Philips 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

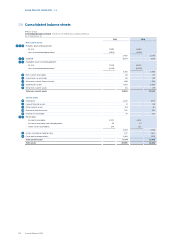

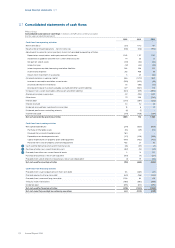

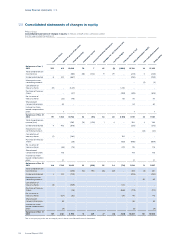

1Group nancial statements 12.9

Annual Report 2014 115

12.9 Notes

Separation - HealthTech and Lighting Solutions

In September 2014 Philips announced its plan to

sharpen its strategic focus by establishing two stand-

alone companies focused on the HealthTech and

Lighting Solutions opportunities.

To achieve this transformation, from January 1, 2015,

Philips started to integrate the sectors Consumer

Lifestyle and Healthcare into one operating company

focused on our HealthTech businesses. At the same

time Philips is taking the next step in the

implementation of its new operating model which will

give the company a dedicated, focused and lean

management structure, as a result of the planned

integration of the relevant sector and group layers.

The establishment of the two stand-alone companies

will also involve the split and allocation of the current

Innovation, Group & Services sector to each company

in 2015. This means that in the course of 2015 the IG&S

sector as currently described in these nancial

statements will disappear and no longer be presented

as a separate segment for reporting purposes.

Philips also started the process to carve out its Lighting

business into a separate legal structure and will

consider various options for ownership structures with

direct access to capital markets. The proposed

separation of the Lighting business impacts all

businesses and markets as well as all supporting

functions and all assets and liabilities of the Group and

may require complex and time consuming

disentanglement eorts.

Prior-period restatements

Prior-period nancial statements have been restated

for the treatment of the combined businesses of

Lumileds and Automotive as discontinued operations

(see note 3, Discontinued operations and other assets

classied as held for sale) and for two voluntary

accounting policy changes (see note 1, Signicant

accounting policies). Movement schedules of balance

sheet items include items from continuing and

discontinued operations and therefore cannot be

reconciled to income from continuing operations and

cash ow from continuing operations only.

Notes to the Consolidated nancial statements

of the Philips Group

1Signicant accounting policies

The Consolidated nancial statements in the Group

nancial statements section have been prepared in

accordance with International Financial Reporting

Standards (IFRS) as endorsed by the European Union

(EU) and with the statutory provisions of Part 9, Book 2

of the Dutch Civil Code. All standards and

interpretations issued by the International Accounting

Standards Board (IASB) and the IFRS Interpretations

Committee eective year-end 2014 have been

endorsed by the EU, except that the EU did not adopt

some of the paragraphs of IAS 39 applicable to certain

hedge transactions. Koninklijke Philips N.V. (hereafter:

the ‘Company’ or ‘Philips’) has no hedge transactions to

which these paragraphs are applicable. Consequently,

the accounting policies applied by Philips also comply

with IFRS as issued by the IASB. These accounting

policies have been applied by group entities.

The Consolidated nancial statements have been

prepared under the historical cost convention, unless

otherwise indicated. The Consolidated nancial

statements are presented in euros, which is the

Company’s presentation currency.

On February 24, 2015, the Board of Management authorized

the Consolidated financial statements for issue. The

Consolidated financial statements as presented in this report

are subject to adoption by the Annual General Meeting of

Shareholders, to be held on May 7, 2015.

Use of estimates

The preparation of the Consolidated financial statements in

conformity with IFRS requires management to make

judgments, estimates and assumptions that affect the

application of accounting policies and the reported amounts

of assets, liabilities, income and expenses. These estimates

inherently contain a degree of uncertainty. Actual results may

differ from these estimates under different assumptions or

conditions.

These estimates and assumptions affect the reported

amounts of assets and liabilities, the disclosure of contingent

liabilities at the date of the Consolidated financial

statements, and the reported amounts of revenues and

expenses during the reporting period. We evaluate these

estimates and judgments on an ongoing basis and base our

estimates on historical experience, current and expected

future outcomes, third-party evaluations and various other

assumptions that we believe are reasonable under the

circumstances. The results of these estimates form the basis

for making judgments about the carrying values of assets and

liabilities as well as identifying and assessing the accounting

treatment with respect to commitments and contingencies.

We revise material estimates if changes occur in the

circumstances or there is new information or experience on

which an estimate was or can be based.

The areas where the most signicant judgments and

estimates are made are goodwill and other intangibles

acquired, deferred tax asset recoverability, impairments,

nancial instruments, the accounting for an arrangement

containing a lease, revenue recognition (multiple element

arrangements), assets and liabilities from employee

benet plans, other provisions, uncertain tax positions and

other contingencies, classication of assets and liabilities

held for sale and the presentation of items of prot and

loss and cash ows as continued or discontinued, as well

as when determining the fair values of acquired

identiable intangible assets based on an assessment of

future cash ows.