Philips 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

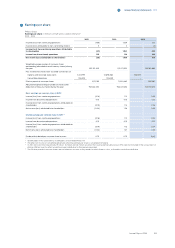

Group nancial statements 12.9 4

130 Annual Report 2014

assets held for sale amounted to EUR 423 million at

moment of disposal (December 31, 2013: EUR 348

million) in the Consolidated balance sheets.

Discontinued operations: Other

Certain results of other divestments including the

Television business formerly reported as discontinued

operations are included with a net gain of EUR 31 million

in 2014 (2013: a net loss of EUR 1 million; 2012: a net loss

of EUR 31 million).

Other assets classied as held for sale

On July 1, 2013, Philips announced to transfer certain

assets and cash proceeds from the sale of certain assets

to the Dutch pension plan. In total EUR 38 million of

related assets are classied as held for sale as of

December 31, 2014 (December 31, 2013: EUR 94 million).

For more details see note 20, Post-employment

benets.

Assets and liabilities directly associated with assets

held for sale relate to property, plant and equipment for

an amount of EUR 23 million (December 31, 2013: EUR

13 million) and businesses classied as held for sale

amounted to EUR 19 million at December 31, 2014

(December 31, 2013 EUR nil million).

In 2014, property, plant and equipment divested assets

classied as held for sale amounted to EUR 17 million

with proceeds of EUR 19 million. Other non-current

nancial assets divested assets classied as held for

sale amounted to EUR 76 million with proceeds of EUR

76 million. Businesses divested assets classied as held

for sale amounted to EUR 49 million and liabilities

directly associated with the assets held for sale

amounted to EUR 3 million. The businesses divested

had proceeds of EUR 45million.

4Acquisitions and divestments

2014

Acquisitions

Philips completed three acquisitions in 2014. These

acquisitions involved an aggregated purchase price of

EUR 171 million.

One of the acquisitions in 2014, was General Lighting

Company (GLC), domiciled in The Kingdom of Saudi

Arabia (KSA). This acquisition enables Philips to grow

its business in KSA, the largest economy in the Middle

East by GDP, particularly in LED lighting.

On September 2, 2014, the Company acquired 51% of

GLC from a consortium of shareholders for a total

amount of EUR 146 million (on a cash-free, debt-free

basis). Taking into account closing conditions, Philips

paid an amount of EUR 148 million. The overall cash

position of GLC on the transaction date was EUR 23

million resulting in a net cash outow related to this

acquisition of EUR 125 million. Acquisition related costs

that were recognized in General and administrative

expenses amounted to EUR 4 million.

Subsequent to the acquisition, Philips’ existing Lighting

activities in KSA were combined with GLC. This

combined entity was renamed Philips Lighting Saudi

Arabia.

Alliance Holding Ltd. is the company that holds a 49%

non-controlling interest in Philips Lighting Saudi

Arabia.

As of September 2, 2014, Philips Lighting Saudi Arabia

is consolidated as part of the Professional Lighting

Solutions business within the Lighting sector. The

condensed balance sheet of GLC, immediately before

and after the acquisition is as follows:

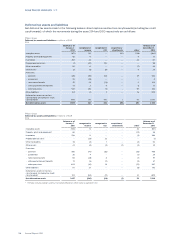

GLC

Balance sheet in millions of EUR

2014

before

acquisition

date

after

acquisition

date

Goodwill 58

Other intangible assets 158

Property, plant and equipment 18 18

Working capital 112 122

Provisions (15) (56)

Cash 23 23

Total assets and liabilities 138 323

Group equity 47 146

Non-controlling interests – 86

Loans 91 91

Financed by 138 323

The fair value of assets and liabilities after the

acquisition is provisional pending a nal assessment in

the course of 2015.

The goodwill is primarily related to the synergies

expected to be achieved from integrating GLC in the

Lighting sector. The goodwill is not tax deductible.

Other intangible assets are comprised of the following:

GLC

Other intangible assets in millions of EUR

2014

amount

amortization

period in years

Order backlog 17 0.2

Brand name 57 20

Customer relationships 84 10

Total other intangible assets 158

For the period from September 2, 2014, Philips Lighting

Saudi Arabia contributed sales of EUR 86 million and

loss from operations of EUR 19 million mainly due to

amortization of other intangible assets.