders of the

ordinary shares. In these circumstances only, the rights of the holders of

the non-cumulative preference shares so to vote shall continue until the

company shall have resumed the payment in full of the dividends in

arrears.

The Group has undertaken that, unless otherwise agreed with the

European Commission, neither the company nor any of its direct or

indirect subsidiaries (excluding companies in the RBS Holdings N.V.

Group, which are subject to different restrictions) will pay external

investors any dividends or coupons on existing hybrid capital instruments

(including preference shares, B shares and upper and lower tier 2

instruments) from 30 April 2010 for a period of two years thereafter ("the

Deferral Period"), or exercise any call rights in relation to these capital

instruments between 24 November 2009 and the end of the Deferral

Period, unless there is a legal obligation to do so. Hybrid capital

instruments issued after 24 November 2009 will generally not be subject

to the restriction on dividend or coupon payments or call options.

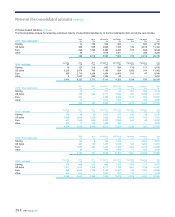

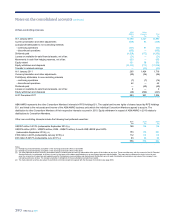

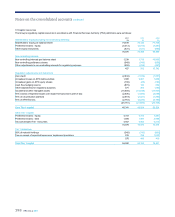

28 Other equity

Paid-in equity - notes issued under the company's euro medium term

note programme with an initial par value of US$1,600 million and

CAD600 million are classified as equity under IFRS. The notes attract

coupons of 6.99% and 6.666% respectively until October 2017 when they

change to 2.67% above the London interbank offered rate for 3-month

US dollar deposits and 2.76% above the Canadian dollar offered rate

respectively. Paid-in equity of US$1,036 million was repurchased in April

2009 and CAD279 million was repurchased in May 2010 as part of the

liability management exercises.

Merger reserve - on 1 January 2009, the merger reserve comprised the

premium on shares issued to acquire NatWest less goodwill amortisation

charged under previous GAAP. No share premium was recorded in the

company financial statements through the operation of the merger relief

provisions of the Companies Act 1985.

Under the arrangements for accession to APS in December 2009, the

company issued B shares in exchange for shares in Aonach Mor Limited.

No share premium was recorded in the company financial statements

through the operation of the merger relief provisions of the Companies

Act 2006. The subsequent redemption of these shares gave rise to

distributable profits of £50 million in 2011, £12,250 million in 2010 and

£9,950 million in 2009, which were transferred from merger reserve to

retained earnings.

Capital redemption reserve - under UK companies legislation, when

shares are redeemed or purchased wholly or partly out of the company's

profits, the amount by which the company's issued share capital is

diminished must be transferred to the capital redemption reserve. The

capital maintenance provisions of UK companies legislation apply to the

capital redemption reserve as if it were part of the company’s paid up

share capital.

Contingent capital reserve - in December 2009, HM Treasury agreed to

subscribe for up to 16 billion B shares of 1p each at 50p per share

subject to certain conditions including the Group's Core Tier 1 capital

ratio falling below 5%. The fair value of the consideration payable by the

company on entering into this agreement amounted to £1,458 million; of

this £1,208 million was debited to the contingent capital reserve.

Own shares held - at 31 December 2011, 1.6 billion (2010 - 1.7 billion;

2009 - 139 million) ordinary shares of 25p each of the company were

held by Employee Share Trusts in respect of share awards and options

granted to employees. Employee share trusts awarded 84.2 million

ordinary shares in satisfaction of the exercise of awards under employee

share plans during the year.

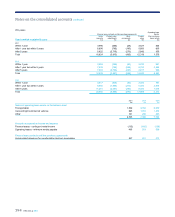

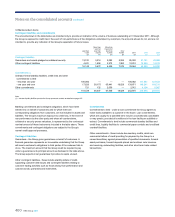

The Group optimises capital efficiency by maintaining reserves in

subsidiaries, including regulated entities. Certain preference shares and

subordinated debt are also included within regulatory capital. The

remittance of reserves to the company or the redemption of shares or

subordinated capital by regulated entities may be subject to maintaining

the capital resources required by the relevant regulator.

UK law prescribes that only the reserves of the company are taken into

account for the purpose of making distributions and in determining the

permissible applications of the share premium account.