Philips 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

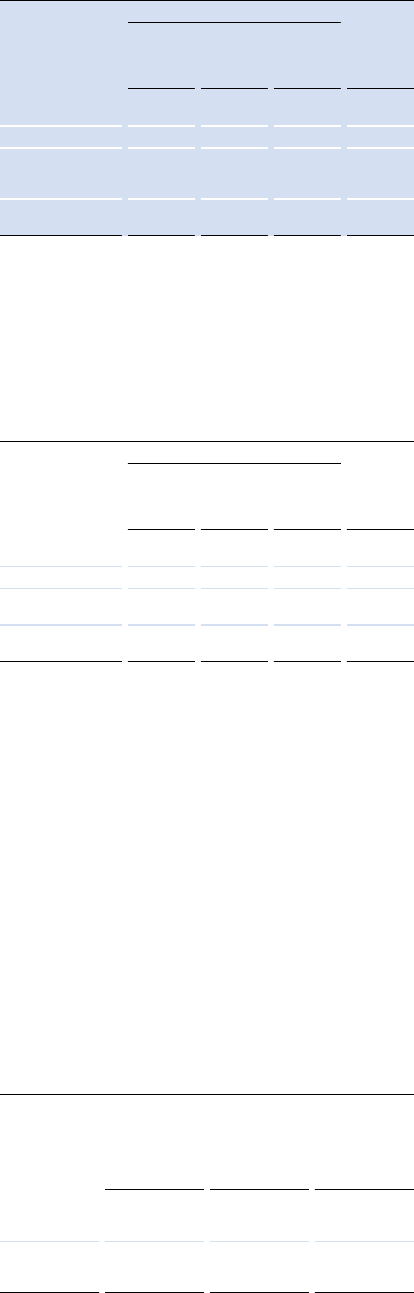

Group nancial statements 12.9

142 Annual Report 2014

Philips Group

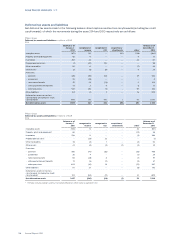

Key assumptions in %

2014

compound sales growth rate1)

initial

forecast

period

extra-

polation

period2)

used to

calculate

terminal

value

pre-tax

discount

rates

Respiratory Care &

Sleep Management 4.2 3.6 2.7 11.4

Imaging Systems 3.3 3.1 2.7 12.8

Patient Care &

Monitoring

Solutions 4.9 3.8 2.7 12.8

Professional

Lighting Solutions 10.1 6.5 2.7 13.8

1) Compound sales growth rate is the annualized steady growth rate over

the forecast period

2) Also referred to later in the text as compound long-term sales growth

rate

The assumptions used for the 2013 cash ow

projections were as follows:

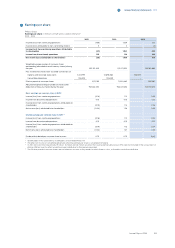

Philips Group

Key assumptions in %

2013

compound sales growth rate1)

initial

forecast

period

extra-

polation

period2)

used to

calculate

terminal

value

pre-tax

discount

rates

Respiratory Care &

Sleep Management 4.9 3.7 2.7 11.3

Imaging Systems 3.9 3.4 2.7 12.4

Patient Care &

Clinical Informatics 4.1 3.5 2.7 13.2

Professional

Lighting Solutions 7.4 5.4 2.7 12.8

1) Compound sales growth rate is the annualized steady growth rate over

the forecast period

2) Also referred to later in the text as compound long-term sales growth

rate

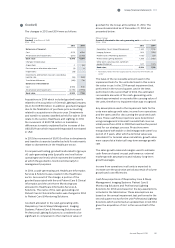

Among the mentioned units, Respiratory Care & Sleep

Management and Professional Lighting Solutions have

the highest amount of goodwill and the lowest excess

of the recoverable amount over the carrying amount.

Based on the annual impairment test performed in the

second quarter, the headroom of Respiratory Care &

Sleep Management was estimated at EUR 820 million.

Based on the updated test performed in Q4, the

headroom of Professional Lighting Solutions was

estimated at EUR 1,000 million. The following changes

could, individually, cause the value in use to fall to the

level of the carrying value:

Philips Group

Sensitivity analysis

increase in

pre-tax

discount rate,

basis points

decrease in

compound

long-term

sales growth

rate, basis

points

decrease in

terminal value

amount, %

Respiratory

Care & Sleep

Management 380 680 49

Professional

Lighting

Solutions 400 1,030 47

The results of the annual impairment test of Imaging

Systems and Patient Care & Monitoring Solutions have

indicated that a reasonably possible change in key

assumptions would not cause the value in use to fall to

the level of the carrying value.

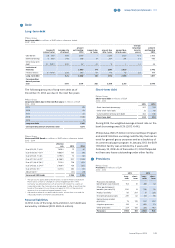

Impairment charge 2013

In the fourth quarter of 2013, the updated impairment

test for Consumer Luminaires resulted in EUR 26 million

impairment. This was mainly a consequence of reduced

growth rate due to slower anticipated recovery of

certain markets and introduction delays of new product

ranges. The pre-tax discount rate applied in the

mentioned Q4 2013 test was 13.5%. The pre-tax

discount rate applied in the 2013 annual impairment

test was 13.4%. Compared to the previous impairment

test there has been no change in the organization

structure which impacts how goodwill is allocated to

this cash-generating unit.

Additional information 2014

In addition to the units with signicant goodwill, other

cash-generating units are sensitive to uctuations in

the assumptions as set out above.

Based on the most recent impairment test, it was noted

that the headroom for the cash-generating unit Home

Monitoring was EUR 30 million. An increase of 150

points in the pre-tax discount rate, a 310 basis points

decline in the compound long-term sales growth rate

or a 21% decrease in terminal value would cause its

value in use to fall to the level of its carrying value. The

goodwill allocated to Home Monitoring at December 31,

2014 amounts to EUR 34 million.

Based on the most recent impairment test, it was noted

that with regard to the headroom for the cash-

generating unit Consumer Luminaires the estimated

recoverable amount approximates the carrying value of

this cash-generating unit. Consequently, any adverse

change in key assumptions would, individually, cause

an impairment loss to be recognized. The goodwill

allocated to Consumer Luminaires at December 31,

2014 amounts to EUR 112 million.

Please refer to note 2, Information by sector and main

country for a specication of goodwill by sector.