Regions Bank 2010 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2010 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

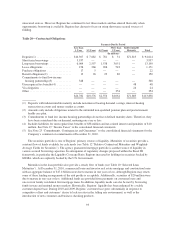

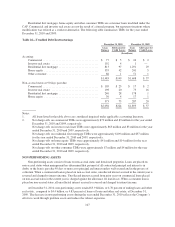

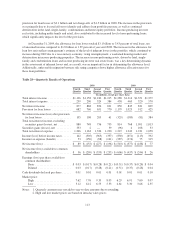

Table 24—Allowance for Credit Losses

2010 2009 2008

(In millions)

Allowance for loan losses at January 1 ........................................ $ 3,114 $ 1,826 $ 1,321

Loans charged-off:

Commercial and industrial .............................................. 429 384 235

Commercial real estate mortgage—owner occupied .......................... 225 89 60

Commercial real estate construction—owner occupied ....................... 25 19 12

Commercial investor real estate mortgage .................................. 879 590 328

Commercial investor real estate construction ............................... 565 488 556

Residential first mortgage .............................................. 240 206 83

Equity .............................................................. 432 442 243

Indirect ............................................................. 34 68 56

Other consumer ...................................................... 83 83 66

2,912 2,369 1,639

Recoveries of loans previously charged-off:

Commercial and industrial .............................................. 33 28 26

Commercial real estate mortgage—owner occupied .......................... 11 6 5

Commercial real estate construction—owner occupied ....................... 1 1 2

Commercial investor real estate mortgage .................................. 14 8 4

Commercial investor real estate construction ............................... 10 4 3

Residential first mortgage .............................................. 2 4 2

Equity .............................................................. 18 27 17

Indirect ............................................................. 15 21 15

Other consumer ...................................................... 16 17 18

120 116 92

Net charge-offs:

Commercial and industrial .............................................. 396 356 209

Commercial real estate mortgage—owner occupied .......................... 214 83 55

Commercial real estate construction—owner occupied ....................... 24 18 10

Commercial investor real estate mortgage .................................. 865 582 324

Commercial investor real estate construction ............................... 555 484 553

Residential first mortgage .............................................. 238 202 81

Equity .............................................................. 414 415 226

Indirect ............................................................. 19 47 41

Other consumer ...................................................... 67 66 48

2,792 2,253 1,547

Allowance allocated to sold loans and loans transferred to loans held for sale — — (5)

Provision for loan losses from continuing operations ............................. 2,863 3,541 2,057

Allowance for loan losses at December 31 ..................................... 3,185 3,114 1,826

Reserve for unfunded credit commitments at January 1 ........................... 74 74 58

Provision for unfunded credit commitments ................................ (3) — 16

Reserve for unfunded credit commitments at December 31 ........................ 71 74 74

Allowance for credit losses ................................................. $ 3,256 $ 3,188 $ 1,900

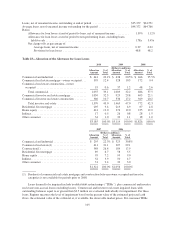

Loans, net of unearned income, outstanding at end of period ....................... $82,864 $90,674 $97,419

Average loans, net of unearned income outstanding for the period .................. $86,660 $94,523 $97,601

Ratios:

Allowance for loan losses at end of period to loans, net of unearned income .... 3.84% 3.43% 1.87%

Allowance for loan losses at end of period to non-performing loans, excluding

loans held for sale ............................................... 1.01x 0.89x 1.74x

Net charge-offs as percentage of:

Average loans, net of unearned income ............................. 3.22 2.38 1.59

Provision for loan losses ........................................ 97.5 63.6 75.2

103