Philips 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11 Group nancial statements 12.9

Annual Report 2014 141

11 Goodwill

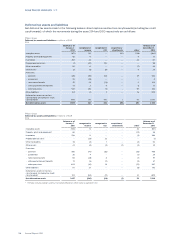

The changes in 2013 and 2014 were as follows:

Philips Group

Goodwill in millions of EUR

2013 - 2014

2013 2014

Balance as of January 1:

Cost 9,119 8,596

Amortization and impairments (2,171) (2,092)

Book value 6,948 6,504

Changes in book value:

Acquisitions 4 68

Purchase price allocation adjustment (4) 8

Impairments (26) –

Divestments and transfers to assets classied as

held for sale (55) (160)

Translation dierences (363) 738

Balance as of December 31:

Cost 8,596 9,151

Amortization and impairments (2,092) (1,993)

Book value 6,504 7,158

Acquisitions in 2014 which included goodwill mainly

related to the acquisition of General Lighting Company

(GLC) for EUR 58 million. In addition, goodwill changed

due to the nalization of purchase price accounting

related to acquisitions in the prior year. Divestments

and transfer to assets classied as held for sale in 2014

relate to the sectors Healthcare and Lighting. In 2014

the movement of EUR 738 million in translation

dierences is mainly explained by the increase of the

USD/EUR rate which impacted the goodwill nominated

in USD.

In 2013 the movement of EUR 55 million in divestments

and transfers to assets classied as held for sale mainly

relate to divestments in the Healthcare sector.

For impairment testing, goodwill is allocated to (groups

of) cash-generating units (typically one level below

operating sector level), which represent the lowest level

at which the goodwill is monitored internally for

management purposes.

In 2014, a cash-generating unit Healthcare Informatics

Services & Solutions was created in the Healthcare

sector. As a result of the change, a portion of the

goodwill associated with the unit Patient Care & Clinical

Informatics and the unit Home Monitoring was

allocated to Healthcare Informatics Services &

Solutions. The name of the cash-generating unit

Patient Care & Clinical Informatics was changed in 2014

to Patient Care & Monitoring Solutions.

Goodwill allocated to the cash-generating units

Respiratory Care & Sleep Management, Imaging

Systems, Patient Care & Monitoring Solutions and

Professional Lighting Solutions is considered to be

signicant in comparison to the total book value of

goodwill for the Group at December 31, 2014. The

amounts associated as of December 31, 2014, are

presented below:

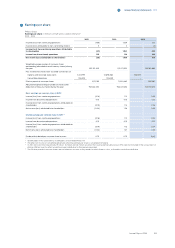

Philips Group

Goodwill allocated to the cash-generating units in millions of EUR

2013 - 2014

2013 2014

Respiratory Care & Sleep Management 1,544 1,704

Imaging Systems 1,414 1,592

Patient Care & Monitoring Solutions 1,0631) 1,317

Professional Lighting Solutions 1,266 1,470

Other (units carrying a non-signicant

goodwill balance) 1,217 1,075

Book value 6,504 7,158

1) Revised to reect the new organizational structure of the Healthcare

sector

The basis of the recoverable amount used in the

impairment tests for the units disclosed in this note is

the value in use. In the 2014 annual impairment test,

performed in the second quarter, and in the tests

performed in the second half of 2014, the estimated

recoverable amounts of the cash-generating units

tested approximated or exceeded the carrying value of

the units, therefore no impairment loss was recognized.

Key assumptions used in the impairment tests for the

units were sales growth rates, income from operations

and the rates used for discounting the projected cash

ows. These cash ow projections were determined

using management’s internal forecasts that cover an

initial period from 2014 to 2018 that matches the period

used for our strategic process. Projections were

extrapolated with stable or declining growth rates for a

period of 5 years, after which a terminal value was

calculated. For terminal value calculation, growth rates

were capped at a historical long-term average growth

rate.

The sales growth rates and margins used to estimate

cash ows are based on past performance, external

market growth assumptions and industry long-term

growth averages.

Income from operations in all units is expected to

increase over the projection period as a result of volume

growth and cost eciencies.

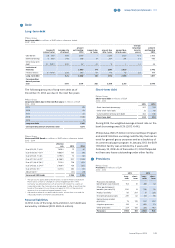

Cash ow projections of Respiratory Care & Sleep

Management, Imaging Systems, Patient Care &

Monitoring Solutions and Professional Lighting

Solutions for 2014 were based on the key assumptions

included in the table below. These assumptions are

based on the annual impairment test performed in the

second quarter except for the unit Professional Lighting

Solutions which performed an updated test in Q4 2014

given the acquisition of GLC in the second half of the

year.