BB&T 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.143

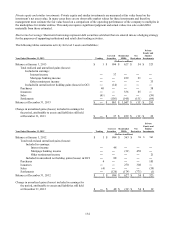

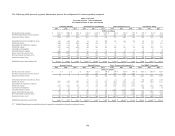

NOTE 20. Operating Segments

BB&T's operations are divided into six reportable business segments that have been identified based on BB&T’s

organizational structure. The segments require unique technology and marketing strategies and offer different products and

services through a number of distinct branded LOBs. While BB&T is managed as an integrated organization, individual

executive managers are held accountable for the operations of these business segments.

BB&T emphasizes revenue growth by focusing on client service, sales effectiveness and relationship management along with

an organizational focus on referring clients between LOBs. The business objective is to provide BB&T’s entire suite of

products to our clients with the end goal of providing our clients the best financial experience in the marketplace. The

segment results contained herein are presented based on internal management accounting policies that were designed to

support these strategic objectives. Unlike financial accounting, there is no comprehensive authoritative body of guidance for

management accounting equivalent to GAAP. The performance of the segments is not comparable with BB&T’s

consolidated results or with similar information presented by any other financial institution. Additionally, because of the

interrelationships of the various segments, the information presented is not indicative of how the segments would perform if

they operated as independent entities.

The management accounting process uses various estimates and allocation methodologies to measure the performance of the

operating segments. To determine financial performance for each segment, BB&T allocates capital, funding charges and

credits, an allocated provision for loan and lease losses, certain noninterest expenses and income tax provisions to each

segment, as applicable. To promote revenue growth, certain revenues are reflected in noninterest income in the individual

segment results and also allocated to Community Banking and Financial Services. These allocated revenues are reflected in

intersegment net referral fees and eliminated in Other, Treasury and Corporate. Additionally certain client groups of

Community Banking have also been identified as clients of other LOBs within the business segments. These client groups

include the commercial clients being serviced within the Commercial Finance LOB that is part of the Specialized Lending

segment and the identified wealth and private banking clients of the Wealth Division within the Financial Services segment.

The net interest income and associated net FTP associated with these customers’ loans and deposits is accounted for in

Community Banking in the respective line categories of net interest income (expense) and net intersegment interest income

(expense). For the Commercial Finance LOB and the Wealth Division, NIM and net intersegment interest income have been

combined in the net intersegment interest income (expense) line with an appropriate offsetting amount to the Other, Treasury

and Corporate line item to ensure consolidated totals reflect the Company’s total NIM for loans and deposits. Allocation

methodologies are subject to periodic adjustment as the internal management accounting system is revised and business or

product lines within the segments change. Also, because the development and application of these methodologies is a

dynamic process, the financial results presented may be periodically revised.

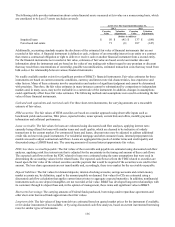

BB&T utilizes an FTP system to eliminate the effect of interest rate risk from the segments’ net interest income because such

risk is centrally managed within the Treasury function. The FTP system credits or charges the segments with the economic

value or cost of the funds the segments create or use. The net FTP credit or charge, which includes intercompany interest

income and expense, is reflected as net intersegment income (expense) in the accompanying tables.

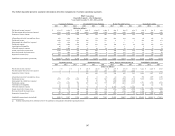

The allocated provision for loan and lease losses is also allocated to the relevant segments based on management’s

assessment of the segments’ credit risks. The allocated provision is designed to achieve a high degree of correlation between

the loan loss experience and the GAAP basis provision at the segment level, while at the same time providing management

with a measure of operating performance that gives appropriate consideration to the risks inherent in each of the Company’s

operating segments. Any over or under allocated provision for loan and lease losses is reflected in Other, Treasury and

Corporate to arrive at consolidated results.

BB&T allocates expenses to the reportable segments based on various methodologies, including volume and amount of loans

and deposits and the number of full-time equivalent employees. Allocation systems are refined from time to time along with

further identification of certain cost pools. These cost pools and refinements are implemented to provide for improved

managerial reporting of cost to the appropriate business segments. A portion of corporate overhead expense is not allocated,

but is retained in corporate accounts and reflected as Other, Treasury and Corporate in the accompanying tables. The majority

of depreciation expense is recorded in support units and allocated to the segments as part of allocated corporate expense.

Income taxes are allocated to the various segments based on taxable income and statutory rates applicable to the segment.