Bank of America 2005 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2005 Bank of America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

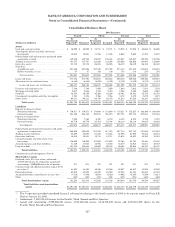

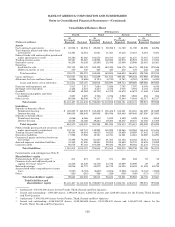

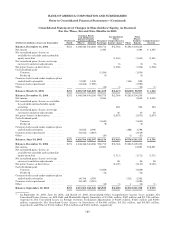

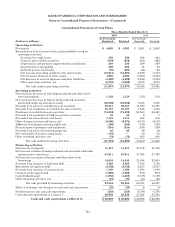

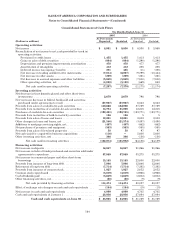

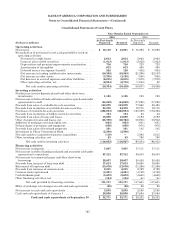

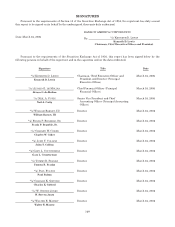

BANK OF AMERICA CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements—(Continued)

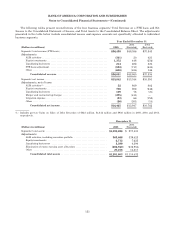

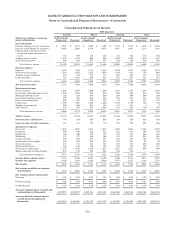

Consolidated Statement of Changes in Shareholders’ Equity, As Restated

For the Three, Six and Nine Months in 2005

Preferred

Stock

Common Stock

and Additional

Paid-in Capital Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)(1) Other

Total

Share-

holders’

Equity Comprehensive

Income(Dollars in millions, shares in thousands) Shares Amount

Balance, December 31, 2004 ............ $271 4,046,546 $ 44,236 $ 58,773 $ (2,764) $ (281) $ 100,235

Netincome ............................. 4,393 4,393 $ 4,393

Net unrealized gains (losses) on

available-for-sale debt and marketable

equity securities ...................... (1,541) (1,541) (1,541)

Net unrealized gains (losses) on foreign

currency translation adjustments ....... (5) (5) (5)

Net gains (losses) on derivatives .......... (1,306) (1,306) (1,306)

Cash dividends paid:

Common............................ (1,830) (1,830)

Preferred ........................... (5) (5)

Common stock issued under employee plans

and related tax benefits ................ 31,987 1,343 (344) 999

Common stock repurchased .............. (43,214) (1,990) (1,990)

Other .................................. (22) (1) (23) (1)

Balance, March 31, 2005 ............... $271 4,035,319 $43,589 $61,309 $(5,617) $(625)$ 98,927 $ 1,540

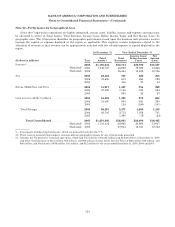

Balance, December 31, 2004 ............ $271 4,046,546 $ 44,236 $ 58,773 $ (2,764) $ (281) $ 100,235

Netincome ............................. 9,050 9,050 $ 9,050

Net unrealized gains (losses) on available-

for-sale debt and marketable equity

securities ............................ 584 584 584

Net unrealized gains (losses) on foreign

currency translation adjustments ....... 30 30 30

Net gains (losses) on derivatives .......... (2,873) (2,873) (2,873)

Cash dividends paid:

Common............................ (3,640) (3,640)

Preferred ........................... (9) (9)

Common stock issued under employee plans

and related tax benefits ................ 53,672 2,090 (292) 1,798

Common stock repurchased .............. (83,514) (3,819) (3,819)

Other .................................. (20) (1) (21)

Balance, June 30, 2005 ................. $271 4,016,704 $42,507 $64,154 $(5,023) $(574)$101,335 $ 6,791

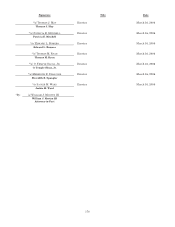

Balance, December 31, 2004 ............ $271 4,046,546 $ 44,236 $ 58,773 $ (2,764) $ (281) $ 100,235

Netincome ............................. 12,891 12,891 $12,891

Net unrealized gains (losses) on

available-for-sale debt and marketable

equity securities ...................... (1,711) (1,711) (1,711)

Net unrealized gains (losses) on foreign

currency translation adjustments ....... 26 26 26

Net gains (losses) on derivatives .......... (2,130) (2,130) (2,130)

Cash dividends paid:

Common............................ (5,658) (5,658)

Preferred ........................... (14) (14)

Common stock issued under employee plans

and related tax benefits ................ 60,704 2,593 (211) 2,382

Common stock repurchased .............. (94,187) (4,281) (4,281)

Other .................................. (12) (1) 1 (12) (1)

Balance, September 30, 2005 ........... $271 4,013,063 $42,548 $65,980 $(6,580) $(491) $101,728 $ 9,075

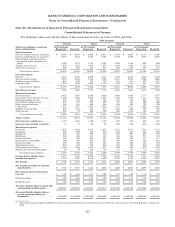

(1) At September 30, 2005, June 30, 2005, and March 31, 2005, Accumulated Other Comprehensive Income (Loss) includes Net

Unrealized Gains (Losses) on AFS Debt and Marketable Equity Securities of $(1,908) million, $387 million and $(1,738) million,

respectively; Net Unrealized Losses on Foreign Currency Translation Adjustments of $(129) million, $(125) million and $(160)

million, respectively; Net Unrealized Gains (Losses) on Derivatives of $(4,409) million, $(5,152) million, and $(3,585) million,

respectively; and Other of $(134) million, $(134) million and $(134) million, respectively.

160