Philips 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sector performance 6.2.3

Annual Report 2014 53

6.2.3 2014 highlights

• Empowering consumers to take control of their own

health with digital solutions for healthy living and

disease prevention, Philips launched its latest

connected devices and apps at IFA in Berlin.

Highlights included a smart air purier, an app to

manage treatment of chronic pain and an oral

healthcare app to help kids brush their teeth more

eectively.

• Continuing the geographical expansion of Philips

product innovations, the Philips Airfryer is now

available in more than 100 countries. Philips is a

leader in the world’s low-fat fryer market.

• The success of established propositions like the

Philips Sonicare DiamondClean and the Philips

Sonicare AirFloss, along with new introductions like

Philips Sonicare for Kids, drove continued growth

across the world, in particular in China, Japan,

Germany and North America.

• Delivering on its male grooming growth strategy to

drive loyalty and create more value among existing

users, Philips launched the Philips Shaver Series

9000, our most advanced shaver yet, in 47 countries

around the world.

• Award-winning designs and advanced technology

further strengthened Philips’ leadership position in

the Chinese air purication market, with consumers

responding to innovations such as the Vitashield

Intelligent Purication System, which removes indoor

contaminants that can impact health and well-being.

• Professional endorsement and channel expansion

are core to the growth momentum of Philips’ Mother

and Childcare business (Avent). In Germany,

distribution was further extended in the drugstore

channel, with professional endorsement a key trigger

for consumers. In China, distribution was expanded

to more cities, with a continued focus to make Philips

Avent the brand that is most recommended by

mothers.

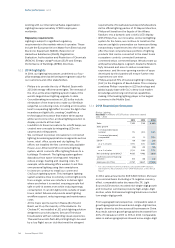

6.2.4 2014 nancial performance

Philips Consumer Lifestyle

Key data in millions of EUR unless otherwise stated

2012 - 2014

2012 2013 2014

Sales 4,319 4,605 4,731

Sales growth

% increase (decrease), nominal 15% 7% 3%

% increase (decrease),

comparable1) 9% 10% 6%

EBITA 1) 456 483 573

as a % of sales 10.6% 10.5% 12.1%

EBIT 400 429 520

as a % of sales 9.3% 9.3% 11.0%

Net operating capital (NOC)1) 1,205 1,261 1,353

Cash ows before nancing

activities1) 413 480 553

Employees (in FTEs) 16,542 17,255 16,639

1) For a reconciliation to the most directly comparable GAAP measures,

see chapter 15, Reconciliation of non-GAAP information, of this Annual

Report

Sales amounted to EUR 4,731 million, a nominal

increase of 3% compared to 2013. Excluding a 3%

negative currency impact, comparable sales were 6%

higher year-on-year. Health & Wellness achieved

double-digit-growth and Domestic Appliances

recorded high-single-digit growth, while Personal Care

recorded low-single-digit growth. Green Product sales

amounted to EUR 2,605 million, or 55% of total sector

sales.

From a geographical perspective, comparable sales

showed an 8% increase in growth geographies and 3%

growth in mature geographies. In growth geographies,

increase was mainly driven by China and Middle East &

Turkey, primarily in the Health & Wellness and Domestic

Appliances businesses. Growth geographies’ share of

sector sales was in line with 2013 at 47%.

EBITA increased from EUR 483 million, or 10.5% of sales,

in 2013 to EUR 573 million, or 12.1% of sales, in 2014.

Restructuring and acquisition-related charges

amounted to EUR 9 million in 2014, compared to EUR

14 million in 2013. EBITA in 2013 also included a EUR 1

million past-service pension cost gain in the US. The

year-on-year EBITA increase was driven by improved

earnings in all businesses and more than oset currency

headwinds.

EBIT amounted to EUR 520 million, or 11.0% of sales,

which included EUR 53 million of amortization charges,

mainly related to intangible assets at Health & Wellness

and Domestic Appliances.

Net operating capital increased from EUR 1,261 million

in 2013 to EUR 1,353 million in 2014, due to higher

working capital and a reduction in provisions.

Cash ows before nancing activities increased from

EUR 480 million in 2013 to EUR 553 million in 2014,

mainly attributable to higher earnings.

Philips Consumer Lifestyle

Sales per geographic cluster in millions of EUR

2010 - 2014

1,273

560

193

1,290

3,316

‘10

1,323

688

228

1,532

3,771

‘11

1,325

768

272

1,954

4,319

‘12

1,350

769

299

2,187

4,605

‘13

1,403 Western Europe

781 North America

324 Other mature

2,223 Growth

4,731

‘14