Philips 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3Group nancial statements 12.9

Annual Report 2014 129

3Discontinued operations and other assets

classied as held for sale

Discontinued operations included in the Consolidated

statements of income and the Consolidated statements

of cash ows consist of the combined Lumileds and

Automotive businesses, the Audio, Video, Multimedia

and Accessories (AVM&A) business and certain other

divestments reported as discontinued operations.

Discontinued operations: Combined Lumileds and

Automotive businesses

Philips announced in a press release on June 30, 2014,

that it will start the process to combine its Lumileds

(LED components) and Automotive businesses into a

stand-alone company within the Philips Group and that

it will explore strategic options to attract capital from

third-party investors for this business.

The company is in discussion with external investors for

the combined Lumileds and Automotive Lighting

businesses and expects to complete a transaction in

the rst half of 2015.

The combined businesses of Lumileds and Automotive

were reported as discontinued operations in the

Consolidated statements of income and Consolidated

statements of cash ows with the related assets and

liabilities as per the end of November 2014 included as

Assets classied as held for sale and Liabilities directly

associated with assets held for sale in the Consolidated

balance sheet.

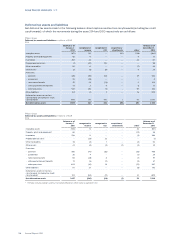

The following table summarizes the results of the

combined businesses of Lumileds and Automotive

included in the Consolidated statements of income as

discontinued operations.

Philips Group

Results of combined Lumileds and Automotive Lighting

businesses in millions of EUR

2012 - 2014

2012 2013 2014

Sales 1,139 1,268 1,416

Costs and expenses (1,083) (1,134) (1,202)

Income before taxes 56 134 214

Income taxes 33 (1) (73)

Results from discontinued

operations 89 133 141

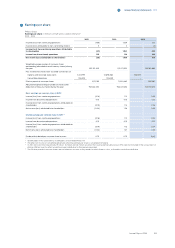

Upon disposal, the associated currency translation

dierences, part of Shareholders’ equity, will be

recognized in the Consolidated statement of income. At

December 31, 2014, the estimated release amounts to a

EUR 24 million gain.

The following table presents the assets and liabilities of

the combined Lumileds and Automotive business, as

Assets classied as held for sale and Liabilities directly

associated with assets classied as held for sale in the

Consolidated balance sheet as of 2014.

Philips Group

Assets and liabilities of combined Lumileds and Automotive

Lighting businesses in millions of EUR

2014

2014

Property, plant and equipment 666

Intangible assets including goodwill 295

Inventories 248

Accounts receivable 278

Other assets 14

Assets classied as held for sale 1,501

Accounts payable (134)

Provisions (34)

Other liabilities (149)

Liabilities directly associated with assets held for

sale (317)

Non-transferrable balance sheet positions, such as

certain accounts receivable, accounts payable, accrued

liabilities and provisions are reported on the respective

balance sheet captions.

Discontinued operations: Audio, Video, Multimedia

and Accessories business

As announced on April 28, 2014, the AVM&A business

was divested to Gibson Brands, Inc. The transfer was

eected on June 29, 2014 and in December 2014 a nal

settlement closed the deal.

The following table summarizes the results of the

AVM&A business included in the Consolidated

statements of income as Discontinued operations.

Philips Group

Results of Audio, Video, Multimedia and Accessories business

in millions of EUR

2012 - 2014

2012 2013 2014

Sales 1,414 1,189 469

Costs and expenses (1,295) (1,180) (473)

Gain on sale of business – – 10

Income before taxes 119 9 6

Income taxes (38) (3) 12

Investments in associates (3)

Results from discontinued

operations 78 6 18

The following table shows the components of the gain

on the sale of the AVM&A business.

Philips Group

Gain on the sale of the Audio, Video, Multimedia and Accessories

business in millions of EUR

2014

2014

Consideration 74

Carrying value of net assets disposed (61)

Cost of disposal (3)

Gain on sale of business 10

Income taxes 12

Net gain on sale of business 22

Assets classied as held for sale amounted to EUR 484

million at moment of disposal (December 31, 2013: EUR

400 million). Liabilities directly associated with the