RBS 2004 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2004 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

166

Notes on the accounts

Notes on the accounts continued

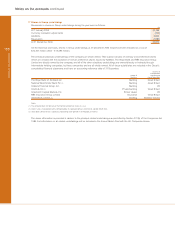

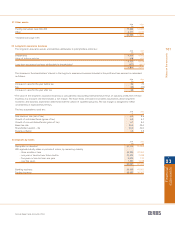

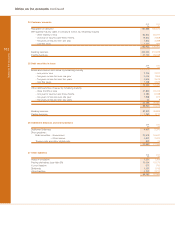

31 Undated loan capital including convertible debt 2004 2003

£m £m

The company

US$350 million undated floating rate primary capital notes (callable on any interest payment date) (1,2) 181 196

US$200 million 8.5% exchangeable capital securities, Series A (callable June 2004) (1,3) 103 112

US$50 million undated 7.993% capital securities (callable November 2005) (1) 26 28

US$35 million undated 7.755% capital securities (callable December 2005) (1) 18 19

US$200 million undated 7.375% reset capital securities (callable April 2006) (1) 103 112

US$75 million floating rate perpetual capital securities (callable September 2007) (1) 39 42

US$850 million 5.75% exchangeable capital securities, Series B (4) —464

US$1,200 million 7.648% perpetual regulatory tier one securities (callable September 2031) (1,5) 615 666

1,085 1,639

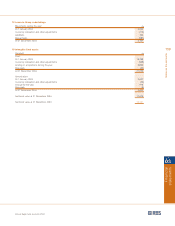

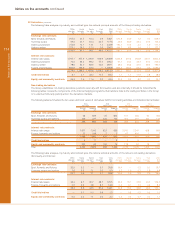

The Royal Bank of Scotland plc

£125 million 9.25% undated subordinated step-up notes (callable April 2006) 125 125

£150 million undated subordinated floating rate step-up notes (callable March 2007) 150 150

FRF1,000 million (redesignated 152 million) 5.875% undated subordinated notes (callable October 2008) 107 107

£175 million 7.375% undated subordinated notes (callable August 2010) 174 173

£350 million 6.25% undated subordinated notes (callable December 2012) 348 348

500 million 5.125% subordinated notes (issued July 2004; callable July 2014) (6) 350 —

1,000 million floating rate subordinated notes (issued July 2004; callable July 2014) (7) 701 —

£500 million 6.0% subordinated notes (issued June 2004; callable September 2014) (8) 496 —

£500 million 5.125% undated subordinated notes (callable March 2016) 491 491

£200 million 9.5% undated subordinated bonds (callable August 2018) (9) 198 198

£600 million 5.5% subordinated notes (issued December 2004; callable December 2019) (10) 595 —

£500 million 6.2% undated subordinated notes (callable March 2022) 497 497

£300 million 5.625% undated subordinated notes (callable September 2026) 298 298

£200 million 5.625% undated subordinated notes (callable September 2026) 210 211

£400 million 5.625% undated subordinated notes (callable September 2026) 397 396

£350 million 5.625% undated subordinated notes (callable June 2032) 346 346

£150 million 5.625% undated subordinated notes (callable June 2032) 144 144

JPY25 billion 2.605% subordinated notes (issued November 2004; callable November 2034) (11) 126 ––

National Westminster Bank Plc

US$500 million primary capital floating rate notes, Series A (callable on any interest payment date) 258 280

US$500 million primary capital floating rate notes, Series B (callable on any interest payment date) 258 280

US$500 million primary capital floating rate notes, Series C (callable on any interest payment date) 258 280

US$500 million 7.875% exchangeable capital securities (callable on any interest payment date) (12) 258 280

US$500 million 7.75% reset subordinated notes (callable October 2007) 255 275

100 million floating rate undated subordinated step-up notes (callable October 2009) 71 70

400 million 6.625% fixed/floating rate undated subordinated notes (callable October 2009) 280 280

£325 million 7.625% undated subordinated step-up notes (callable January 2010) 329 330

£200 million 7.125% undated subordinated step-up notes (callable October 2022) 203 203

£200 million 11.5% undated subordinated notes (callable December 2022) (13) 281 285

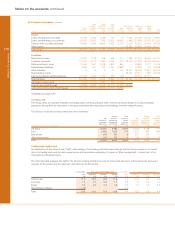

First Active plc (14)

£20 million 11.75% perpetual tier two capital 24 —

IR£30 million 11.375% perpetual tier two capital 38 —

£1.3 million floating rate perpetual tier two capital 2 —

9,353 7,686

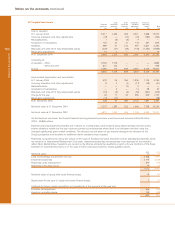

Notes:

(1) On-lent to The Royal Bank of Scotland plc on a subordinated basis.

(2) Interest is payable at a rate of 0.25% per annum over an average calculated by reference to six month euro dollar deposits in London for each interest period.

(3) Redeemable in certain circumstances related to changes in the tax laws of the UK, in whole or in part, at the option of the company on any interest payment date.

Exchangeable, in whole or in part, at the option of the company on any interest payment date, or in certain circumstances related to changes in the tax laws of the UK,

in whole but not in part, into the company’s non-cumulative preference shares of US$0.01 each.

(4) Exchanged for 34 million non-cumulative dollar preference shares of US0.01, Series L on 30 September 2004.

(5) Redeemable by the company on or after 30 September 2031 or on any interest payment date thereafter or at any time on the occurrence of certain events, subject to the prior

approval of the UK Financial Services Authority.

Interest on the PROs is payable semi-annually in arrears at a fixed rate of 7.648% per annum until 30 September 2031 and thereafter quarterly in arrears at a variable rate of

2.5% per annum above three month dollar LIBOR. The company can satisfy interest payment obligations by issuing ordinary shares to appointed Trustees sufficient to enable

them, on selling these shares, to settle the interest payment.

(6) Net proceeds received 496 million, £334 million.

(7) Net proceeds received 994 million, £668 million.

(8) Net proceeds received £495 million.

(9) Guaranteed by the company.

(10) Net proceeds received £595 million.

(11) Net proceeds received JPY25 billion, £127 million.

(12) Exchangeable at the option of the issuer into 20 million 8.75% (gross) non-cumulative preference shares of US$25 each of National Westminster Bank Plc at any time.

(13) Exchangeable at the option of the issuer into 200 million 8.392% (gross) non-cumulative preference shares of £1 each of National Westminster Bank Plc at any time.

(14) Arising from acquisition of First Active.

(15) Except as stated above, claims in respect of the Group's undated loan capital are subordinated to the claims of other creditors. None of the Group's undated loan capital is secured.

(16) Except as stated above, interest payable on Group floating rate undated issues is at a margin over London interbank rates. Interest on £4,875 million, US$1,668 million,

1,052 million and JPY25 billion of fixed rate undated issues is swapped into floating rates at a margin over London interbank rates.

(17) Where the issuer has the ability to redeem the undated loan capital, this is subject to prior approval of the UK Financial Services Authority.