Philips 2009 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2009 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

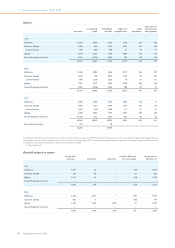

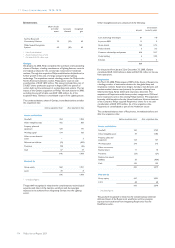

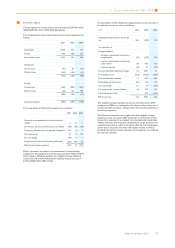

Divestments

inflow of cash

and other

assets1)

net assets

divested

recognized

gain

Set-Top Boxes and

Connectivity Solutions 742) (32) 42

Philips Speech Recognition

Systems 653) (20) 45

1) Net of cash divested

2) Assets received in lieu of cost

3) Of which EUR 22 million cash

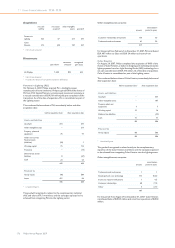

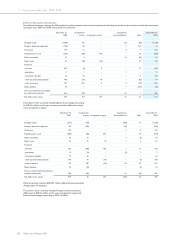

Genlyte

On January 22, 2008, Philips completed the purchase of all outstanding

shares of Genlyte, a leading manufacturer of lighting fixtures, controls

and related products for the commercial, industrial and residential

markets. Through this acquisition Philips established a solid platform for

further growth in the area of energy-saving and green lighting

technology. The acquisition created a leading position for Philips in the

North American luminaires market. Philips paid a total net cash

consideration of EUR 1,894 million. This amount included the cost of

331,627 shares previously acquired in August 2007, the pay-off of

certain debt and the settlement of outstanding stock options. The net

impact of the Genlyte acquisition on Philips’ net cash position in 2008,

excluding the pay-off of debt, was EUR 1,805 million. As of the

acquisition date, Genlyte is consolidated as part of the Lighting sector.

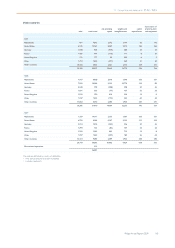

The condensed balance sheet of Genlyte, immediately before and after

the acquisition date:

before acquisition date1) after acquisition date

Assets and liabilities

Goodwill 254 1,024

Other intangible assets 102 860

Property, plant and

equipment 129 191

Working capital 134 160

Other current financial

assets − 3

Deferred tax liabilities (12) (300)

Provisions (18) (36)

Cash 57 57

646 1,959

Financed by

Group equity 568 1,951

Loans 78 8

646 1,959

1) Unaudited figures

The goodwill recognized is related to the complementary technological

expertise and talent of the Genlyte workforce and the synergies

expected to be achieved from integrating Genlyte into the Lighting

sector.

Other intangible assets are comprised of the following:

amount

amortization

period in years

Core technology and designs 81 1-8

In-process R&D 11 5

Group brands 142 2-14

Product brands 5 2-5

Customer relationships and patents 614 9-17

Order backlog 6 0.25

Software 1 3

860

For the period from January 22 to December 31, 2008, Genlyte

contributed EUR 1,024 million to Sales and EUR 34 million to Income

from operations.

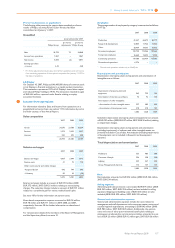

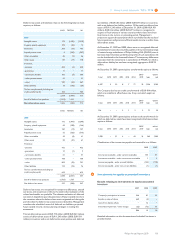

Respironics

On March 10, 2008, Philips acquired 100% of the shares of Respironics,

a leading provider of innovative solutions for the global sleep and

respiratory markets. Respironics designs, develops, manufactures and

markets medical devices used primarily for patients suffering from

Obstructive Sleep Apnea (OSA) and respiratory disorders. The

acquisition of Respironics added new product categories in OSA and

home respiratory care to the existing Philips business. This acquisition

formed a solid foundation for the Home Healthcare Solutions business

of the Company. Philips acquired Respironics’ shares for a net cash

consideration of EUR 3,196 million. As of the acquisition date,

Respironics is consolidated as part of the Healthcare sector.

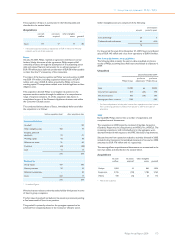

The condensed balance sheet of Respironics, immediately before and

after the acquisition date:

before acquisition date1) after acquisition date

Assets and liabilities

Goodwill 165 2,162

Other intangible assets 39 1,186

Property, plant and

equipment 123 137

Working capital 214 215

Other non-current

financial assets 11 10

Provisions (27) (27)

Deferred tax assets/

liabilities 35 (439)

Cash 135 135

695 3,379

Financed by

Group equity 647 3,331

Loans 48 48

695 3,379

1) Unaudited figures

The goodwill recognized is related to the complementary technical

skills and talent of the Respironics workforce and the synergies

expected to be achieved from integrating Respironics into the

Healthcare sector.

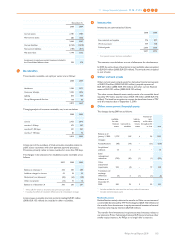

11 Group financial statements 11.12 - 11.12

174 Philips Annual Report 2009