RBS 2004 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2004 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

section

03

151

Annual Report and Accounts 2004

Notes on the accounts

Financial

statements

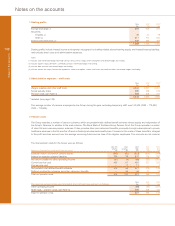

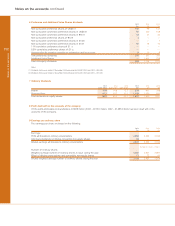

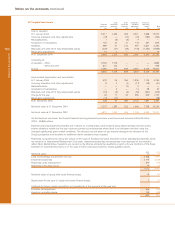

5 Tax on profit on ordinary activities

2004 2003 2002

£m £m £m

Current taxation:

UK corporation tax charge for the year at 30% 1,305 1,095 909

Over provision in respect of prior periods (66) (66) (13)

Relief for overseas taxation (212) (211) (26)

1,027 818 870

Overseas taxation:

Current year charge 786 538 370

Over provision in respect of prior periods (102) (11) (2)

1,711 1,345 1,238

Share of associated undertakings 11 22

Current tax charge for the year 1,722 1,347 1,240

Deferred taxation:

Origination and reversal of timing differences 482 576 398

Over provision in respect of prior periods (49) (35) (56)

Tax charge for the year 2,155 1,888 1,582

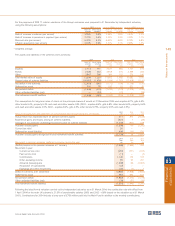

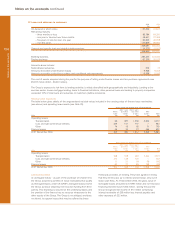

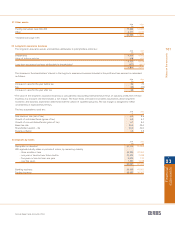

The actual tax charge differs from the expected tax charge computed by applying the standard rate of UK corporation tax

of 30% as follows:

2004 2003 2002

£m £m £m

Expected tax charge 2,075 1,823 1,456

Goodwill amortisation 241 200 183

Contributions to employee share schemes (32) (35) (40)

Non-deductible items 227 248 179

Non-taxable items (251) (207) (188)

Capital allowances in excess of depreciation (415) (626) (340)

Taxable foreign exchange movements (10) 54

Foreign profits taxed at other rates 49 26 2

Unutilised losses brought forward and carried forward 6 (15) —

Current taxation adjustments relating to prior periods (168) (77) (15)

Current tax charge for the year 1,722 1,342 1,241

Deferred taxation:

Origination and reversal of timing differences 482 581 397

Adjustments in respect of prior periods (49) (35) (56)

Actual tax charge 2,155 1,888 1,582

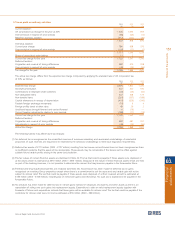

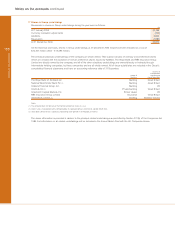

The following factors may affect future tax charges:

(1) No deferred tax is recognised on the unremitted reserves of overseas subsidiary and associated undertakings. A substantial

proportion of such reserves are required to be retained by the overseas undertakings to meet local regulatory requirements.

(2) Deferred tax assets of £110 million (2003 – £127 million) resulting from tax losses carried forward have not been recognised as there

is insufficient evidence that the asset will be recoverable. These assets may be recoverable if the losses can be offset against

suitable future taxable profits arising in the same tax jurisdiction.

(3) The fair values of certain financial assets are disclosed in Note 40. The tax that could be payable if these assets were disposed of

at the values shown is estimated at £910 million (2003 – £561 million). Because of the nature of these financial assets which are held

as part of the banking business, it is not possible to determine the amount that may become payable in the foreseeable future.

(4) Freehold and long leasehold properties are revalued (see Note 20). No provision has been made for deferred tax on gains

recognised on revaluing Group properties except where there is a commitment to sell the asset and any taxable gain will not be

subject to rollover relief. The tax that could be payable if these assets were disposed of at their revalued amount is estimated at

£129 million (2003 – £109 million), including tax on rolled over gains (see (5) below). No such tax is expected to be payable in the

foreseeable future.

(5) No provision has been made for deferred tax on certain gains realised on disposals of property and other assets as there is an

expectation of rolling over such gains into replacement assets. Expenditure to date on valid replacement assets together with

forecasts of future such expenditure indicate that these gains will be available for rollover relief. The tax that could be payable if the

conditions for rollover relief were not met is estimated at £16 million (2003 – £68 million).