Philips 2014 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company nancial statements 13.5

Annual Report 2014 183

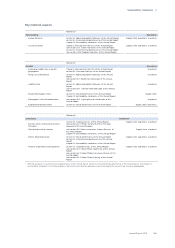

13.5 Independent auditor’s report

To: The Annual General Meeting of Shareholders of

Koninklijke Philips N.V.

Report on the audit of the nancial statements

2014

Our opinion

We have audited the nancial statements 2014 of

Koninklijke Philips N.V. (the Company), Eindhoven, the

Netherlands. The nancial statements include the

consolidated and company nancial statements.

In our opinion:

•the consolidated nancial statements give a true and

fair view of the nancial position of Koninklijke Philips

N.V. as at December 31, 2014 and of its result and its

cash ows for 2014 in accordance with International

Financial Reporting Standards as adopted by the

European Union (EU-IFRS) and with Part 9 of Book 2

of the Dutch Civil Code.

•

The company financial statements give a true and fair view

of the financial position of Koninklijke Philips N.V. as at

December 31, 2014 and of its result for 2014 in accordance

with Part 9 of Book 2 of the Dutch Civil Code.

The consolidated nancial statements comprise:

1. the consolidated balance sheet as at December 31,

2014;

2. the following statements for 2014: consolidated

statements of income, comprehensive income,

cash ows and changes in equity for the year then

ended; and

3. the notes comprising a summary of the signicant

accounting policies and other explanatory

information.

The company nancial statements comprise:

1. the company balance sheet as at December 31,

2014;

2. the company statement of income for 2014; and

3.

the notes comprising a summary of the significant

accounting policies and other explanatory information.

Basis for our opinion

We conducted our audit in accordance with Dutch law,

including the Dutch Standards on Auditing. Our

responsibilities under those standards are further

described in the “Our responsibilities for the audit of the

nancial statements” section of our report.

We are independent of Koninklijke Philips N.V. in

accordance with the “Verordening inzake de

onafhankelijkheid van accountants bij assurance-

opdrachten” (ViO) and other relevant independence

regulations in the Netherlands. Furthermore, we have

complied with the “Verordening gedrags- en

beroepsregels accountants” (VGBA).

We believe that the audit evidence we have obtained is

sufficient and appropriate to provide a basis for our

opinion.

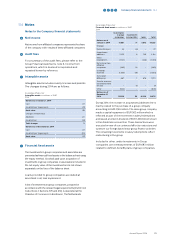

Materiality

Misstatements can arise from fraud or errors and are

considered material if, individually or in the aggregate,

they could reasonably be expected to influence the

economic decisions of users taken on the basis of these

financial statements. The materiality affects the nature,

timing and extent of our audit procedures and the

evaluation of the effect of identified misstatements on our

opinion.

Based on our professional judgment we determined the

materiality for the nancial statements as a whole at

EUR 80 million. Materiality is based on sales, as we

consider this benchmark to be the most relevant given

the nature of the business and size of the Company and

approximates 0.4% of sales. We have also taken into

account misstatements and/or possible misstatements

that in our opinion are material for qualitative reasons

for the users of the nancial statements.

We agreed with the Supervisory Board that

misstatements in excess of EUR 4 million, which are

identied during the audit, would be reported to them,

as well as smaller misstatements that in our view must

be reported on qualitative grounds.

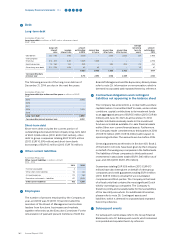

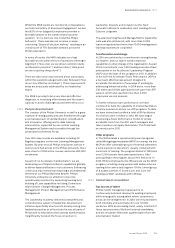

Scope of our group audit

Koninklijke Philips N.V. is the parent company of the

Philips Group (the Group). The nancial information of

the Group is included in the nancial statements of

Koninklijke Philips N.V

Considering our ultimate responsibility for the opinion,

we are responsible for directing, supervising and

performing the group audit. In this context, we have

determined the nature and extent of the audit

procedures to be performed for group entities

(components). Decisive factors were the signicance

and / or the risk prole of the components. On this basis,

we selected the components for which an audit of

account balance or specied procedures had to be

performed. Furthermore, we have determined the audit

procedures that we perform at group level, sector level

and in the Finance Operations centers.

We scope components to be involved with the audits of

account balances into the group audit where account

balances are of signicant size, have signicant risks of

material misstatement to the Group associated with

them or are considered signicant for other reasons.

Where this does not give adequate coverage we use our

judgment to scope-in additional procedures on

account balances or request the component auditors to

perform specied procedures. As a result of our scoping

of account balances and the performance of audit

procedures at dierent levels in the organization, our