RBS 2004 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2004 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

210

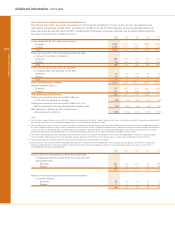

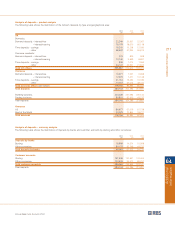

Additional information

Additional information continued

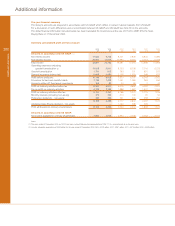

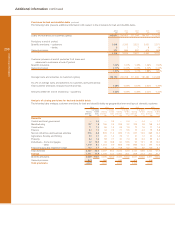

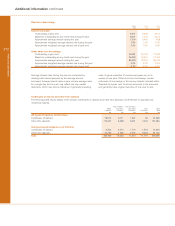

Risk elements in lending and potential problem loans

The Group’s loan control and review procedures do not include the classification of loans as non-accrual, accruing past due,

restructured and potential problem loans, as defined by the SEC in the US. The following table shows the estimated amount of

loans that would be reported using the SEC’s classifications. The figures incorporate estimates and are stated before deducting

the value of security held or related provisions.

2004 2003 2002 2001 2000

£m £m £m £m £m

Loans accounted for on a non-accrual basis (3):

Domestic 3,705 3,221 3,077 2,829 2,482

Foreign 1,075 1,211 1,098 737 344

Total 4,780 4,432 4,175 3,566 2,826

Accruing loans which are contractually overdue 90 days

or more as to principal or interest (4):

Domestic 646 561 363 643 662

Foreign 79 81 129 142 168

Total 725 642 492 785 830

Loans not included above which are classified

as ‘troubled debt restructurings’ by the SEC:

Domestic 14 53 144 26 43

Foreign 10 30 60 116 122

Total 24 83 204 142 165

Total risk elements in lending 5,529 5,157 4,871 4,493 3,821

Potential problem loans (5)

Domestic 173 492 639 801 699

Foreign 107 99 544 279 73

Total potential problem loans 280 591 1,183 1,080 772

Closing provisions for bad and doubtful debts as

a % of total risk elements in lending 76% 76% 80% 81% 82%

Closing provisions for bad and doubtful debts as a % of

total risk elements in lending and potential problem loans 73% 68% 65% 65% 68%

Risk elements in lending as a % of gross loans

and advances to customers 1.58% 2.01% 2.14% 2.31% 2.23%

Notes:

(1) For the analysis above, ‘Domestic’ consists of the UK domestic transactions of the Group. ‘Foreign’ comprises the Group’s transactions conducted through offices outside the UK

and through those offices in the UK specifically organised to service international banking transactions.

(2) The classification of a loan as non-accrual, past due 90 days or troubled debt restructuring does not necessarily indicate that the principal of the loan is uncollectable in whole

or in part. Collection depends in each case on the individual circumstances of the loan, including the adequacy of any collateral securing the loan and therefore classification of

a loan as non-accrual, past due 90 days or troubled debt restructuring does not always require that a provision be made against such a loan. In accordance with the Group’s

provisioning policy for bad and doubtful debts, it is considered that adequate provisions for the above risk elements in lending have been made.

(3) The Group’s UK banking subsidiary undertakings account for loans on a non-accrual basis from the point in time at which the collectability of interest is in significant doubt.

Certain subsidiary undertakings of the Group, principally Citizens, generally account for loans on a non-accrual basis when interest or principal is past due 90 days.

(4) Overdrafts generally have no fixed repayment schedule and consequently are not included in this category.

(5) Loans that are current as to the payment of principal and interest but in respect of which management has serious doubts about the ability of the borrower to comply with

contractual repayment terms. Substantial security is held in respect of these loans and appropriate provisions have already been made in accordance with the Group’s

provisioning policy for bad and doubtful debts.

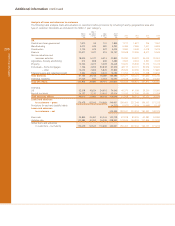

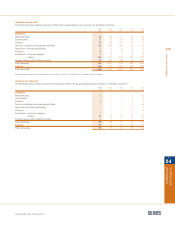

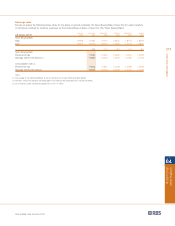

2004 2003 2002 2001 2000

£m £m £m £m £m

Gross income not recognised but which would have been

recognised under the original terms of non-accrual and

restructured loans

Domestic 237 237 234 173 148

Foreign 58 55 73 60 48

295 292 307 233 196

Interest on non-accrual and restructured loans included in

net interest income

Domestic 58 60 47 42 30

Foreign 737148

65 63 54 56 38