Philips 2014 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2014 Philips annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group nancial statements 12.9 17

146 Annual Report 2014

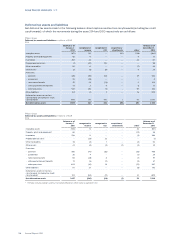

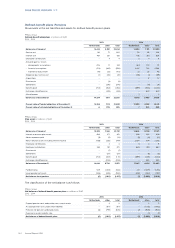

The changes in the allowance for doubtful accounts

receivable are as follows:

Philips Group

Allowance for doubtful accounts receivable in millions of EUR

2012 - 2014

20121) 20131) 2014

Balance as of January 1 265 230 204

Additions charged to expense 13 29 48

Deductions from allowance2) (49) (33) (46)

Other movements 1 (22) 21

Balance as of December 31 230 204 227

1) Amounts have been revised following reclassication

2) Write-os for which an allowance was previously provided

The allowance for doubtful accounts receivable has

been primarily established for receivables that are past

due.

Included in above balances as per December 31, 2014

are allowances for individually impaired receivables of

EUR 200 million (2013: EUR 172 million; 2012: EUR 194

million).

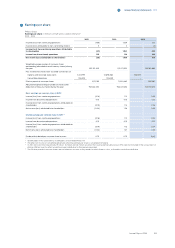

17 Equity

Common shares

As of December 31, 2014, the issued and fully paid share

capital consists of 934,819,413 common shares, each

share having a par value of EUR 0.20.

In June 2014, Philips settled a dividend of EUR 0.80 per

common share, representing a total value of EUR 729

million. Shareholders could elect for a cash dividend or

a share dividend. 60% of the shareholders elected for

a share dividend, resulting in the issuance of 18,811,534

new common shares. The settlement of the cash

dividend resulted in a payment of EUR 293 million

including tax and service charges.

The following table shows the movements in the

outstanding number of shares:

Philips Group

Outstanding number of shares in number of shares

2013 - 2014

2013 2014

Balance as of January 1 914,591,275 913,337,767

Dividend distributed 18,491,337 18,811,534

Purchase of treasury shares (27,811,356) (28,537,921)

Re-issuance of treasury shares 8,066,511 10,777,489

Balance as of December 31 913,337,767 914,388,869

Preference shares

The ‘Stichting Preferente Aandelen Philips’ has been

granted the right to acquire preference shares in the

Company. Such right has not been exercised. As a

means to protect the Company and its stakeholders

against an unsolicited attempt to acquire (de facto)

control of the Company, the General Meeting of

Shareholders in 1989 adopted amendments to the

Company’s articles of association that allow the Board

of Management and the Supervisory Board to issue

(rights to acquire) preference shares to a third-party. As

of December 31, 2014, no preference shares have been

issued.

Option rights/restricted and performance

shares

The Company has granted stock options on its common

shares and rights to receive common shares in the

future (see note 28, Share-based compensation).

Treasury shares

In connection with the Company’s share repurchase

programs, shares which have been repurchased and are

held in treasury for (i) delivery upon exercise of options,

performance and restricted share programs and

employee share purchase programs, and (ii) capital

reduction purposes, are accounted for as a reduction of

shareholders’ equity. Treasury shares are recorded at

cost, representing the market price on the acquisition

date. When issued, shares are removed from treasury

shares on a rst-in, rst-out (FIFO) basis.

When treasury shares are reissued under the

Company’s option plans, the dierence between the

cost and the cash received is recorded in retained

earnings.

Dividend withholding tax in connection with the

Company’s purchase of treasury shares is recorded in

retained earnings.

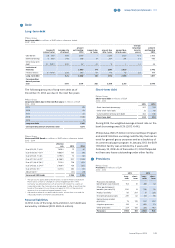

The following transactions took place resulting from

employee option and share plans:

Philips Group

Employee option and share plan transactions

2013 - 2014

2013 2014

Shares acquired 3,984 7,254,606

Average market price EUR 22.51 EUR 24.53

Amount paid EUR 0 million EUR 178 million

Shares delivered 8,066,511 10,777,489

Average market price EUR 28.35 EUR 30.26

Cost of delivered shares EUR 229 million EUR 326 million

Total shares in treasury

at year-end 20,650,427 17,127,544

Total cost EUR 618 million EUR 470 million