Philips 2014 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group nancial statements 12.9 27 28

162 Annual Report 2014

The decision by the jury is part of extensive litigation,

which started in 2009, between Masimo and Philips

involving several claims and counterclaims related to a

large number of patents in the eld of pulse oximetry.

The lawsuit led by Masimo alleges that certain Philips

products infringe certain Masimo patents. In response

to these claims, Philips led its answer and

counterclaims alleging infringement of a number of

Philips’ patents and violation of US antitrust laws and

patent misuse by Masimo. The Court has decided to

handle the litigation in several phases, the rst phase of

which was tried in September 2014. The October 2014

decision by the jury is associated with this rst phase of

the litigation. Philips intends to pursue all avenues of

appeal of this verdict at both the District and Appellate

courts in the US.

Due to the considerable uncertainty associated with

the next phases of this litigation, including the impact

of the appeals thereon, the Company has concluded

that, on the basis of current knowledge, potential losses

cannot be reliably estimated with respect to the

remaining phases of the litigation. The outcome of the

litigation could have a materially adverse eect on the

company’s consolidated nancial position, results of

operations and cash ows.

27 Related-party transactions

In the normal course of business, Philips purchases and

sells goods and services from/to various related parties

in which Philips typically holds a 50% or less equity

interest and has signicant inuence. These

transactions are generally conducted with terms

comparable to transactions with third parties.

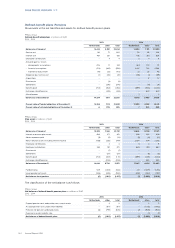

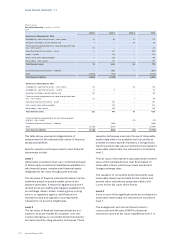

Philips Group

Related-party transactions in millions of EUR

2012 - 2014

2012 2013 2014

Sales of goods and services 288 305 215

Purchases of goods and services 130 143 85

Receivables from related parties 13 39 14

Payables to related parties 4 4 4

Non-recourse nancing of third-party receivables

provided by an associate amounted to EUR 103 million

in 2014 (2013: EUR 84 million; 2012: EUR 52 million).

In light of the composition of the Executive Committee,

the Company considers the members of the Executive

Committee and the Supervisory board to be the key

management personnel as dened in IAS 24 ‘Related

parties’.

For remuneration details of the Executive Committee,

the Board of Management and the Supervisory Board

see note 29, Information on remuneration.

For employee benet plans see note 20, Post-

employment benets.

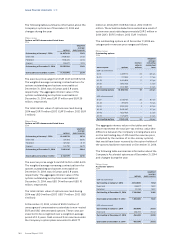

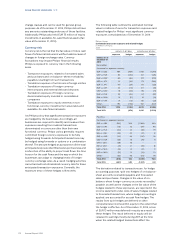

28 Share-based compensation

The purpose of the share-based compensation plans is

to align the interests of management with those of

shareholders by providing incentives to improve the

Company’s performance on a long-term basis, thereby

increasing shareholder value.

The Company has the following plans:

•performance shares: rights to receive common shares

in the future based on performance and service

conditions;

•restricted shares: rights to receive common shares in

the future based on a service condition;

• Options on its common shares, including the 2012

and 2013 Accelerate! grant.

Since 2013 the Board of Management and other

members of the Executive Committee, executives and

certain selected employees are granted performance

shares. Restricted shares are granted only to new

employees or certain selected employees. Prior to 2013

restricted shares and options were granted to members

of the Board of Management and other members of the

Executive Committee, executives and certain selected

employees.

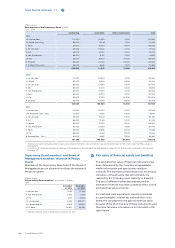

Furthermore, as part of the Accelerate! program, the

Company has granted options (Accelerate! options)

and restricted shares (Accelerate! shares). These

Accelerate! options and shares were granted to a group

of approximately 500 key employees below the level

of Board of Management in January 2012 and to the

Board of Management in January 2013. On January 28,

2014 the Supervisory Board resolved that all

performance targets under the Accelerate! program,

which were based on the 2013 mid-term nancial

targets have been met. Accelerate! shares fully vested

at December 31, 2013.

Share-based compensation costs were EUR 85 million

(2013: EUR 104 million, 2012: EUR 80 million). The

amount recognized as an expense is adjusted for

forfeiture. USD-denominated performance shares,

restricted shares and options are granted to employees

in the United States only.

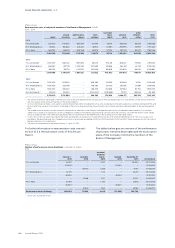

Performance shares

The performance is measured over a three-year

performance period. The performance shares have two

performance conditions, relative Total Shareholders’

Return compared to a peer group of 21 companies and

adjusted Earnings Per Share growth. The performance

shares vest three years after the grant date. The number

of performance shares that will vest is dependent on

achieving the two performance conditions, which are

equally weighted, and provided that the grantee is still

employed with the Company.