RBS 2004 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2004 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188

Notes on the accounts

Notes on the accounts continued

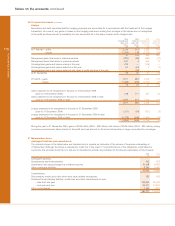

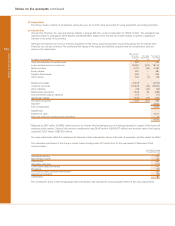

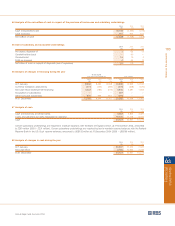

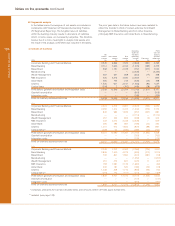

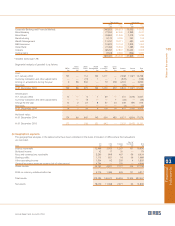

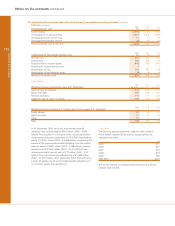

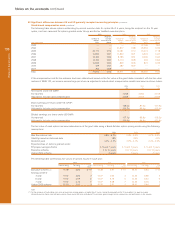

53 Significant differences between UK and US

generally accepted accounting principles (continued)

scheme assets compared with liabilities is recognised in

the balance sheet as an asset (surplus) or liability (deficit).

An asset is only recognised to the extent that the surplus

can be recovered through reduced contributions in the

future or through refunds from the scheme. US GAAP

requires a similar method but allows a certain portion of

actuarial gains and losses to be deferred and allocated in

equal amounts over the average remaining service lives of

current employees. A minimum additional liability must be

recognised if the accumulated benefit obligation (the

current value of accrued benefits without allowance for

future salary increases) exceeds the fair value of plan

assets and the Group has recorded a prepaid pension

costs or has an accrued liability that is less than the

unfunded accumulated benefit. Movements in the minimum

additional liability, together with the related deferred tax,

are recognised through other comprehensive income.

(h) Long-term assurance business

The shareholders’ interest in the long-term assurance fund

is valued as the discounted value of the cash flows

expected to be generated from in-force policies together

with net assets in excess of the statutory liabilities. Under

US GAAP, for traditional business, premiums are

recognised as revenue when due from the policyholders.

Costs of claims are recognised when insured events occur.

A liability for future policy benefits is established based

upon the present value of future benefits less the present

value of future net premiums. Acquisition costs for

traditional business contracts are charged to the profit and

loss account in proportion to premium revenue recognised.

For unit-linked business, premiums and front-end load-type

charges receivable from customers and acquisition costs

relating to the acquisition of new contracts are capitalised

and depreciated in proportion to the present value of

estimated gross profits. Costs of claims are recognised

when insured events occur.

(i) Extinguishment of liabilities

Under UK GAAP, recognition of a financial liability ceases

once any transfer of economic benefits to the creditor is no

longer likely. Under US GAAP, a financial liability is

derecognised only when the creditor is paid or the debtor

is legally released from being the primary obligator under

the liability, either judicially or by the creditor.

(j) Leasing

In accordance with UK GAAP, the Group’s accounting

policy for finance lease income receivable is to allocate

total gross earnings to accounting periods so as to give a

constant periodic rate of return on the net cash investment,

and certain operating lease assets are depreciated on a

reverse-annuity basis. Under US GAAP, finance lease

income is recognised so as to give a level rate of return on

the investment in the lease but without taking into account

the associated tax flows, and all operating lease assets are

depreciated on a straight-line basis.

(k) Securities

Under UK GAAP, the Group’s debt securities and equity

shares are classified as being held as investment

securities or for dealing purposes. Investment securities

are stated at cost less provision for any permanent

diminution in value. Premiums and discounts on dated debt

securities are amortised to interest income over the period

to maturity. Securities held for dealing purposes are carried

at fair value with changes in fair value recognised in the

profit and loss account. Under US GAAP, securities held by

the Group’s private equity business are considered to be

held by investment companies and are carried at fair value,

with changes in fair value being reflected in net income.

The Group’s other investment debt securities and

marketable investment equity shares are classified as

available-for-sale securities with unrealised gains and

losses reported in a separate component of equity, except

when the unrealised loss is considered other than

temporary in which case the loss is included in net income.

Under US GAAP, the Group recognises an other than

temporary impairment on an available-for-sale equity share

when its carrying value has exceeded its market value for

more than twelve months.

(l) Derivatives and hedging activities

SFAS 133 ‘Accounting for Derivative Instruments and

Hedging Activities’ was effective for the Group’s US GAAP

information from 1 January 2001. The Group has not made

changes in its use of non-trading derivatives to meet the

hedge criteria of SFAS 133. As a result, from 1 January

2001, for US GAAP purposes, the Group’s portfolio of non-

trading derivatives has been remeasured to fair value and

changes in fair value reflected in net income. Under UK

GAAP, these derivatives continue to be classified as non-

trading and accounted for in accordance with the underlying

transaction or transactions being hedged.

SFAS 133 does not permit a non-derivative financial

instrument to be designated as the hedging instrument in a

fair value hedge of the foreign exchange exposure of

available-for-sale securities.

SFAS 133 also requires derivatives embedded in other

financial instruments to be accounted for on a stand-alone

basis if they have economic characteristics and risks that

differ from those of the host instrument.

US GAAP does not permit a profit or loss to be recognised

on transacting a derivative unless its valuation is based on

observable market data. There is no similar requirement

under UK GAAP. Inception profits and losses reflecting the

application of the Group’s usual pricing methodologies are

recognised as they arise.

(m) Software development costs

Under UK GAAP, most software development costs are

written off as incurred. Under US GAAP, certain costs

relating to software developed for own use that are

incurred after 1 January 1999 are capitalised and

depreciated over the estimated useful life of the software.