Regions Bank 2009 Annual Report Download - page 194

Download and view the complete annual report

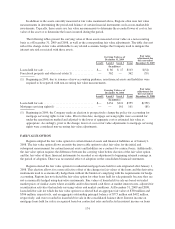

Please find page 194 of the 2009 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.predict the ultimate resolution or financial liability with respect to these contingencies, management is currently

of the opinion that the outcome of these proceedings would not have a material effect on Regions’ consolidated

financial position or results of operations.

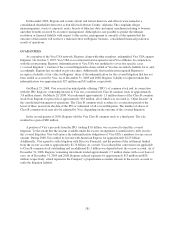

In July 2009, Morgan Keegan & Company, Inc. (“Morgan Keegan”), a wholly-owned subsidiary of

Regions, Morgan Asset Management, Inc. and three employees each received a Wells notice from the Staff of the

Atlanta Regional Office of the Securities and Exchange Commission (“SEC”) stating that the Staff intends to

recommend that the Commission bring enforcement actions for possible violations of the federal securities laws.

The potential actions relate to the Staff’s investigation of the Funds. Additionally, in July 2009, Morgan Keegan

received a Wells notice from the enforcement staff of the Financial Industry Regulatory Authority (“FINRA”)

advising Morgan Keegan that it had made a preliminary determination to recommend disciplinary action against

Morgan Keegan for violation of various NASD rules relating to sales of the Funds during 2006 and 2007. A

Wells notice is neither a formal allegation nor a finding of wrongdoing. The notices provide the recipients the

opportunity to provide their perspective and to address issues raised prior to any formal action being taken by the

SEC or FINRA. Responses have been submitted to both the SEC and FINRA notices. Also, a joint state task

force has indicated that it is considering charges against Morgan Keegan, related entities and certain of their

officers in connection with sales of the Funds. Discussions are ongoing with the state securities commissioners in

the task force about the proposed charges and possible resolutions. Although it is not possible to predict the

ultimate resolution or financial liability with respect to these matters, management is currently of the opinion that

the outcome of these matters will not have a material effect on Regions’ business, consolidated financial position

or results of operations.

In March 2009, Morgan Keegan received a Wells notice from the SEC’s Atlanta Regional Office related to

auction rate securities (“ARS”) indicating that the SEC staff intended to recommend that the Commission take

civil action against Morgan Keegan. On July 21, 2009, the SEC filed a complaint in United States District Court

for the Northern District of Georgia against Morgan Keegan alleging violations of the federal securities laws in

connection with ARS that Morgan Keegan underwrote, marketed and sold. The SEC is seeking an injunction

against Morgan Keegan for violations of the antifraud provisions of the federal securities laws, as well as

disgorgement, financial penalties and other equitable relief for customers, including repurchase by Morgan

Keegan of all ARS that it sold prior to March 20, 2008. Beginning in February 2009, Morgan Keegan

commenced a voluntary program to repurchase ARS that it underwrote and sold to the firm’s customers, and

extended that repurchase program on October 1, 2009 to include certain ARS that were sold by Morgan Keegan

to its customers but were underwritten by other firms. As of December 31, 2009, customers of Morgan Keegan

owned approximately $247 million of ARS and Morgan Keegan held approximately $166 million of ARS on its

balance sheet. On July 21, 2009, the Alabama Securities Commission issued a “Show Cause” order to Morgan

Keegan arising out of the ARS matter that is the subject of the SEC complaint described above. The order

requires Morgan Keegan to show cause why its registration as a broker-dealer should not be suspended or

revoked in the State of Alabama and also why it should not be subject to disgorgement, repurchasing all ARS

sold to Alabama residents and payment of costs and penalties. Although it is not possible to predict the ultimate

resolution or financial liability with respect to the ARS matter, management is currently of the opinion that the

outcome of this matter will not have a material effect on Regions’ business, consolidated financial position or

results of operations.

In April 2009, Regions, Regions Financing Trust III (the “Trust”) and certain of Regions’ current and

former directors, were named in a purported class-action lawsuit filed in the U.S. District Court for the Southern

District of New York on behalf of the purchasers of trust preferred securities offered by the Trust. The complaint

alleges that defendants made statements in Regions’ registration statement, prospectus and year-end filings which

were materially false and misleading. No class has been certified, and at this stage of the lawsuit Regions cannot

determine the probability of a material adverse result or reasonably estimate a range of potential exposures, if

any. However, it is possible that an adverse resolution of these matters may be material to Regions’ business,

consolidated financial position or results of operations.

180