RBS 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234

|

|

section

01

Operating and

financial review

83

Annual Report and Accounts 2004

Operating and financial review

2003 compared with 2002

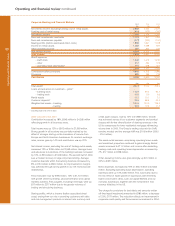

The division achieved strong volume growth across all personal

product areas - current accounts, mortgages and loans and

savings. Despite lower interest rates and the adverse effect of

the pricing remedies agreed following the Competition

Commission inquiry into SME banking which were implemented

from 1 January 2003, income increased by 5% or £194 million

to £4,473 million, and contribution by 3% or £96 million to

£3,170 million.

Net interest income rose by 4% or £110 million to £2,959 million,

reflecting the continued strong growth in customer advances

and deposits which was partially offset by the implementation

of the Competition Commission pricing remedies and the

impact of a lower interest rate environment. Excluding the

effect of the Competition Commission the increase was 8%.

Average loans to customers, excluding mortgages, grew by

9% or £1.9 billion to £23.7 billion. Average mortgage lending

grew by 12% or £3.6 billion to £33.7 billion. Average customer

deposits increased by 6% or £3.7 billion to £60.9 billion.

Non-interest income rose by 6% or £84 million to £1,514 million.

This reflected further growth in the customer base and a 15%

growth in general insurance income to £301 million. Embedded

value profits of the life assurance business increased by 14%,

or £7 million to £57 million.

Direct expenses increased by 4% or £38 million to £1,030

million. Staff expenses increased 9% or £64 million to £793

million reflecting further investment in customer facing staff.

Other expenses decreased 10% or £26 million to £237 million,

as a result of our rigorous approach to management of non-

staff costs.

The charge for provisions for bad debts increased by £60 million

to £273 million. The overall quality of the loan portfolio

remained stable and the increased charge reflected growth

in lending over recent years particularly in NatWest since its

acquisition.