RBS 2011 Annual Report Download - page 435

Download and view the complete annual report

Please find page 435 of the 2011 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476 -

477

477 -

478

478 -

479

479 -

480

480 -

481

481 -

482

482 -

483

483 -

484

484 -

485

485 -

486

486 -

487

487 -

488

488 -

489

489 -

490

490

|

|

RBS Group 2011 433

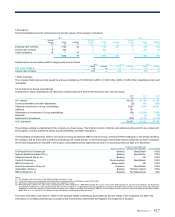

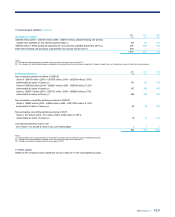

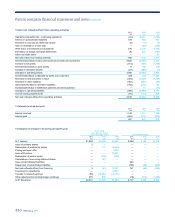

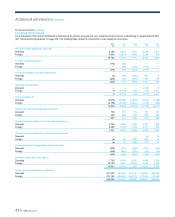

Financial summary

The Group's financial statements are prepared in accordance with IFRS. Selected data under IFRS for each of the five years ended 31 December 2011

are presented below.

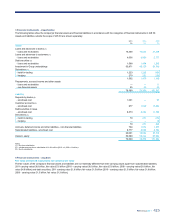

Summary consolidated income statement 2011

£m

2010

£m

2009

£m

2008

£m

2007

£m

Net interest income 12,679 14,209 13,388 15,482 11,550

Non-interest income (1,2,3) 16,258 17,659 19,638 5,248 17,922

Total income 28,937 31,868 33,026 20,730 29,472

Operating expenses (4,5,6,7,8)(18,026) (18,228) (17,417) (35,065) (13,383)

Profit/(loss) before insurance net claims and impairment losses 10,911 13,640 15,609 (14,335) 16,089

Insurance net claims (2,968) (4,783) (4,357) (3,917) (4,528)

Impairment losses (9,10) (8,709) (9,256) (13,899) (7,439) (1,925)

Operating (loss)/profit before tax (766) (399) (2,647) (25,691) 9,636

Tax (charge)/credit (1,250) (634) 429 2,167 (2,011)

(Loss)/profit from continuing operations (2,016) (1,033) (2,218) (23,524) 7,625

Profit/(loss) from discontinued operations, net of tax 47 (633) (105) (11,018) 87

(Loss)/profit for the year (1,969) (1,666) (2,323) (34,542) 7,712

(Loss)/profit attributable to:

Non-controlling interests 28 (665) 349 (10,832) 163

Preference shareholders — 105 878 536 246

Paid-in equity holders — 19 57 60 —

Ordinary and B shareholders (1,997) (1,125) (3,607) (24,306) 7,303

Notes:

(1) Includes loss on strategic disposals of £104 million (2010 - £171 million gain; 2009 - £132 million gain; 2008 - £442 million gain).

(2) Includes gain on redemption of own debt of £255 million (2010 - £553 million; 2009 - £3,790 million).

(3) Includes movement in fair value of own debt of £1,846 million profit (2010 - £174 million profit; 2009 - £142 million loss; 2008 - £1,232 million profit).

(4) Includes Payment Protection Insurance costs of £850 million.

(5) Includes integration and restructuring costs of £1,064 million (2010 - £1,032 million; 2009 - £1,286 million; 2008 - £1,357 million; 2007 - £108 million).

(6) Includes amortisation of purchased intangible assets of £222 million (2010 - £369 million; 2009 - £272 million; 2008 - £443 million; 2007 - £162 million).

(7) Includes write-down of goodwill and other intangible assets of £11 million (2010 - £10 million; 2009 - £363 million; 2008 - £16,911 million).

(8) Includes gains on pensions curtailment of £2,148 million in 2009.

(9) Includes sovereign debt impairment of £1,099 million.

(10) Includes interest rate hedge adjustments on impaired available-for-sale Greek government bonds of £169 million.

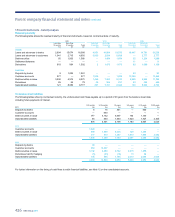

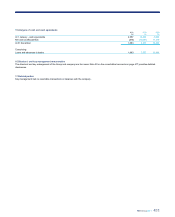

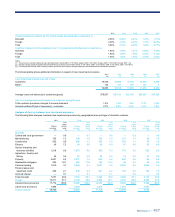

Summary consolidated balance sheet 2011

£m

2010

£m

2009

£m

2008

£m

2007

£m

Loans and advances 598,916 655,778 820,146 1,012,919 1,047,998

Debt securities and equity shares 224,263 239,678 286,782 293,879 347,682

Derivatives and settlement balances 537,389 438,682 453,487 1,010,391 293,991

Other assets 146,299 119,438 136,071 84,463 151,158

Total assets 1,506,867 1,453,576 1,696,486 2,401,652 1,840,829

Owners' equity 74,819 75,132 77,736 58,879 53,038

Non-controlling interests 1,234 1,719 16,895 21,619 38,388

Subordinated liabilities 26,319 27,053 37,652 49,154 38,043

Deposits 611,759 609,483 756,346 897,556 994,657

Derivatives, settlement balances and short positions 572,499 478,076 475,017 1,025,641 363,073

Other liabilities 220,237 262,113 332,840 348,803 353,630

Total liabilities and equity 1,506,867 1,453,576 1,696,486 2,401,652 1,840,829