BB&T 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

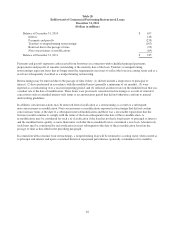

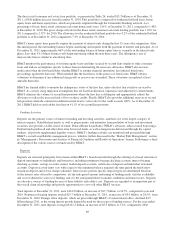

comprehensive income was primarily due to a $401 million after-tax increase in the value of the available for sale

securities portfolio, partially offset by declines of $235 million related to pensions and other post-retirement benefit plans

and $112 million in unrecognized losses on cash flow hedges.

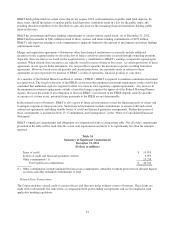

BB&T’s tangible shareholders’ equity available to common shareholders was $11.7 billion at December 31, 2011, an

increase of $952 million, or 8.9%, compared to December 31, 2010. BB&T’s tangible book value per common share at

December 31, 2011 was $16.73 compared to $15.43 at December 31, 2010. As of December 31, 2011, measures of

tangible capital were not required by the regulators and, therefore, were considered non-GAAP measures. Refer to the

section titled “Capital” herein for a discussion of how BB&T calculates and uses these measures in the evaluation of the

Company.

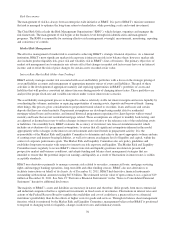

Risk Management

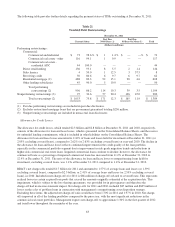

In the normal course of business BB&T encounters inherent risk in its business activities. Risk is managed on a

decentralized basis with risk decisions made as closely as possible to where the risk occurs. Centrally, risk oversight is

managed at the corporate level through oversight, policies and reporting. The principal types of inherent risk include

regulatory, credit, liquidity, market, operational, reputation and strategic risks.

Regulatory risk

Regulatory risk is the risk to earnings, capital, or reputation arising from violations of, or nonconformance with current and

changing laws, regulations, supervisory guidance, regulatory expectations, or the rules, standards, or codes of conduct of self

regulatory organizations.

Credit risk

Credit risk is the risk to earnings or capital arising from the default, inability or unwillingness of a borrower, obligor, or

counterparty to meet the terms of any financial obligation with BB&T or otherwise perform as agreed. Credit risk exists in

all activities where success depends on the performance of a borrower, obligor, or counterparty. Credit risk arises when

BB&T funds are extended, committed, invested, or otherwise exposed through actual or implied contractual agreements,

whether on or off the balance sheet. Credit risk also occurs when the credit quality of an issuer whose securities or other

instruments the bank holds deteriorates.

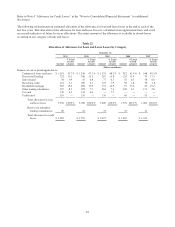

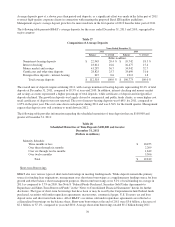

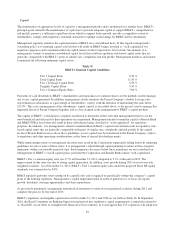

BB&T has established the following general practices to manage credit risk:

• limiting the amount of credit that individual lenders may extend to a borrower;

• establishing a process for credit approval accountability;

• careful initial underwriting and analysis of borrower, transaction, market and collateral risks;

• ongoing servicing of individual loans and lending relationships;

• continuous monitoring of the portfolio, market dynamics and the economy; and

• periodically reevaluating the bank’s strategy and overall exposure as economic, market and other relevant

conditions change.

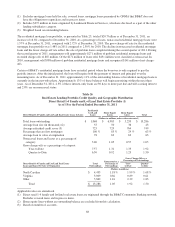

The following discussion presents the principal types of lending conducted by BB&T and describes the underwriting

procedures and overall risk management of BB&T’s lending function.

Underwriting Approach

Recognizing that the loan portfolio is a primary source of profitability and risk, proper loan underwriting is critical to

BB&T’s long-term financial success. BB&T’s underwriting approach is designed to define acceptable combinations of

specific risk-mitigating features that ensure credit relationships conform to BB&T’s risk philosophy. Provided below is a

summary of the most significant underwriting criteria used to evaluate new loans and loan renewals:

•Cash flow and debt service coverage—cash flow adequacy is a necessary condition of creditworthiness, meaning

that loans not clearly supported by a borrower’s cash flow must be justified by secondary repayment sources.

72