Philips 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29 Group nancial statements 12.9

Annual Report 2014 165

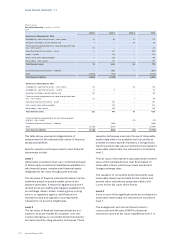

The exercise prices of the Accelerate! options are EUR

15.24 and EUR 22.43 for EUR-denominated options and

is USD 20.02 for USD-denominated options. The

weighted average remaining contractual term for EUR-

denominated Accelerate! options outstanding and

exercisable at December 31, 2014 is 7.2 and 7.1 years,

respectively. The weighted average remaining

contractual term for USD-Accelerate! options

outstanding and exercisable at December 31, 2014 is 7.1

years. The aggregate intrinsic value of the EUR-

denominated Accelerate! options outstanding and

exercisable at December 31, 2014, was EUR 15 million

and EUR 14 million, respectively. The aggregate intrinsic

value of the USD-denominated Accelerate! options

outstanding and exercisable at December 31, 2014, was

USD 4 million and USD 4 million, respectively.

Cash received from exercises for EUR-denominated

and USD-denominated Accelerate! options amounted

to EUR 21 million in 2014. The actual tax deductions

realized as a result of Accelerate! options exercises

totaled approximately EUR 1 million in 2014.

The total intrinsic value of Accelerate! options exercised

during 2014 was EUR 10 million for EUR-denominated

options and USD 5 million for USD-denominated

options.

Other plans

Employee share purchase plan

Under the terms of employee stock purchase plans

established by the Company in various countries,

substantially all employees in those countries are

eligible to purchase a limited number of Philips shares

at discounted prices through payroll withholdings, of

which the maximum ranges from 10% to 20% of total

salary. Generally, the discount provided to the

employees is in the range of 10% to 20%. A total of

1,326,548 shares were bought by employees in 2014

under the plan at an average price of EUR 24.94 (2013:

1,425,048 shares at EUR 21.92; 2012: 1,906,183 shares at

EUR 15.69).

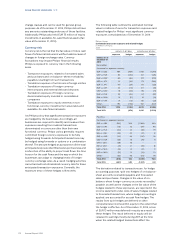

29 Information on remuneration

Remuneration of the Executive Committee

In 2014, the total remuneration costs relating to the

members of the Executive Committee (including the

members of the Board of Management) amounted to

EUR 16,878,909 (2013: EUR 24,773,537, 2012: EUR

18,585,112) consisting of the elements in the table

below.

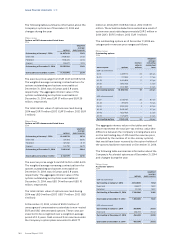

Philips Group

Remuneration costs of the Executive Committee in EUR

2012 - 2014

2012 2013 2014

Salary 5,640,090 6,011,557 6,513,027

Annual incentive1) 4,839,949 4,422,732 1,526,658

Performance shares2) 1,049,205 6,478,554 3,357,142

Stock options2) 1,194,444 2,020,040 583,755

Restricted share rights2) 1,566,448 1,115,504 409,809

Pension costs 2,054,516 2,277,705 2,458,759

Other compensation3) 2,240,460 2,447,445 2,029,759

1) The annual incentives are related to the performance in the year reported which are paid out in the subsequent year

2) Costs of performance shares, stock options and restricted share rights are based on accounting standards (IFRS) and do not reect the value of stock options at

the end of the lock up period and the value of performance shares and restricted share rights at the vesting/release date. Costs for the Accelerate! Grant are

included in 2012 and 2013

3) The stated amounts mainly concern (share of) allowances to members of the Executive Committee that can be considered as remuneration. In a situation where

such a share of an allowance can be considered as (indirect) remuneration (for example, private use of the company car), then the share is both valued and

accounted for here. The method employed by the scal authorities in the Netherlands is the starting point for the value stated. In 2012 and 2013 a crisis levy tax

has been imposed by the Dutch government, amounting in total to EUR 1,245,944 for 2013 and to EUR 702,940 for 2012. These amounts are included in the

amounts stated under Other compensation.

At December 31, 2014, the members of the Executive

Committee (including the members of the Board of

Management) held 1,050,080 (2013: 1,479,498, 2012:

1,376,913) stock options at a weighted average exercise

price of EUR 18.53 (2013: EUR 18.69, 2012: EUR 18.23).

Remuneration of the Board of Management

In 2014, the total remuneration costs relating to the

members of the Board of Management amounted to

EUR 6,635,334 (2013: EUR 10,928,951, 2012: EUR

7,301,335).

At December 31, 2014, the members of the Board of

Management held 586,500 stock options (2013:

586,500; 2012: 454,500) at a weighted average exercise

price of EUR 19.60 (2013: EUR 19.60; 2012: EUR 18.78).