Philips 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Supervisory Board report 10.2.1

84 Annual Report 2014

benchmarked regularly against companies in the

general industry and aims at the median market

position.

One of the goals behind the policy is to focus on

improving the performance of the company and to

enhance the value of the Philips Group. Consequently,

the remuneration package includes a variable part in

the form of an annual cash incentive and a long-term

incentive consisting of performance shares. The policy

does not encourage inappropriate risk-taking.

The performance targets for the members of the Board

of Management are determined annually at the

beginning of the year. The Supervisory Board

determines whether performance conditions have

been met and can adjust the payout of the annual cash

incentive and the long-term incentive grant upward or

downward if the predetermined performance criteria

were to produce an inappropriate result in

extraordinary circumstances. The authority for such

adjustments exists on the basis of contractual ultimum-

remedium and claw-back clauses. In addition, pursuant

to Dutch legislation eective January 1, 2014, incentives

may, under certain circumstances, be amended or

clawed back pursuant to statutory powers. For more

information please refer to chapter 11, Corporate

governance, of this Annual Report. Further information

on the performance targets is given in the chapters on

the Annual Incentive (see sub-section 10.2.6, Annual

Incentive, of this Annual Report) and the Long-Term

Incentive Plan (see sub-section 10.2.7, Long-Term

Incentive Plan, of this Annual Report) respectively.

Key features of our Executive Committee

Compensation Program

The list below highlights Philips’ approach to

remuneration, in particular taking into account

Corporate Governance practices in the Netherlands.

What we do

• We pay for performance

• We conduct scenario analyses

• We have robust stock ownership guidelines

• We have claw-back policies incorporated into our

incentive plans

• We have a simple and transparent remuneration

structure in place

What we do not do

•We do not pay dividend equivalents on stock options

and unvested restricted share or performance share

units

• We do not oer executive contracts with longer than

12 months’ separation payments

• We do not have a remuneration policy in place that

encourages our Board of Management to take any

inappropriate risks or to act in their own interests

• We do not reward failing members of the Board of

Management upon termination of employment

•We do not grant loans or give guarantees to the Board

of Management

10.2.2 Contracts

Below, the main elements of the contracts of the

members of the Board of Management are included.

These contracts expire at the end of the Annual General

Meeting on May 7, 2015. Please refer to sub-section

10.2.11, Year 2015, of this Annual Report at the end of this

section.

Term of appointment

The members of the Board of Management are

appointed for a period of 4 years it being understood

that this period expires no later than at the end of the

following general meeting of shareholders (AGM) held

in the fourth year after the year of appointment.

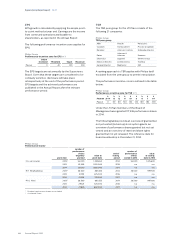

Philips Group

Contract terms for current members

end of term

F.A. van Houten AGM 2015

R.H. Wirahadiraksa AGM 2015

P.A.J. Nota AGM 2015

Notice period

Termination of the contract by a member of the Board

of Management is subject to three months’ notice. A

notice period of six months will be applicable in the

case of termination by the Company.

Severance payment

The severance payment is set at a maximum of one

year’s salary.

Share ownership

Simultaneously with the introduction of the current LTI

Plan in 2013, the guideline for members of the Board of

Management to hold a certain number of shares in the

Company has been increased to the level of at least

200% of base pay (300% for the CEO). Until this level

has been reached the members of the Board of

Management are required to retain all after-tax shares

derived from any long-term incentive plan.

Both Ron Wirahadiraksa and Pieter Nota have reached

the required level and the CEO has increased his

ownership signicantly throughout the year to currently

70% of his target.

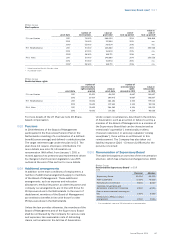

10.2.3 Scenario analysis

The Remuneration Committee conducts a scenario

analysis annually. This includes the calculation of

remuneration under dierent scenarios, whereby

dierent Philips performance assumptions and

corporate actions are examined. The Supervisory Board

concluded that the current policy has proven to

function well in terms of a relationship between the

strategic objectives and the chosen performance

criteria and believes that the Annual and Long-Term

Incentive Plans support this relationship.