BB&T 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 BB&T annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

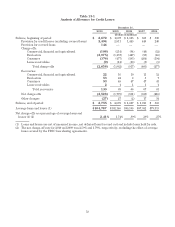

The following tables provide further details regarding BB&T’s commercial real estate lending, residential

mortgage and consumer home equity portfolios as of December 31, 2010.

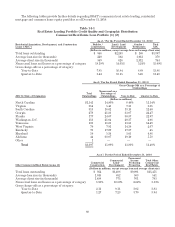

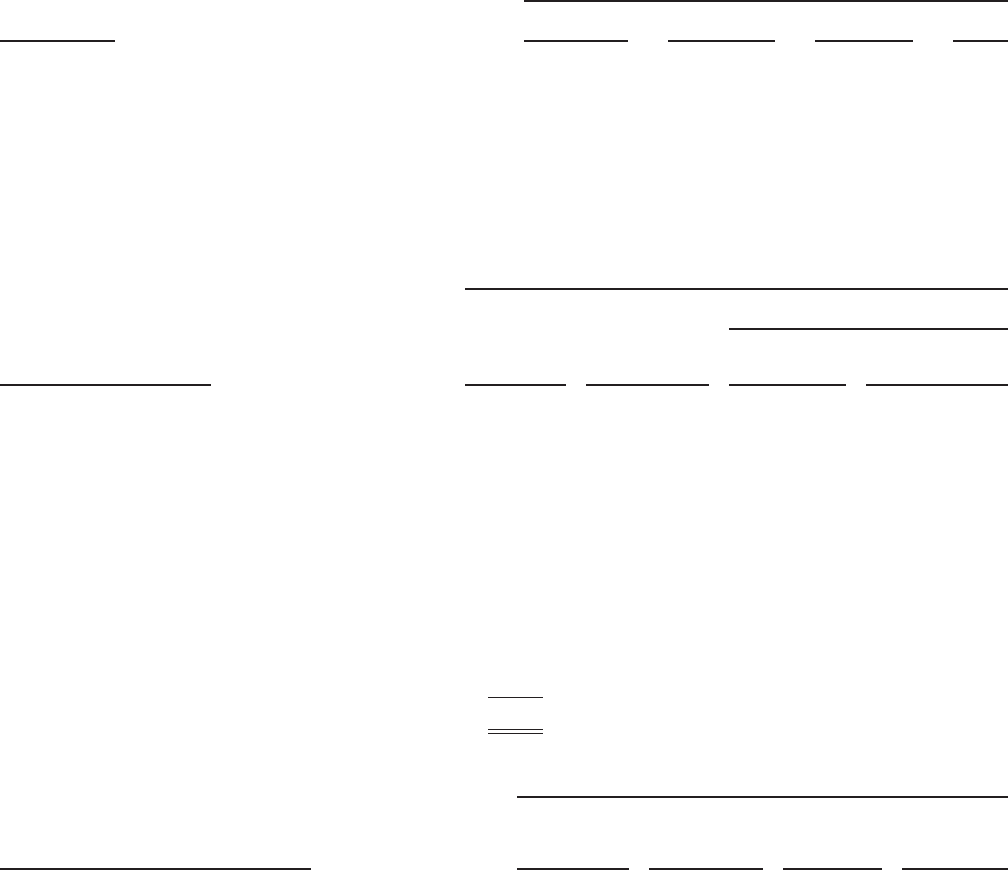

Table 14-1

Real Estate Lending Portfolio Credit Quality and Geographic Distribution

Commercial Real Estate Loan Portfolio (1) (2)

As of / For the Period Ended December 31, 2010

Residential Acquisition, Development, and Construction

Loans (“ADC”) Builder /

Construction Land / Land

Development Condos /

Townhomes Total

ADC

(Dollars in millions, except average loan and average client size)

Total loans outstanding $ 948 $2,263 $ 186 $3,397

Average loan size (in thousands) 220 502 1,012 378

Average client size (in thousands) 549 828 2,312 744

Nonaccrual loans and leases as a percentage of category 18.19% 14.61% 5.24% 15.09%

Gross charge-offs as a percentage of category:

Year-to-Date 7.85 16.84 8.89 13.86

Quarter-to-Date 8.44 13.15 5.25 11.40

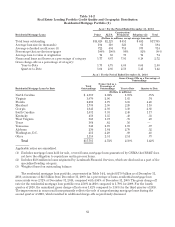

As of / For the Period Ended December 31, 2010

Gross Charge-Offs as a Percentage of

Outstandings

ADC by State of Origination Total

Outstandings

Nonaccrual as a

Percentage of

Outstandings Year-to-Date Quarter-to-Date

(Dollars in millions)

North Carolina $1,541 14.86% 8.40% 11.54%

Virginia 614 5.45 7.35 6.31

South Carolina 315 16.62 13.15 12.40

Georgia 278 21.83 33.07 22.47

Florida 177 24.07 30.57 22.97

Washington, D.C. 113 21.04 20.37 2.06

Tennessee 100 18.60 13.53 14.49

West Virginia 79 7.91 14.39 2.67

Kentucky 76 17.09 17.87 .45

Maryland 59 5.54 3.05 4.86

Alabama 44 68.07 19.10 5.58

Other 1 — — —

Total $3,397 15.09% 13.86% 11.40%

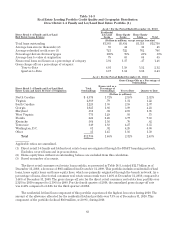

As of / For the Period Ended December 31, 2010

Other Commercial Real Estate Loans (3) Commercial

Construction

Commercial

Land/

Development

Permanent

Income

Producing

Properties

Total Other

Commercial

Real Estate

(Dollars in millions, except average loan and average client size)

Total loans outstanding $ 952 $1,408 $9,091 $11,451

Average loan size (in thousands) 1,018 652 503 541

Average client size (in thousands) 1,488 773 761 793

Nonaccrual loans and leases as a percentage of category 1.98% 10.50% 2.62% 3.53%

Gross charge-offs as a percentage of category:

Year-to-Date 2.11 9.11 3.02 3.83

Quarter-to-Date 1.27 7.23 3.70 3.94

60