Philips 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

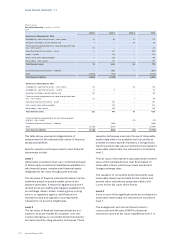

31 Group nancial statements 12.9

Annual Report 2014 171

September 2014 the option matured with the changes

of fair value of EUR 7 million recorded as nancial

income and expense.

Deferred consideration and loan extension options to

TP Vision were included in level 3 in 2013. In May, 2014

Philips transferred the loans from TP Vision to TPV

Technology Limited. As a result, the extension options

ceased to exist with the changes of fair value of EUR 13

million recorded in the prot and loss.

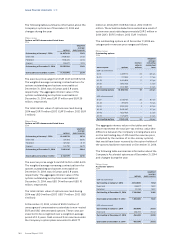

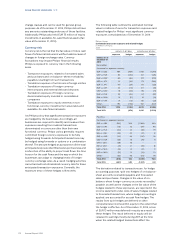

The table below shows the reconciliation from the

beginning balance to the end balance for fair value

measured in Level 3 of the fair value hierarchy.

Philips Group

Reconciliation of the fair value hierarchy in millions of EUR

2014

nancial

assets

nancial

liabilities

Balance as of January 1, 2014 61 (13)

Total gains and losses recognized in:

-prot or loss 5 13

- other comprehensive income (8) –

Balance as of December 31, 2014 58 –

Philips has the following balances related to its

derivative activities. These transactions are subject to

master netting and set-o agreements. In case of

certain termination events, under the terms of the

Master Agreement, Philips can terminate the

outstanding transactions and aggregate their positive

and negative values to arrive at a single net termination

sum (or close-out amount). This contractual right is

subject to the following:

• The right may be limited by local law if the

counterparty is subject to bankruptcy proceedings;

• The right applies on a bilateral basis.

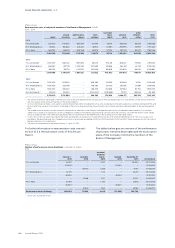

Philips Group

Financial assets subject to osetting, enforceable master netting

arrangements or similar agreements in millions of EUR

2013 - 2014

2013 2014

Derivatives

Gross amounts of recognized nancial assets 150 207

Gross amounts of recognized nancial liabilities

oset in the balance sheet – –

Net amounts of nancial assets presented in

the balance sheet 150 207

Related amounts not oset in the balance sheet

Financial instruments (85) (161)

Cash collateral received – –

Net amount 65 46

Philips Group

Financial liabilities subject to osetting, enforceable master

netting arrangements or similar agreements in millions of EUR

2013 - 2014

2013 2014

Derivatives

Gross amounts of recognized nancial liabilities (368) (857)

Gross amounts of recognized nancial assets

oset in the balance sheet – –

Net amounts of nancial liabilities presented in

the balance sheet (368) (857)

Related amounts not oset in the balance sheet

Financial instruments 85 161

Cash collateral received – –

Net amount (283) (696)

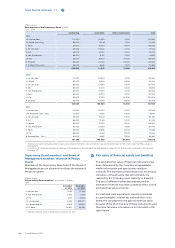

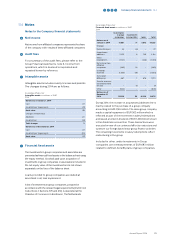

31 Details of treasury / other nancial risks

Philips is exposed to several types of nancial risks. This

note further analyzes nancial risks. Philips does not

purchase or hold derivative nancial instruments for

speculative purposes. Information regarding nancial

instruments is included in note 30, Fair value of nancial

assets and liabilities.

Liquidity risk

Liquidity risk is the risk that an entity will encounter

diculty in meeting obligations associated with

nancial liabilities.

Liquidity risk for the group is monitored through the

Treasury liquidity committee which tracks the

development of the actual cash ow position for the

group and uses input from a number of sources in order

to forecast the overall liquidity position both on a short

and long term basis. Group Treasury invests surplus

cash in money market deposits with appropriate

maturities to ensure sucient liquidity is available to

meet liabilities when due.

The rating of the Company’s debt by major rating

services may improve or deteriorate. As a result, Philips’

future borrowing capacity may be inuenced and its

nancing costs may uctuate. Philips has various

sources to mitigate the liquidity risk for the group. At

December 31, 2014, Philips had EUR 1,873 million in cash

and cash equivalents (2013: EUR 2,465 million), within

which short-term deposits of EUR 1,057 million (2013:

EUR 1,714 million) and other liquid assets of EUR 121

million (2013: EUR 18 million). Philips pools cash from

subsidiaries to the extent legally and economically

feasible; cash not pooled remains available for

operational or investment needs by the Company.

Furthermore, Philips has a USD 2.5 billion Commercial

Paper Program and a EUR 1.8 billion revolving credit

facility that can be used for general group purpose and

as a backstop for its commercial paper program. In

January 2013 the EUR 1.8 billion facility was extended

by 2 years until February 18, 2018. The facility has no

nancial covenants and repetitive material adverse