Philips 2014 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Company nancial statements 13.5

184 Annual Report 2014

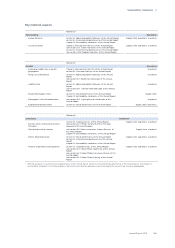

actual coverage varies per account balance and the

depth of our audit procedures per account balance

varies depending on our risk assessment.

Accordingly, our audit coverage per account balance

included in the key audit matters stated below, can be

summarized as follows:

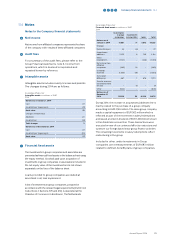

• For goodwill, we have applied a centralized audit

approach with specied audit procedures on 90% of

the goodwill account balance and limited procedures

on the remaining of the goodwill account balance.

•For income taxes, we have identied 10 entities in the

group for which we performed an audit of account

balances and/or specied procedures at the

component level. These 10 entities represent 90% of

the income tax accounts deferred tax assets and

income tax provisions. The remaining population is

covered by limited procedures performed centrally

by the group auditor.

•For revenue recognition, we have identied 31 entities

in the group for which we performed an audit of

account balances and/or specied procedures at the

component level. These 31 entities represent 58% of

sales. This scope is extended by specied procedures

on sales performed centrally, representing an

additional 17% of sales resulting in a coverage of 75%

of sales. The remaining population is covered by

limited procedures performed.

• For contingent liabilities and provisions from legal

proceedings, we have applied a centralized audit

approach with specied audit procedures performed

by the component auditors. Our audit procedures

cover 96% of the recognized legal claim provision

and all signicant legal proceedings without a legal

claim provision recognized.

Audits of account balances or specied procedures

were performed to materiality levels, the majority of

which were based on the relevant local statutory audit

materiality which is considerably lower than Group

materiality. In the other cases, component materiality

was determined by the judgment of the group auditor,

having regard to the materiality for the nancial

statements as a whole and the reporting structure

within the Group. Component materiality did not

exceed EUR 40 million and the majority of our

component auditors applied a component materiality

that is signicantly less than this threshold.

The group auditor sent detailed instructions to all

component auditors, covering the signicant areas that

should be covered (which included the relevant risks of

material misstatement detailed above) and set out the

information required to be reported to the group

auditor. Based on our risk assessment, the group

auditor visited component locations in China, Germany,

Indonesia, the Netherlands, Panama, Singapore and

the USA. Most of our component auditors visited the

Netherlands in 2014 to attend our global audit

conference, which is held every three years, to discuss

the Group audit, risks, audit approach and instructions.

Telephone calls were also held with the auditors of

components that were both physically and not

physically visited. During these visits and meetings, the

audit approach, ndings and observations reported to

the group auditor were discussed in more detail.

We have used other auditors for the audit of

components outside The Netherlands. By performing

the procedures mentioned above at components,

combined with additional procedures at group level,

sector level and at Finance Operations centers, we have

been able to obtain sucient and appropriate audit

evidence regarding the group’s nancial information to

provide an opinion on the nancial statements.

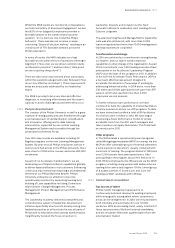

Our key audit matters

Key audit matters are those matters that, in our

professional judgment, were of most signicance in our

audit of the nancial statements. We have

communicated the key audit matters to the Supervisory

Board. The key audit matters are not a comprehensive

reection of all matters discussed.

These matters were addressed in the context of our

audit of the nancial statements as a whole and in

forming our opinion thereon, and we do not provide a

separate opinion on these matters.

Finance Transformation

The Company continued to implement its global

Accelerate! initiative, which includes a Finance

Transformation program. The Finance Transformation

has a signicant impact on the Company’s business

processes, control activities and internal control

responsibilities. We focused on the Finance

Transformation as part of our audit because there is a

signicant risk that a material misstatement could occur

if the program was not implemented with proper

oversight and a focus on maintaining eective internal

controls throughout the process.

Our audit procedures included, amongst others, meetings

with the Board of Management and the Audit Committee

of the Supervisory Board on a regular basis during the

year to understand and monitor the effects of changes to

the Company’s internal control environment, across the

organization. We performed site visits in three major

geographic regions to test the effectiveness of controls

impacted by the Finance Transformation and instructed

our component auditors globally to perform procedures

designed to provide reasonable assurance that a material

misstatement did not exist in the financial statements as

a result of the program. We also tested monitoring

activities executed at different levels of the organization

designed to ensure continued effectiveness of the internal

control framework during the Finance Transformation.

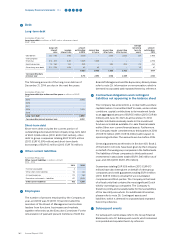

Valuation of goodwill

Under EU-IFRSs, the Company is required to test the

amount of goodwill for impairment, both annually and

if there is a trigger for testing. The impairment tests were

signicant to our audit due to the complexity of the