Philips 2014 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company nancial statements 13.5

186 Annual Report 2014

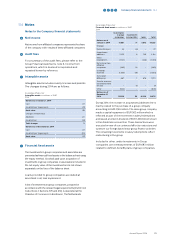

The accounting for (contingent) liabilities from claims,

proceedings and investigations is complex and

judgemental, and the amounts involved are, or can be

material to the nancial statements as a whole. At

December 31, 2014, the provisions from legal

proceedings amount to EUR 653 million, in case the

company has a present legal or constructive obligation

that cannot be estimated reliably, no provisions have

been recognized.

In response to these risks, our audit procedures

included, amongst others, testing the eectiveness of

the Company’s controls around the identication and

evaluation of claims, proceedings and investigations at

dierent levels in the organization, and the recording

and continuous re-assessment of the related

(contingent) liabilities and provisions and disclosures,

in accordance with EU-IFRS. We also inquired with both

legal and nancial sta in respect of ongoing

investigations or claims, proceedings and

investigations, inspected relevant correspondence,

inspected the minutes of the meetings of the Audit

Committee, Supervisory Board and Executive

Committee, requested external legal conrmation

letters from a selection of external legal counsel and

obtained a legal representation letter from the

Company.

We evaluated and tested the Company’s policies,

procedures and controls surrounding the application of

the General Business Principles (GBP), the

identication and reporting of violations and assessed

management’s response to any GBP violations. We also

assessed the disclosure regarding (contingent)

liabilities from legal proceedings and investigations as

contained in Section 12.9, Note 19 Provisions, Note 22

Other Liabilities and Note 26 Contingent assets and

liabilities.

Responsibilities of the Board of Management and

the Supervisory Board for the nancial statements

The Board of Management is responsible for the

preparation and fair presentation of the nancial

statements in accordance with EU-IFRS and Part 9 of

Book 2 of the Dutch Civil Code, and for the preparation

of the Management report in accordance with Part 9 of

Book 2 of the Dutch Civil Code. Furthermore, the Board

of Management is responsible for such internal control

as the Board of Management determines is necessary

to enable the preparation of the nancial statements

that are free from material misstatement, whether due

to fraud or error.

In preparing the nancial statements, the Board of

Management is responsible for assessing the

Company’s ability to continue as a going concern.

Based on the nancial reporting frameworks

mentioned, the Board of Management should prepare

the nancial statements using the going concern basis

of accounting unless the Board of Management either

intends to liquidate the Company or to cease

operations, or has no realistic alternative but to do so.

The Board of Management should disclose events and

circumstances that may cast signicant doubt on the

Company’s ability to continue as a going concern in the

nancial statements.

The Supervisory Board is responsible for overseeing the

Company’s nancial reporting process.

Our responsibilities for the audit of the nancial

statements

Our objective is to plan and perform the audit assignment in

a manner that allows us to obtain sufficient and appropriate

audit evidence for our opinion.

Our audit has been performed with a high, but not

absolute, level of assurance, which means we may have

not detected all errors and fraud.

For a further description of our responsibilities in

respect of an audit of nancial statements in general,

we refer to the website of the professional body for

accountants in the Netherlands (NBA).

www.nba.nl/standardtexts-auditorsreport.

Report on other legal and regulatory requirements

Report on the Management report and the other

information

Pursuant to legal requirements under Part 9 of Book 2

of the Dutch Civil Code (concerning our obligation to

report about the Management report and other

information):

•

We have no deficiencies to report as a result of our

examination whether the Management report, to the

extent we can assess, has been prepared in accordance

with Part 9 of Book 2 of the Dutch Civil Code, and whether

the information as required by Part 9 of Book 2 of the

Dutch Civil Code has been annexed.

•

We report that the Management report, to the extent we

can assess, is consistent with the financial statements.

Appointment

We were appointed before 2008 for the rst time as

auditor of Koninklijke Philips N.V. and operated as

auditor since then. We were re-appointed by the

Annual General Meeting of Shareholders as auditor of

Koninklijke Philips N.V. on March 31, 2011, for the three

year period 2012 – 2014. On May 1, 2014, we were

appointed by the Annual General Meeting of

Shareholders as auditor of Koninklijke Philips N.V. for

the year 2015, after which we will mandatorily rotate o

from the Philips audit pursuant to Dutch law.

Amsterdam, The Netherlands

February 24, 2015

KPMG Accountants N.V.

E.H.W. Weusten RA