Philips 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group nancial statements 12.9 20

152 Annual Report 2014

contracts and expected losses on existing projects /

orders totaling EUR 103 million (2013: 93 million),

provision for employee jubilee funds EUR 74 million

(2013: EUR 76 million), self-insurance liabilities of EUR

65 million (2013: EUR 56 million), provisions for rights of

return of EUR 52 million (2013: EUR 45 million),

provision for possible taxes/social security of EUR 97

million (2013: EUR 65 million) and provision for

decommissioning costs of EUR 36 million (2013: EUR 33

million).

Less than half of the provision for employee jubilee

funds, provision for possible taxes/social security and

provision for decommissioning costs is expected to be

utilized within next ve years. The provision for self-

insurance liabilities is expected to be used within the

next ve years. All other provisions are expected to be

utilized mainly within the next three years, except for

provision for rights of return, which the Company

expects to use within the next year.

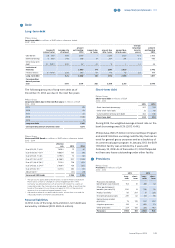

Philips Group

Other provisions in millions of EUR

2012 - 2014

2012 2013 2014

Balance as of January 1 640 529 519

Changes:

Additions 322 198 213

Utilizations (489) (224) (153)

Releases (28) (48) (37)

Reclassication 84 80 17

Liabilities directly associated with

assets held for sale – (3) (13)

Accretion 1 – 6

Translation dierences (1) (13) 23

Balance as of December 31 529 519 575

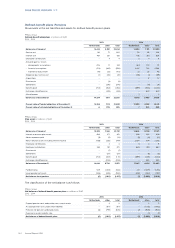

20 Post-employment benets

Employee post-employment plans have been

established in many countries in accordance with the

legal requirements, customs and the local practice in

the countries involved.

The Company sponsors a number of dened-benet

pension plans. The benets provided by these plans are

based on employees’ years of service and

compensation levels. The Company also sponsors a

limited number of dened-benet retiree medical

plans. The benets provided by these plans are

typically covering a part of the healthcare insurance

costs after retirement. Most employees that take part in

a Company pension plan however are covered by

dened-contribution (DC) pension plans.

The largest dened-benet pension plans are in:

• The Netherlands,

• The United Kingdom (UK) and

• The United States (US).

Together these plans account for more than 90% of the

total dened-benet obligation and plan assets. Philips

is one of the sponsors of Philips Pensionskasse VVaG

in Germany, which is a multi-employer plan and is

accounted for as a DC plan.

The Netherlands

The pension plan in the Netherlands (the Flexplan) was

changed in 2014 following the new funding agreement

agreed with the Trustees of the Company Pension

Fund. Under the new funding agreement, which

became eective January 1, 2014, the Company has no

further nancial obligation to the Pension Fund other

than to pay an agreed xed contribution for the annual

accrual of active members. Executives are in a ‘hybrid

plan’ with an accrual rate of 1.25% per service year next

to a DC contribution, the level of which depends on the

executive grade. Both plans are executed by the

Company Pension Fund.

Although the new funding agreement de-risked the

plan, the annual premium can be subject to variability

after ve years due to potential discounts and as a

result, the plan continued to be accounted for as a

dened-benet plan. The other 2014 changes in the

plan were a new pensionable age of 67 (was 65) and

the introduction of an employee contribution. These

changes had no material impact on the existing

dened-benet obligation.

As part of the above changes, the Company agreed to

transfer a one-o EUR 600 million to the Company

Pension Fund of which EUR 433 million has been paid

in 2014. The remainder is to be settled before July 2015

and is included in the 2015 cash projection in this note.

In 2014 the Fund adopted the Prognosis mortality table

2014 with new experience rating which resulted in a

decrease of the Company’s dened-benet obligation.

This eect is recognized in Other comprehensive

income under Remeasurements for pension and other

post-employment plans.

New legislation eective January 1, 2015 introduces a

mandatory cap of EUR 100 thousand on the pension

salary for future pension accrual. The Company has

changed the pension plan accordingly at the end of

2014. For employees earning more than this cap the

Company has announced certain compensatory

measures and the introduction of a voluntary net

pension saving scheme for the salary part above the

cap. To limit the number of plans the Company further

announced to cease the executive pension plan and

transfer its members and their accrued dened-benet

rights to the Flexplan. Accrued dened-contribution

rights in the executive pension plan are optionally

transferred to either the Flexplan or an individual

product. The net pension saving scheme and the

individual product are with an external provider other

than the Company Pension Fund.

The net result of these changes was a EUR 68 million