RBS 2003 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2003 RBS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

186

Notes on the accounts continued

Notes on the accounts

(a) At 31 December 2003, the amounts outstanding in relation

to transactions, arrangements and agreements entered into

by authorised institutions in the Group were £343,298 in

respect of loans to eight persons who were directors of

the company (or persons connected with them) at any time

during the financial period and £31,783 to one person who

was an officer of the company at any time during the

financial period.

(b) There were no contracts of significance to the business of

the company and its subsidiaries which subsisted at 31

December 2003, or during the year then ended, in which

any director of the company had a material interest.

Subsidiary undertakings

In accordance with Financial Reporting Standard 8 ‘Related

Party Disclosures’(“FRS 8”), transactions or balances between

Group entities that have been eliminated on consolidation are

not reported.

Investments

Group members provide development and other types of

capital support to businesses in their roles as providers of

finance. These investments are made in the normal course of

business and on arm’s-length terms depending on their nature.

In some instances, the investment may extend to ownership or

control over 20% or more of the voting rights of the investee

company. However, these investments are not considered to

give rise to transactions of a materiality requiring disclosure

under FRS 8.

Pension Fund

The Group recharges The Royal Bank of Scotland Group

Pension Fund with the cost of administration services incurred

by it. The amounts involved are not material to the Group.

Santander Central Hispano (“SCH”)

Details of the Group’s cross-holding with SCH are given on

page 55. It is not a related party as defined in FRS 8.

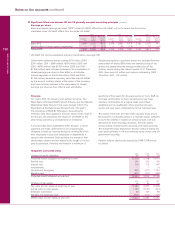

The consolidated financial statements of the Group are

prepared in accordance with UK generally accepted

accounting principles (“GAAP”) that differ in certain material

respects from US GAAP. The significant differences are

summarised as follows:

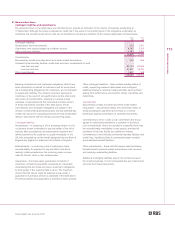

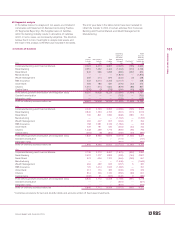

(a) Acquisition accounting

Under UK GAAP, all integration costs relating to

acquisitions are expensed as post-acquisition expenses.

Under US GAAP, certain restructuring and exit costs

incurred in the acquired business are treated as liabilities

assumed on acquisition and taken into account in the

calculation of goodwill.

Under UK GAAP, provisional fair value adjustments made in

the accounting year in which the acquisition occurs may

be amended in the subsequent accounting year. Under US

GAAP, the allocation of the cost of acquisition to the fair

values of assets and liabilities is generally completed

within 12 months of the date of acquisition.

(b) Goodwill

Under the Group’s UK GAAP accounting policy, goodwill

arising on acquisitions after 1 October 1998 is recognised

as an asset and amortised on a straight-line basis over its

estimated useful economic life. Impairment tests on goodwill

are carried out at the end of the first full accounting period

after its acquisition, and whenever there are indications of

impairment. Goodwill arising on acquisitions before 1

October 1998 was deducted from reserves immediately.

Under US GAAP, goodwill is recognised as an asset, and is

not amortised. Under the transition rules of SFAS 142

‘Goodwill and Other Intangible Assets’, no amortisation is

charged on acquisitions made after 30 June 2001;

amortisation is charged up to 31 December 2001 for other

goodwill. All goodwill is tested for impairment at least

annually. Certain amounts included in goodwill under UK

GAAP are classified as intangible assets under US GAAP

and amortised over their useful economic life.

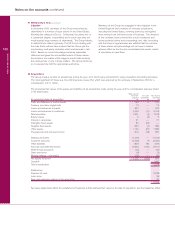

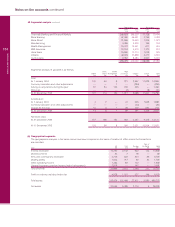

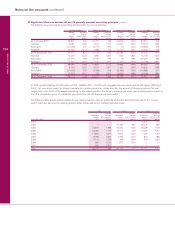

(c) Property revaluation and depreciation

The Group’s freehold and leasehold properties are carried

at original cost or subsequent valuation. The surplus or

deficit on revaluation is included in the Group’s reserves.

Under US GAAP, revaluations of property are not permitted

to be reflected in the financial statements.

Depreciation charged and gains or losses on disposal

under UK GAAP are based on the revalued amount of

freehold and long leasehold properties; no depreciation is

charged on investment properties which are revalued

annually. Under US GAAP, the depreciation charge and

gains or losses on disposal are based on the historical

cost of all properties.

(d) Leasehold property provisions

Under UK GAAP, provisions are raised on leasehold

properties when there is a commitment to vacate the

property. US GAAP requires provisions to be recognised at

the time the property is vacated.

(e) Dividends

Under UK GAAP, dividends are recorded in the period to

which they relate, whereas under US GAAP dividends are

recorded in the period in which they are declared.

(f) Loan origination fees

Under UK GAAP, certain loan fees are recognised when

received. Under US GAAP, all non-refundable loan fees

and certain direct costs are deferred and recognised as

an adjustment to the yield on the related loan or facility.

(g) Pension costs

Pension costs, based on actuarial assumptions and

methods, are charged in the consolidated accounts so as

to allocate the cost of providing benefits over the service

lives of employees in a consistent manner approved by the

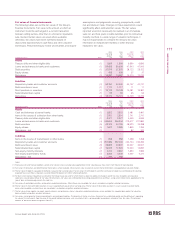

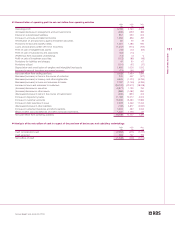

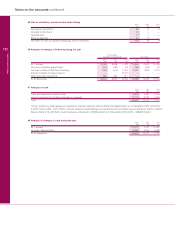

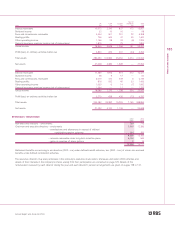

52 Related party transactions

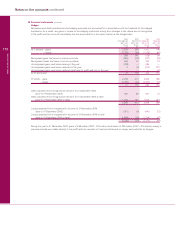

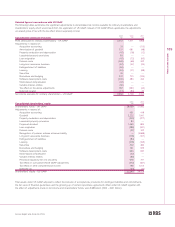

53 Significant differences between UK and US

generally accepted accounting principles

51 Transactions with directors, officers and others