BB&T 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

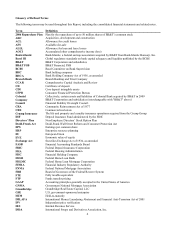

Term Definition

LHFS Loans held for sale

LIBOR London Interbank Offered Rate

LOB Line of business

MBS Mortgage-backed securities

MRLCC Market Risk, Liquidity and Capital Committee

MSR Mortgage servicing right

MSRB Municipal Securities Rulemaking Board

NIM

N

et interest margin

NPA

N

onperforming asse

t

NPL

N

onperforming loan

NPR

N

otice of Proposed Rulemaking

NYSE

N

YSE Euronext, Inc.

OAS Option adjusted spread

OCC Office of the Comptroller of the Currency

OCI Other comprehensive income (loss)

OREO Other real estate owned

OTS Office of Thrift Supervision

OTTI Other-than-temporary impairment

Parent Company BB&T Corporation, the parent company of Branch Bank and other subsidiaries

Patriot Act Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and

Obstruct Terrorism Act of 2001

Peer Group Financial holding companies included in the industry peer group index

Reform Act Federal Deposit Insurance Reform Act of 2005

RMO Risk Management Organization

RSU Restricted stock unit

RUFC Reserve for unfunded lending commitments

S&P Standard & Poor's

SBIC Small Business Investment Company

SCAP Supervisory Capital Assessment Program

SEC Securities and Exchange Commission

Short-Term

Borrowings

Federal funds purchased, securities sold under repurchase agreements and other short-term

borrowed funds with original maturities of less than one year

Simulation Interest sensitivity simulation analysis

TBA To be announced

TDR Troubled debt restructuring

U.S. United States of America

U.S. Treasury United States Department of the Treasury

UPB Unpaid principal balance

VA U.S. Department of Veterans Affairs

VaR Value-at-risk

VIE Variable interest entity

Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, regarding the financial condition, results of operations, business plans and the future

performance of BB&T that are based on the beliefs and assumptions of the management of BB&T and the information

available to management at the time that these disclosures were prepared. Words such as “anticipates,” “believes,”

“estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” “could,” and other similar

expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause

actual results to differ materially from anticipated results. Such factors include, but are not limited to, the following:

general economic or business conditions, either nationally or regionally, may be less favorable than expected,

resulting in, among other things, a deterioration in credit quality and/or a reduced demand for credit, insurance or

other services;