RBS 2004 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2004 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

198

Notes on the accounts

Notes on the accounts continued

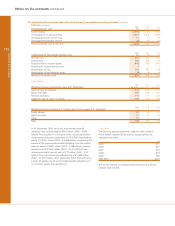

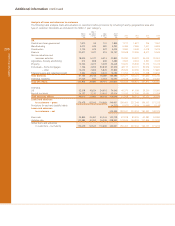

Key economic assumptions used in measuring the value of retained interests at the date of securitisation resulting from securitisations

completed during the year were as follows:

U.S. Agency Consumer Commercial

retained retained retained

Assumptions interests interests interests

Prepayment speed 184-480 PSA 4-45% CPR (1) 0-100 CPY (2)

Weighted average life 1-19 years 1-16 years 1-7 years

Cash flow discount rate 2-27% 2-78% 2-12%

Credit losses N/A (3) 0-2% CDR (4) N/A (5)

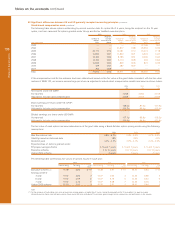

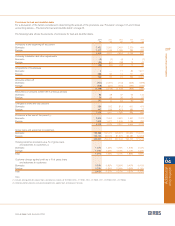

Key economic assumptions and the sensitivity of the current fair value of retained interests at 31 December 2004 to immediate

adverse changes, as indicated below, in those assumptions are as follows:

U.S. Agency Consumer Commercial

retained retained retained

Assumptions/impact on fair value interests interests interests

Fair value of retained interests at 31 December 2004 £509m £864m £56m

Prepayment speed (6) 12-35% CPR (1) 4-45% CPR (1) 0-100% CPY (2)

Impact on fair value of 10% adverse change £0.3m £16.6m ––

Impact on fair value of 20% adverse change £0.4m £32.8m ––

Weighted average life 1-18 years 1-11 years 1-7 years

Cash flow discount rate 2-33% 2-78% 2-12%

Impact on fair value of 10% adverse change £9.4m £20.0m £0.6m

Impact on fair value of 20% adverse change £18.4m £38.7m £1.2m

Credit losses N/A (3) 0-2% CDR (4) N/A (5)

Impact on fair value of 10% adverse change N/A £7.0m N/A

Impact on fair value of 20% adverse change N/A £14.3m N/A

Notes:

(1) Constant prepayment rate – the CPR range represents the low and high points of a dynamic CPR curve

(2) CPR with yield maintenance provision

(3) Population consists of securities whose collateral is guaranteed by US Government Sponsored Entities and therefore, no credit loss has been assumed.

(4) Constant default rate

(5) Population consists of only investment grade senior tranches; therefore, no credit losses are included in the assumptions at deal settlement.

(6) Prepayment speed has been stressed on an overall portfolio basis for US Agency retained interests due to the overall homogeneous nature of the collateral. Consumer and

Commercial retained interests have been stressed on a security level basis.

The sensitivities depicted in the preceding table are

hypothetical and should be used with caution. The likelihood of

those percent variations selected for sensitivity testing is not

necessarily indicative of expected market movements because

the relationship of the change in the assumptions to the

change in fair value may not be linear. Also, the effect of a

variation in a particular assumption on the fair value of a

retained interest is calculated without changing any other

assumptions. This might not be the case in actual market

conditions since changes in one factor might result in changes

to other factors. Further, the sensitivities depicted above do not

consider any corrective actions that the Group might take to

mitigate the effect of any adverse changes in one or more key

assumptions.

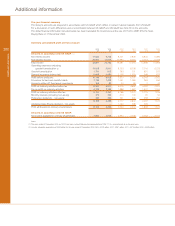

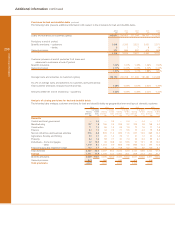

Securitisations (continued)

In some instances, the Group retained certain interests. The

Group typically does not retain a significant portion of the

loans or securities that it securitises. This reduces the impact

that changes to fair values of retained interests might have on

the Group’s financial results.

The Group’s retained interests may be subordinated to other

investors’ interests. The investors and securitisation trusts have

no recourse to the Group’s other assets for failure of debtors to

perform on the securitised loans or securities. The value of the

retained interests varies and is subject to prepayment, credit

and interest rate risks on the transferred assets.

At 31 December 2004, the fair value of the Group’s retained

interests was approximately £1.4 billion (2003 – £1.5 billion).

These retained interests comprises approximately £509 million

in US Agency based retained interests, £864 million in consumer

based retained interests and £56 million in commercial based

retained interests. These retained interests primarily relate to

mortgage loans and securities and arose from securitisations

that have taken place in current and prior years.

Cash flows received in 2004 from retained interests held at

31 December 2004 in connection with securitisations that took

place in current and prior years amounted to approximately

£383 million (2003 – £368 million).

53 Significant differences between UK and US

generally accepted accounting principles (continued)